The cryptocurrency market has been under a dark cloud lately, with most tokens experiencing price drops. However, amidst this bearish trend, VeChain (VET) might be showing signs of life. A renowned market analyst, Ali Martinez is pointing to a potential buy signal on the VET chart, suggesting an upward trajectory could be on the horizon.

Technical Indicators Point to Potential Upswing

Martinez identified buy signals on both the 1-day and 3-day VeChain charts, noting a striking resemblance in their patterns. Both charts displayed a consistent string of red candles with minimal green candles, suggesting potential trend exhaustion. This sentiment is further reinforced by the TD Sequential indicator, a technical tool known for identifying trend reversals.

While Martinez highlights the potential for an upswing in VET’s price, he refrains from providing a precise price target within the established pattern. Notably, in December 2023, Martinez observed a similar pattern that preceded VET’s historic all-time high of $0.2782. Based on this pattern, he anticipated a 150% surge for VET, reaching $0.077 by late January. However, this prediction hinged on VET overcoming a key resistance barrier, which has yet to occur.

Realated: VeChain Bets Big on V3TR: Can it Capture the $20 Trillion Payments Opportunity?

Current Price Slump:

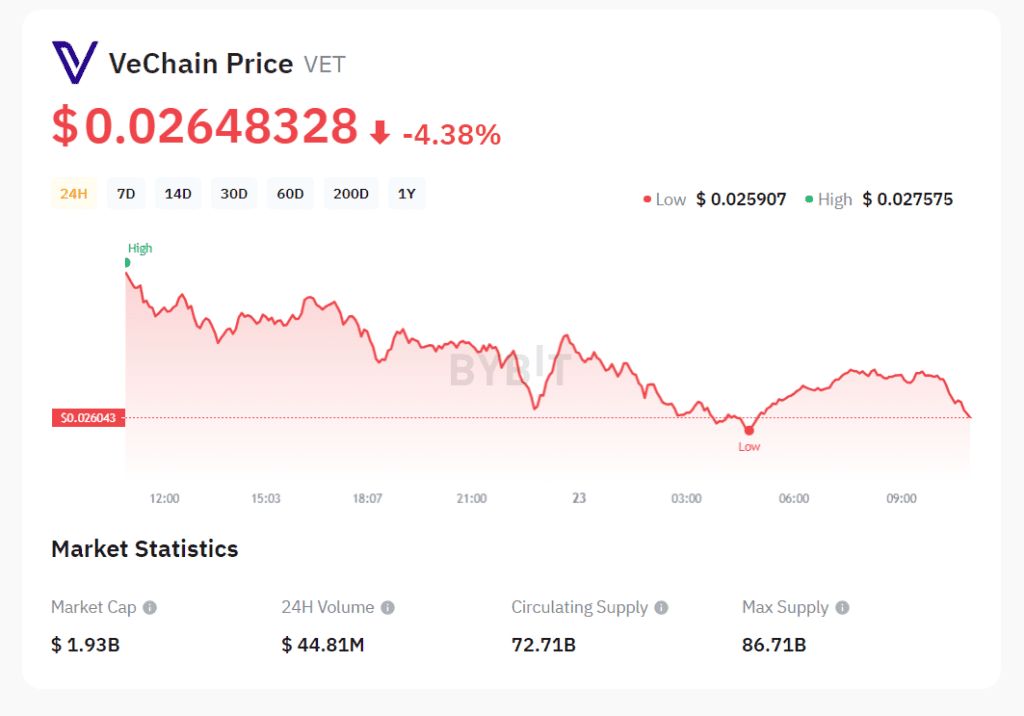

At the time of writing, the global cryptocurrency market cap stands at $1.93 billion, reflecting a -4.49% change in the last 24 hours. VeChain (VET) is currently priced at $0.02648328, experiencing a -4.38% decline over the same period, with a 24-hour trading volume reaching $44.81 million. The circulating supply of VET coins is 72.71 billion, out of a maximum supply of 86.71 billion. VET holds the 45th position in the market cap rankings.

The market dynamics suggest ongoing fluctuations, emphasizing the need for investors to stay vigilant and informed.

VeChain’s Growing Prominence Fuels Long-Term Optimism

Beyond the technical indicators, VeChain’s underlying fundamentals offer reasons for optimism. The platform’s focus on supply chain management and business process optimization positions it well for potential growth in the estimated $18 trillion logistics market. This potential has attracted the attention of prominent figures in the crypto space, who envision VeChain taking a leading role in this sector.