|

Getting your Trinity Audio player ready...

|

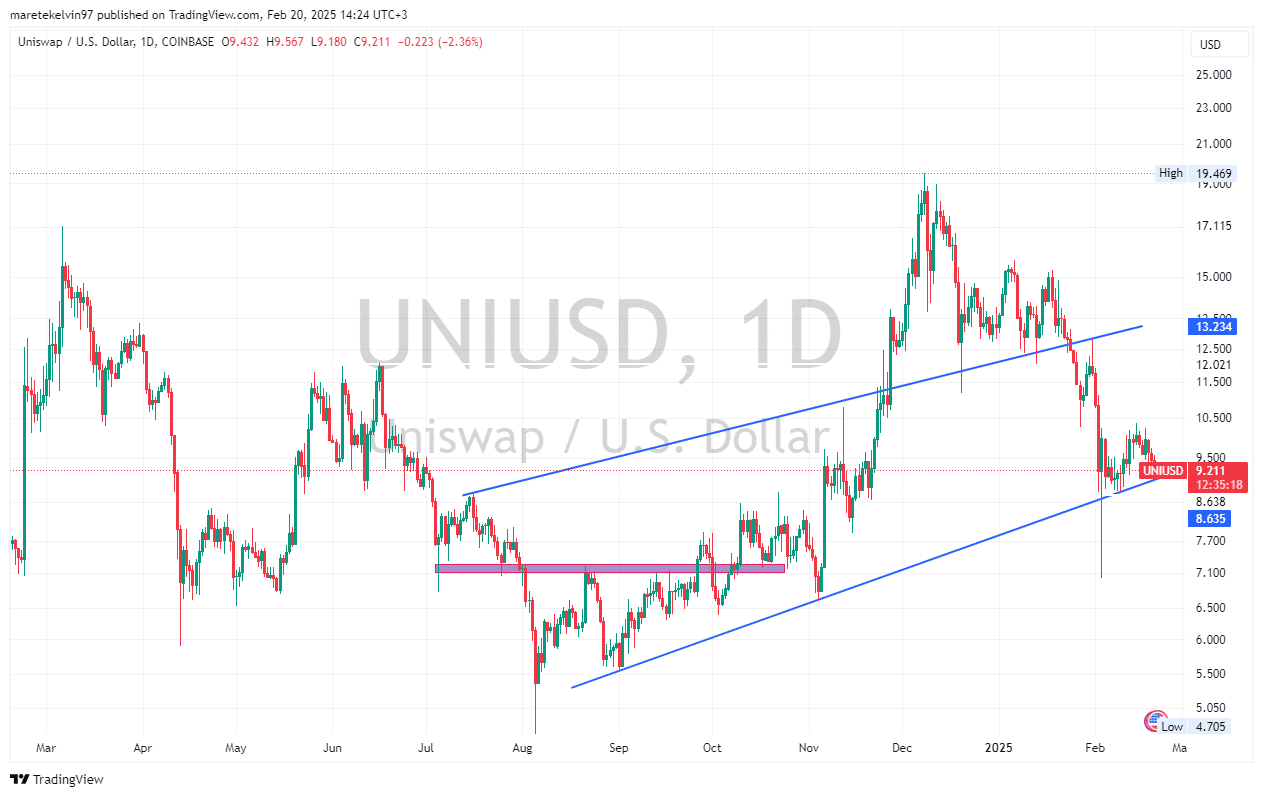

Uniswap’s native token, UNI, is teetering on the edge of a decisive price moment as it approaches a critical trendline support level. After a sharp 10% decline, the decentralized exchange (DEX) token finds itself at a pivotal crossroads. The crypto market is abuzz with speculation—will UNI rebound or plunge further?

UNI Whales Stir as Retail Activity Declines

On-chain data suggests a shifting market landscape for UNI. The number of UNI tokens moving to exchanges has plummeted by 74.73% in the past 24 hours, indicating a sharp decline in retail selling pressure. While smaller traders are stepping back, whales are making their presence felt. Large-volume transactions have surged by 44%, signaling a renewed interest from high-net-worth investors.

Historically, an uptick in whale activity often precedes notable price movements. Their accumulation near key support levels suggests confidence in an impending recovery. This trend, coupled with the easing of selling pressure, could set the stage for a bullish reversal.

A Make-or-Break Scenario for UNI

Market participants are now closely monitoring UNI’s trendline support, a level that has previously triggered significant price rebounds. If UNI manages to hold this support, bullish momentum could build, propelling the token toward the psychological $10 barrier.

Breaking above this resistance could pave the way for further gains, with traders eyeing even higher targets. However, failure to sustain this level might result in increased downward pressure, potentially leading to further declines.

What’s Next for UNI?

With whale activity on the rise and retail selling pressure waning, UNI’s immediate future hinges on its ability to defend the current support level. A bounce from this zone could mark the beginning of a strong uptrend, while a breakdown might usher in more bearish sentiment.

As the market awaits a decisive move, traders and investors remain on high alert. Will UNI capitalize on this setup and reclaim $10, or is a deeper correction on the horizon? The coming days will be crucial in determining Uniswap’s next move.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Ondo Finance Launches Ondo Chain: Boosting Institutional RWA Adoption & On-Chain Growth

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!