|

Getting your Trinity Audio player ready...

|

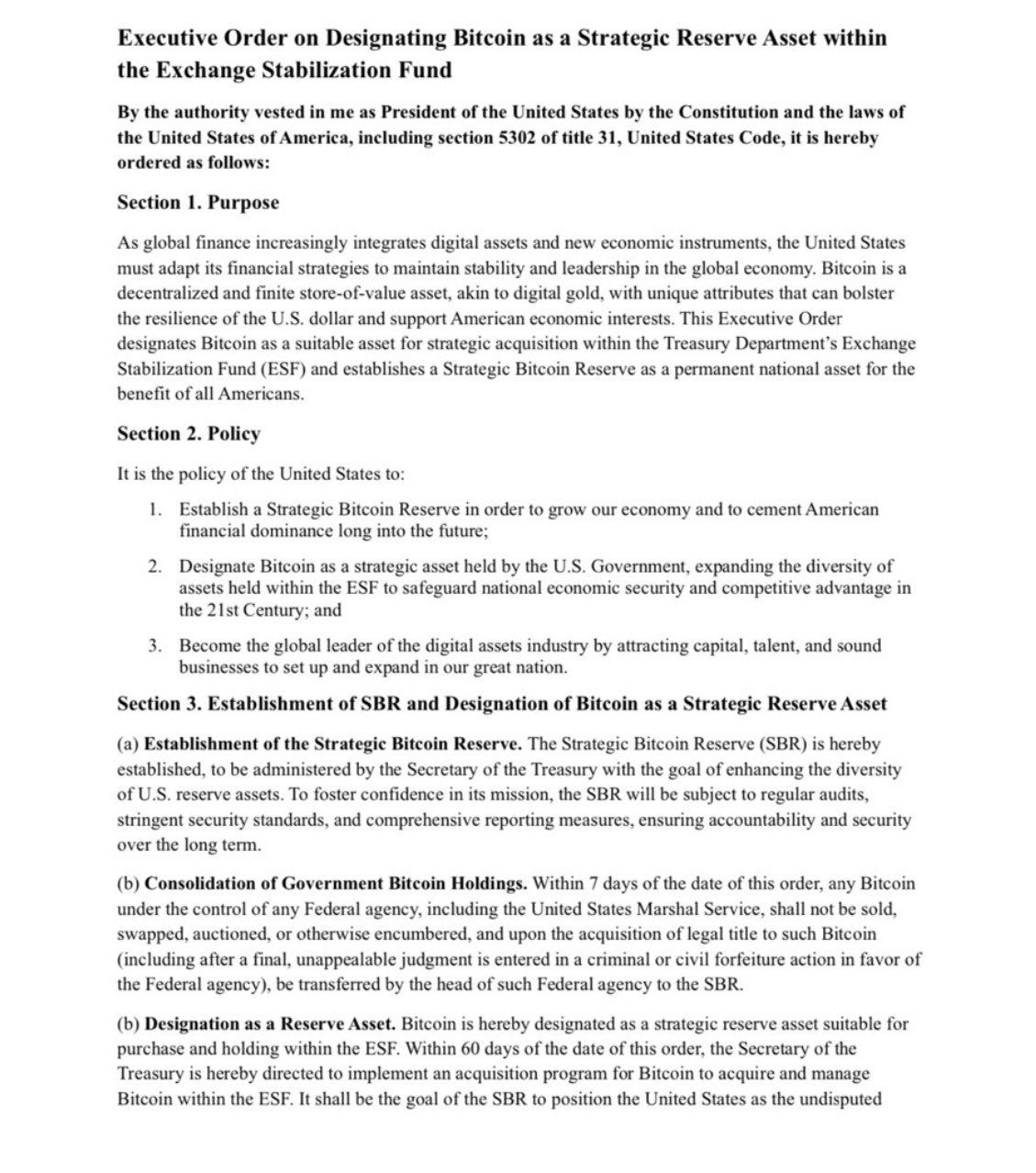

The Bitcoin Policy Institute has drafted a groundbreaking executive order aiming to establish a strategic Bitcoin reserve under the United States Treasury’s Exchange Stabilization Fund (ESF). The proposal seeks to position Bitcoin as a national asset, bolstering the U.S.’s global leadership in the rapidly evolving digital economy.

The order, which would require approval after President Donald Trump’s inauguration, aims to integrate Bitcoin into the U.S. financial system, emphasizing its decentralized, limited-supply nature—qualities often compared to digital gold. By designating Bitcoin as a strategic reserve asset, the draft seeks to diversify U.S. holdings, attract innovation, and foster domestic industry growth.

Key Provisions of the Strategic Bitcoin Reserve (SBR)

Under the draft, the Treasury Secretary would oversee the creation of a $521 billion Bitcoin acquisition plan. Federal agencies, such as the U.S. Marshals Service, would consolidate their Bitcoin holdings into the newly established SBR within seven days of the order’s issuance.

A comprehensive acquisition strategy would be set within 60 days to ensure the U.S. maintains its position as a global leader in Bitcoin holdings and blockchain innovation. This would further elevate the country’s economic security and strategic advantage in the global digital economy.

Safeguarding U.S. Bitcoin Holdings

The draft outlines stringent security protocols for the SBR. While initially relying on third-party custodians, the Treasury would work with the National Security Agency (NSA) and the Cybersecurity and Infrastructure Security Agency (CISA) to develop a self-custody system. This would include multi-signature controls, geographically distributed reserves, and cryptographic reserve proof verification.

The Treasury would also conduct regular audits and publish quarterly proofs of reserve and annual reports, ensuring transparency and maintaining public trust in the initiative.

A Global Context

The U.S. proposal comes at a time of increasing global interest in Bitcoin as a strategic asset. Notably, Sarah Knafo, a member of the European Parliament, has called for the EU to establish its own Bitcoin reserve, advocating for Bitcoin’s decentralized nature as a counter to centralized digital currencies like the proposed digital euro.

Also Read: Ohio Bitcoin Reserve Act: A Game-Changer for State Finances and Digital Innovation

The draft executive order is a significant step in positioning Bitcoin as a key asset for economic and financial security, with the potential to reshape the global financial landscape.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!