|

Getting your Trinity Audio player ready...

|

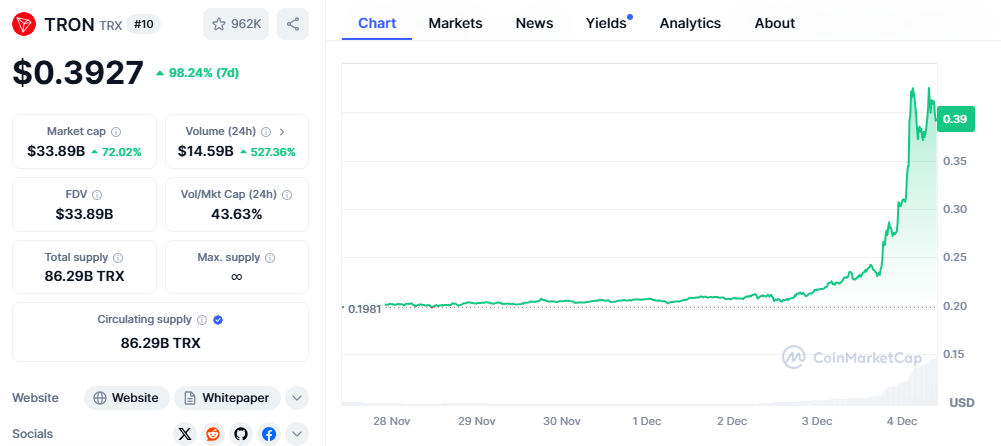

Tron [TRX] is making waves in the cryptocurrency market once again, recently reaching an all-time high (ATH) fueled by robust trading activity. This surge has positioned TRX closer to breaking into the top 10 cryptocurrencies by market capitalization. The question now is: can TRX successfully overtake Avalanche [AVAX] and claim the coveted 10th spot?

A Bullish Run for Tron

Last week, TRX experienced a significant price surge of over 28%. This momentum continued, with the token gaining more than 16% in the past 24 hours. As a result, TRX reached a new ATH of over $0.234. Currently, TRX and AVAX are separated by a market cap difference of approximately $1 billion. If this bullish trend persists, TRX could potentially surpass AVAX and secure the 10th position.

On-Chain Metrics and Market Sentiment

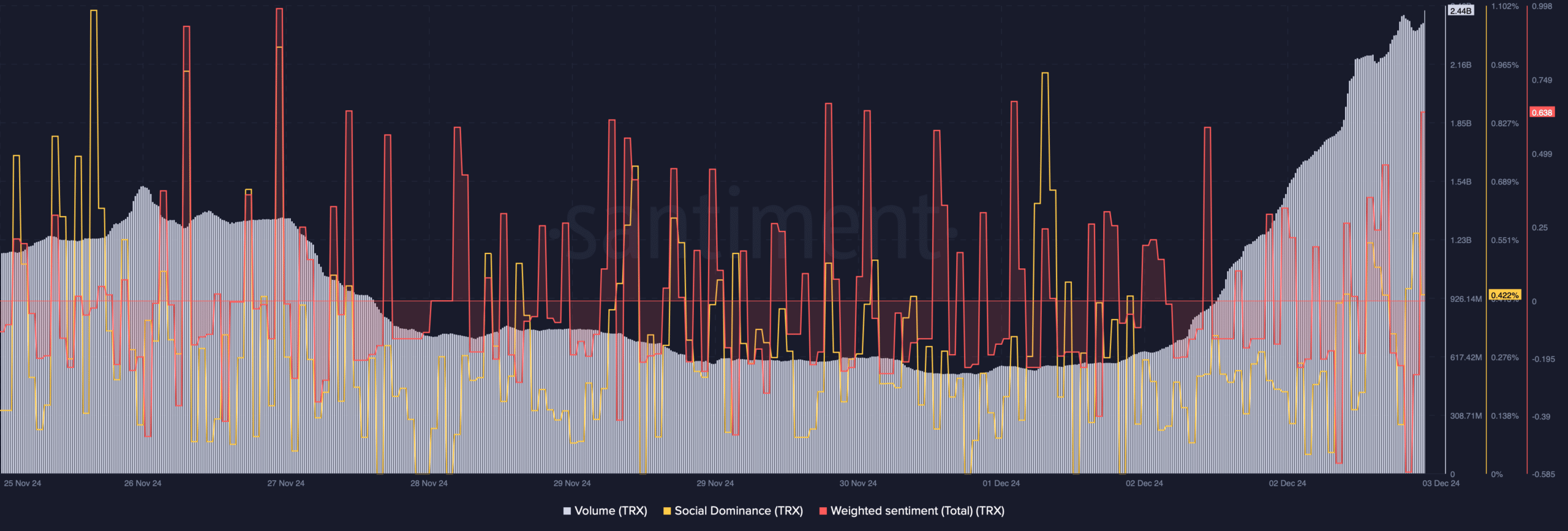

To gauge the sustainability of TRX’s bull run, on-chain metrics provide valuable insights. Santiment’s data reveals a notable increase in trading volume alongside the price surge, a positive indicator for continued upward momentum. Additionally, TRX’s social dominance remains high, reflecting its growing popularity in the crypto community.

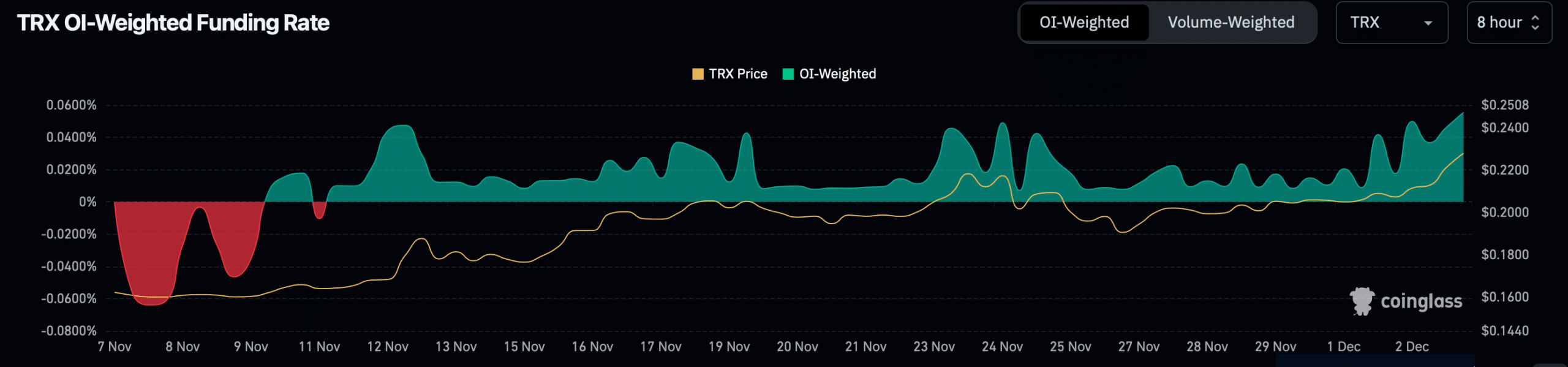

However, the picture isn’t entirely rosy. While TRX reached an ATH, its Weighted Sentiment has declined, suggesting a potential shift in market sentiment. Nonetheless, derivatives metrics offer a more optimistic outlook. Coinglass data indicates a rising funding rate, signaling market optimism and expectations of further price increases.

Technical Analysis

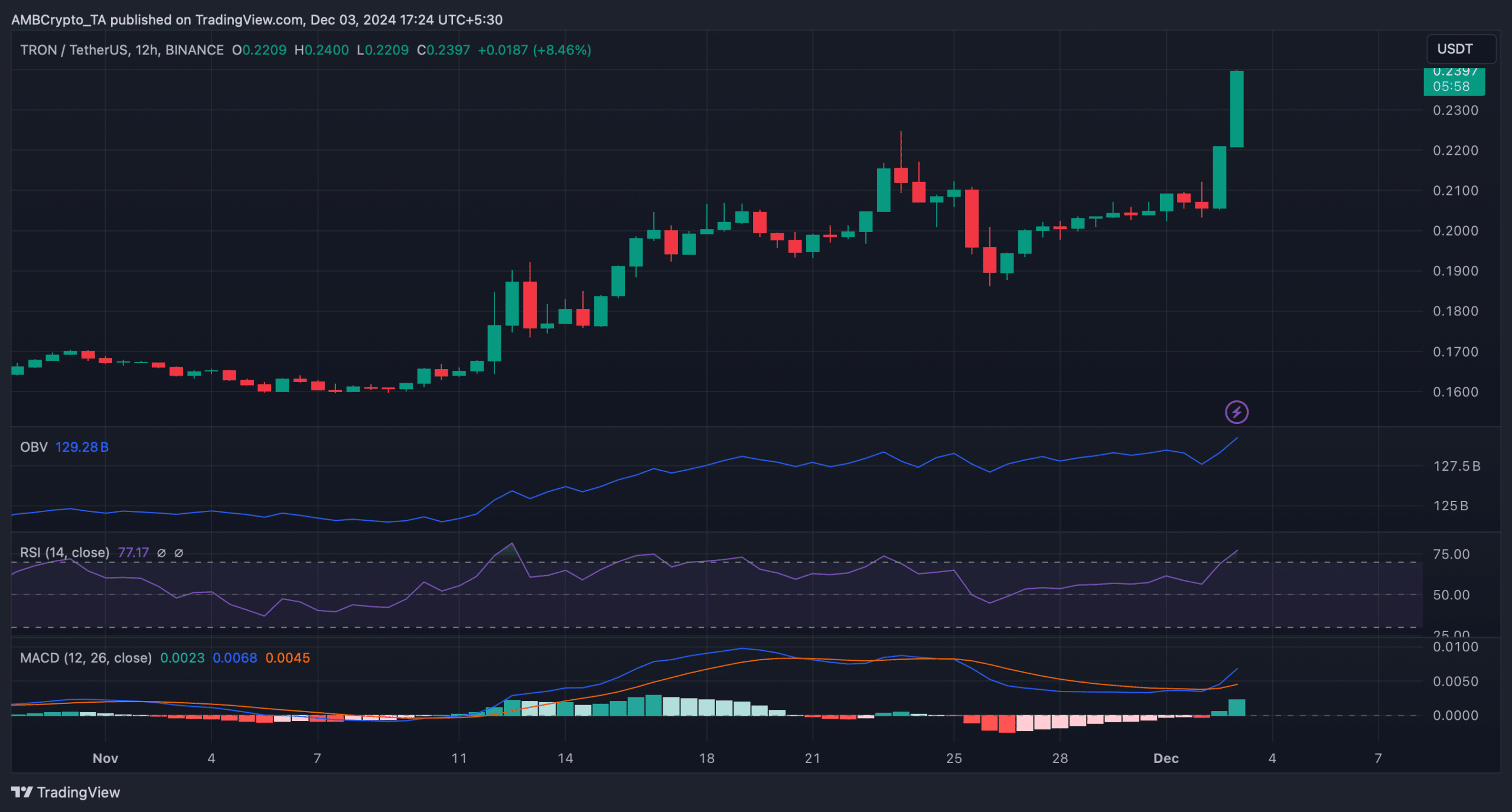

Technical analysis provides further clues to TRX’s future trajectory. The On Balance Volume (OBV) indicator shows an uptick, suggesting stronger buying pressure. Moreover, the Moving Average Convergence Divergence (MACD) displays a clear bullish advantage, pointing to continued price growth.

However, the Relative Strength Index (RSI) has entered overbought territory, which might trigger a potential sell-off and price correction.

Network Activity

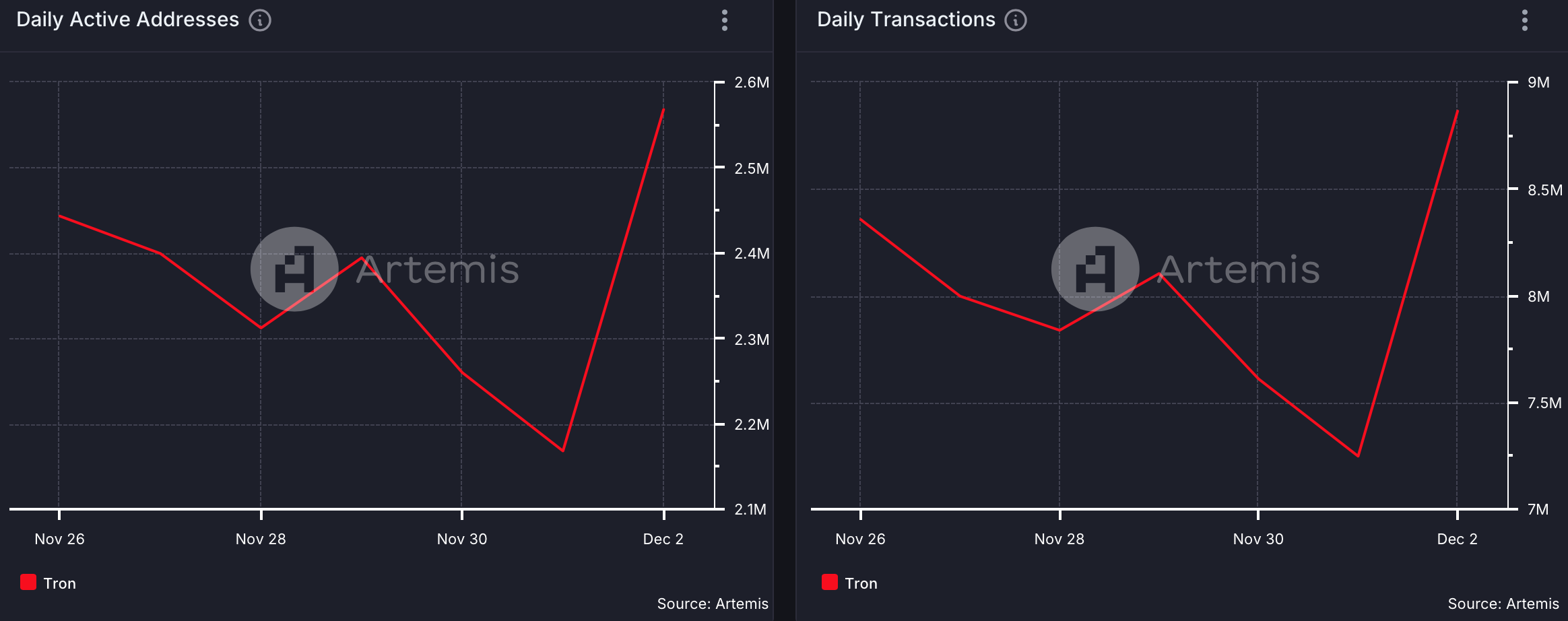

Interestingly, TRX’s network activity has also seen a significant uptick, as evidenced by an increase in daily active addresses and transactions. This suggests that the recent price surge is backed by genuine network usage and not merely speculative trading.

As TRX continues to make headlines, investors and traders are closely watching its price movements. While the current bullish momentum is encouraging, it’s essential to consider potential market corrections and technical indicators. Only time will tell whether TRX can successfully claim the 10th spot and solidify its position among the top cryptocurrencies.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.