|

Getting your Trinity Audio player ready...

|

Key Takeaways:

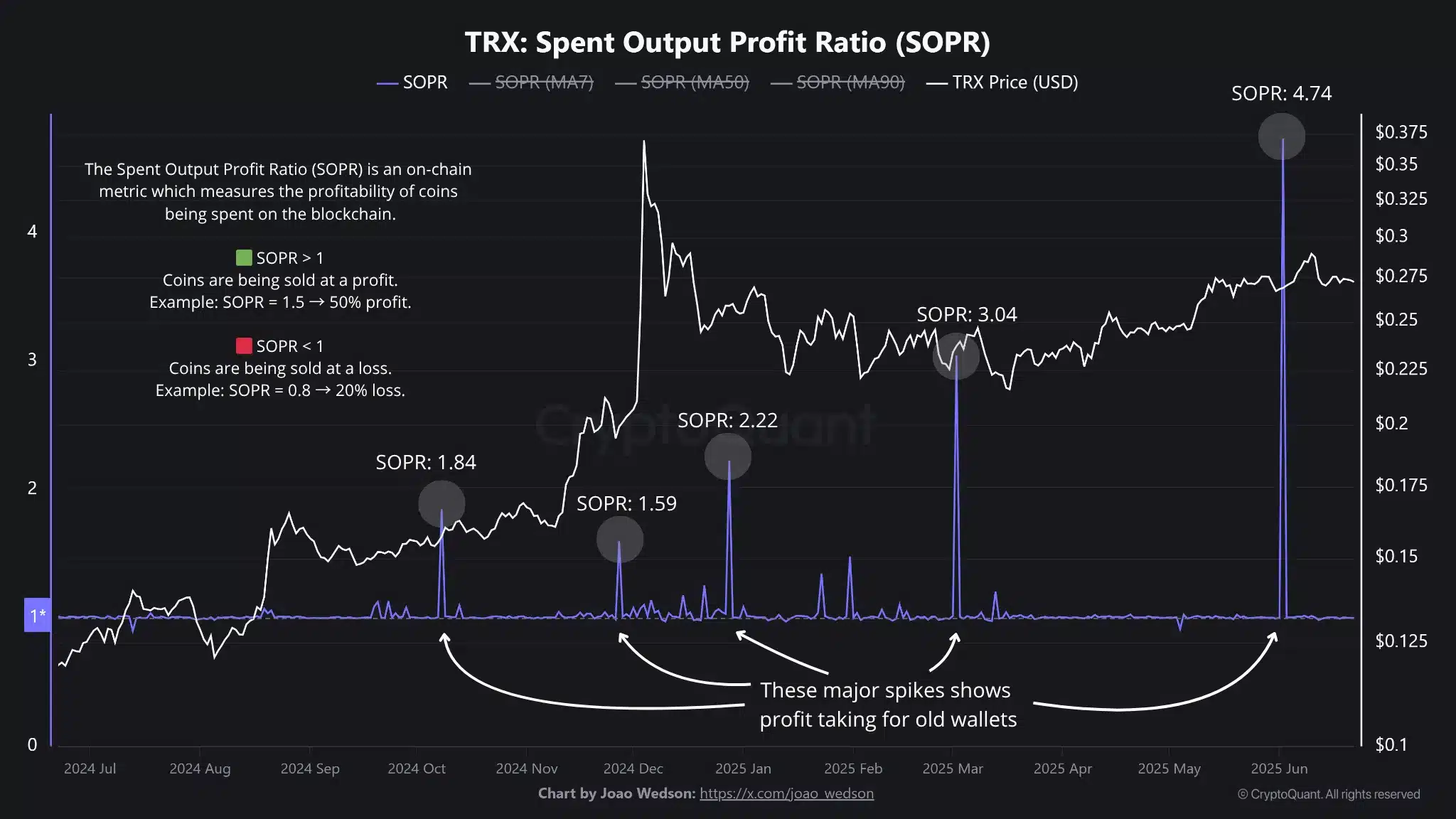

- Long-term holders realized over 374% profits, triggering a spike in SOPR.

- TRON continues to lead in stablecoin utility, with strong retail and institutional demand.

- Social sentiment and derivatives activity are cooling, suggesting cautious momentum.

TRON’s native token TRX experienced a notable on-chain shift, as its Spent Output Profit Ratio (SOPR) surged to 4.74—the highest in months. This spike marked a clear wave of profit-taking, particularly by long-term holders (LTHs) who had purchased the asset around $0.0566. With TRX trading near $0.2730 at press time, these investors realized over 374% in gains, drawing attention to renewed market activity and potential strategic rebalancing.

Long-Term Holders Realize Massive Gains

The SOPR spike confirmed that seasoned wallets, likely dormant for over 18 months, had begun offloading TRX for profit. The move doesn’t resemble panic selling or exit liquidity. Instead, the pattern points to intentional portfolio rebalancing—likely a sign of internal strategy shifts among early adopters. This activity mirrors historical levels from 2022, reinforcing the idea that long-term holders are capitalizing on a strong recovery.

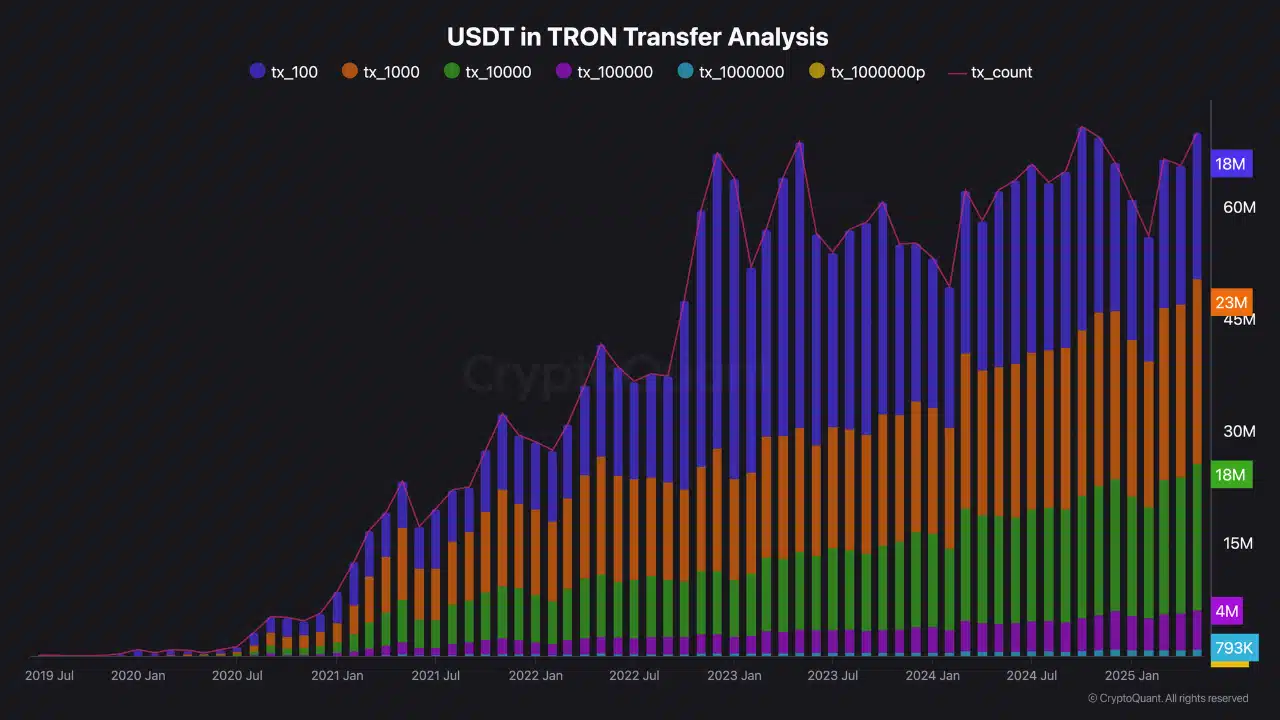

TRON’s Dual Stablecoin Economy: Retail Meets Institutional

TRON’s role in the stablecoin sector continues to expand, with USDT transfer activity offering a detailed look into user dynamics. Over 23 million transactions in the $100–$1,000 range confirm strong adoption among retail users. On the institutional front, large transfers exceeding $1 million have now crossed $215 billion since mid-2024, bringing the total stablecoin volume on TRON to a staggering $610 billion.

This dual-track usage cements TRON’s position as a core payments infrastructure—balancing high-frequency retail transactions with large-scale institutional settlements.

Derivatives Volume and Social Hype Cool Off

Despite growing bullish sentiment, TRON’s derivatives market has seen a slowdown. The Long/Short Ratio rose to 1.62, with long traders holding 61.85% dominance. However, Open Interest fell by 0.54% to $288.82 million, and Derivatives Volume dipped nearly 39% to $193.86 million—indicating cautious positioning among speculators.

Meanwhile, TRON’s social dominance peaked at 1.3% earlier in June but has since dropped to 0.51%, suggesting that the hype cycle may have peaked prematurely unless new catalysts reignite interest.

Liquidation Clusters Could Trigger Volatility

TRX currently trades near a major liquidation cluster at $0.2742. A move above $0.28 could trigger cascading liquidations of short positions, potentially igniting a short squeeze. Conversely, a drop below $0.265 may intensify downside pressure due to over-leveraged long positions, particularly those set with 50x leverage.

These zones present immediate risk thresholds and could determine the asset’s short-term trajectory.

TRON is at a pivotal moment, with profit-taking from old wallets injecting fresh volatility. While institutional and retail engagement remains robust, weakening speculative interest and derivatives activity cast short-term doubt. All eyes now turn to the $0.274–$0.28 zone, where price action may determine the next major TRX move.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

Also Read: Tron [TRX] Hits $80B Stablecoin Milestone as Accumulation Rises

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!