|

Getting your Trinity Audio player ready...

|

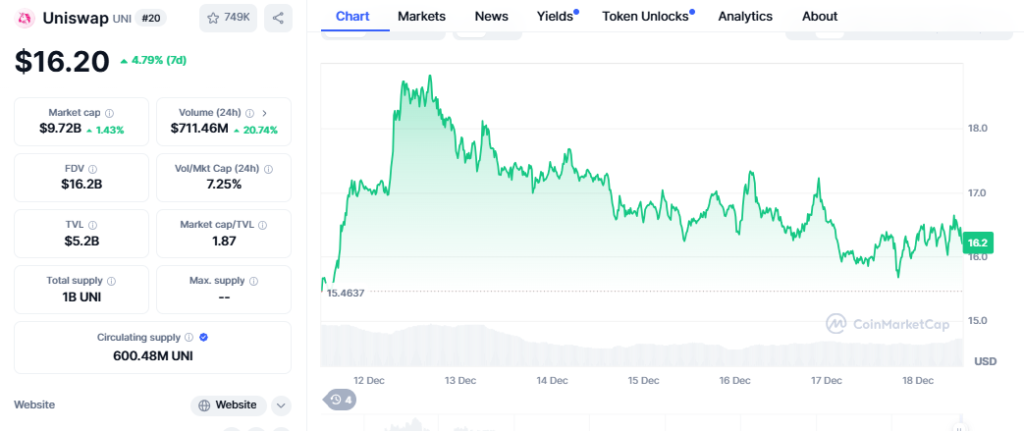

Uniswap (UNI), a prominent decentralized exchange (DEX) token, has been consolidating recently after a stellar rally in November. This consolidation could be a buying opportunity for investors as technical indicators and on-chain whale activity hint at a potential surge in the near future.

Rally Recap and Institutional Interest

UNI enjoyed a 160% surge since early November, decisively breaking past its previous resistance level of $16.50. This impressive run has attracted the attention of institutional investors seeking to diversify their crypto holdings. The token’s mid-cap status (around $16.5 billion fully diluted valuation) coupled with its healthy daily trading volume (approximately $657 million) makes it an attractive option for institutions.

Whale Activity Signals Bullish Sentiment: On-chain data from Santiment reveals a significant influx of UNI tokens onto cryptocurrency exchanges in the past two days. Over 800,000 UNI tokens, valued at more than $13 million, have been deposited. Additionally, a major whale with a $89 million portfolio recently transferred 1.49 million UNI (worth over $24 million) to Binance, further fueling bullish sentiment.

Uniswap Team’s Recent Move Adds Fuel to the Fire

Earlier this week, the Uniswap team transferred nearly 5 million UNI tokens to Coinbase Prime, breaking a dormancy period exceeding four years. While the purpose remains unclear, some speculate it might be related to future development plans, potentially boosting investor confidence.

Institutions have been depositing $UNI into exchanges over the past 2 days!

— Spot On Chain (@spotonchain) December 18, 2024

1/ Whale “0x59a” with a $89.4M portfolio deposited 1.495M $UNI ($24.3M) to #Binance an hour ago, securing an estimated $13.7M profit (+129%) after 5 months.

2/ @Uniswap team-related wallet “0xa37” sent… pic.twitter.com/DOa7ynLXKn

Technical Indicators Align with Bullish Outlook: The daily price chart suggests a retest of a critical support/resistance level around $16.00. A decisive breakout above this level could trigger the next bullish phase. Notably, the weekly Relative Strength Index (RSI) recently surpassed 70% for the first time since early 2024, indicating strong buying pressure.

Midterm Targets and Market Impact

Considering the established uptrend in higher timeframes, UNI’s price is well-positioned for a potential 100% increase in the near term. Even if a short-term correction occurs, solid support exists above $14.00, likely followed by a continuation of the bullish trend.

A sustained bullish run for UNI could have a positive ripple effect on the entire Decentralized Finance (DeFi) space, currently boasting a market capitalization exceeding $138 billion and a daily trading volume of approximately $11.4 billion. Many DeFi-related tokens on both centralized and decentralized exchanges are already exhibiting signs of an imminent breakout towards new all-time highs.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.