|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- Joe Lubin is steering companies like SharpLink toward Ethereum-centric treasury strategies.

- ETH is now a productive asset, with billions staked by institutions generating passive yield.

- Ethereum’s dual leadership—business and technical—points to a robust and scalable future.

Ethereum co-founder and ConsenSys CEO Joe Lubin took over as chairman of NASDAQ-listed SharpLink Gaming in May. The company, which previously focused on sports betting, has since pivoted toward building an Ethereum-centric treasury—a move that signals a broader institutional shift for the blockchain.

Lubin’s leadership underscores Ethereum’s growing role not just as a programmable network, but as a treasury asset for public companies seeking long-term value and yield.

ETH’s Programmability Gains Real-World Traction

According to Lubin in a Bloomberg interview, Ethereum has finally stepped into its long-promised role in global finance. No longer overshadowed by Bitcoin’s “digital gold” status, Ethereum is gaining favor for its staking capabilities, smart contract infrastructure, and increasing regulatory clarity.

“Ethereum offers programmable value storage and decentralized infrastructure,” Lubin explained. “We believe we can accumulate more Ether per share faster than any other project.”

This marks a key shift: institutions are no longer simply experimenting with Ethereum—they’re integrating it directly into business strategies.

Companies Are Now Staking Billions in ETH

SharpLink Gaming is just one example. The company now holds over 360,000 ETH—worth more than $1.3 billion—as a core treasury asset. Another company, BitMine Immersion, pivoted from Bitcoin mining to Ethereum and accumulated more than 566,000 ETH (valued at over $2.1 billion) within weeks.

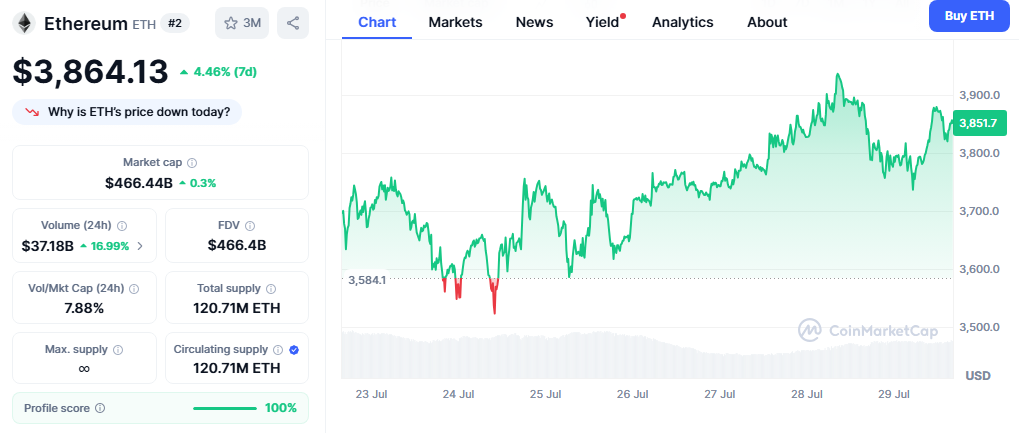

This influx has fueled Ethereum’s price recovery from $1,450 in April to over $3,600 in July. What’s more, both firms are staking their ETH, making it a productive, income-generating asset—something Bitcoin cannot offer due to its lack of native staking.

Vitalik Buterin Focuses on Ethereum’s Long-Term Vision

While Lubin brings Ethereum to boardrooms, co-founder Vitalik Buterin continues to focus on scaling and decentralization. Upgrades like rollups and data sharding aim to improve Ethereum’s capacity and efficiency for mass adoption.

Also Read: Ethereum Gains 50% in July, Nears $4K Breakout

Despite the Decun upgrade slightly reducing ETH’s deflationary burn, Buterin remains committed to Ethereum’s role as a backbone for DeFi and real-world applications, reinforcing its long-term utility.

With over $3.2 billion in ETH now held by public companies, Ethereum is evolving from a developer playground to a serious institutional asset. Joe Lubin’s treasury strategy and Vitalik Buterin’s technical roadmap are converging to position Ethereum as the financial infrastructure of the future.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.