|

Getting your Trinity Audio player ready...

|

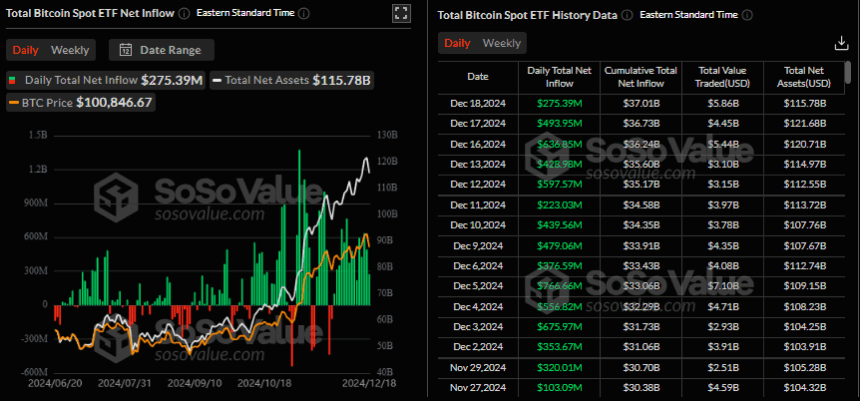

The U.S. spot Bitcoin ETFs are making headlines with a remarkable 15-day streak of high inflows, totaling over $6.7 billion as of December 18, 2024. This unprecedented surge in inflows, which began on November 27, highlights the growing interest and confidence in Bitcoin ETFs among traditional and institutional investors.

The streak reached a daily inflow peak of $275.39 million on December 18, while December 5 marked the record inflow of $766.66 million in a single day. This trend coincided with a historic moment for Bitcoin itself, as its price skyrocketed past the $100,000 mark for the first time. This milestone fueled a surge in trading activity, further driving interest in Bitcoin-related investment products.

The total assets under management (AUM) for Bitcoin ETFs have grown significantly during this period, increasing from $104.32 billion to $115.78 billion. This milestone underscores the vital role spot Bitcoin ETFs are playing in bridging the gap between traditional financial markets and the cryptocurrency space.

Bitcoin’s meteoric rise is attributed to a combination of factors, including heightened geopolitical tensions and the election of former President Donald Trump in 2024, which has created an environment of economic uncertainty. Investors have turned to Bitcoin as a hedge against volatility, driving both its price and the demand for spot Bitcoin ETFs.

Introduced in January 2024, spot Bitcoin ETFs have been instrumental in attracting traditional investors to the crypto market. Unlike futures-based ETFs, spot ETFs directly track Bitcoin‘s price, offering a more straightforward investment avenue. Their introduction has marked a turning point for the crypto industry, providing legitimacy and accessibility to investors who were previously hesitant.

The growing inflows and the surge in Bitcoin’s price underscore a broader trend of mainstream adoption. As Bitcoin ETFs continue to gain traction, they are likely to play an increasingly significant role in shaping the future of cryptocurrency investment.

This historic streak not only highlights the transformative potential of Bitcoin ETFs but also sets the stage for further innovation and adoption in the evolving cryptocurrency landscape.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.