|

Getting your Trinity Audio player ready...

|

- Retail adoption and regulatory clarity are driving the next wave of onchain growth

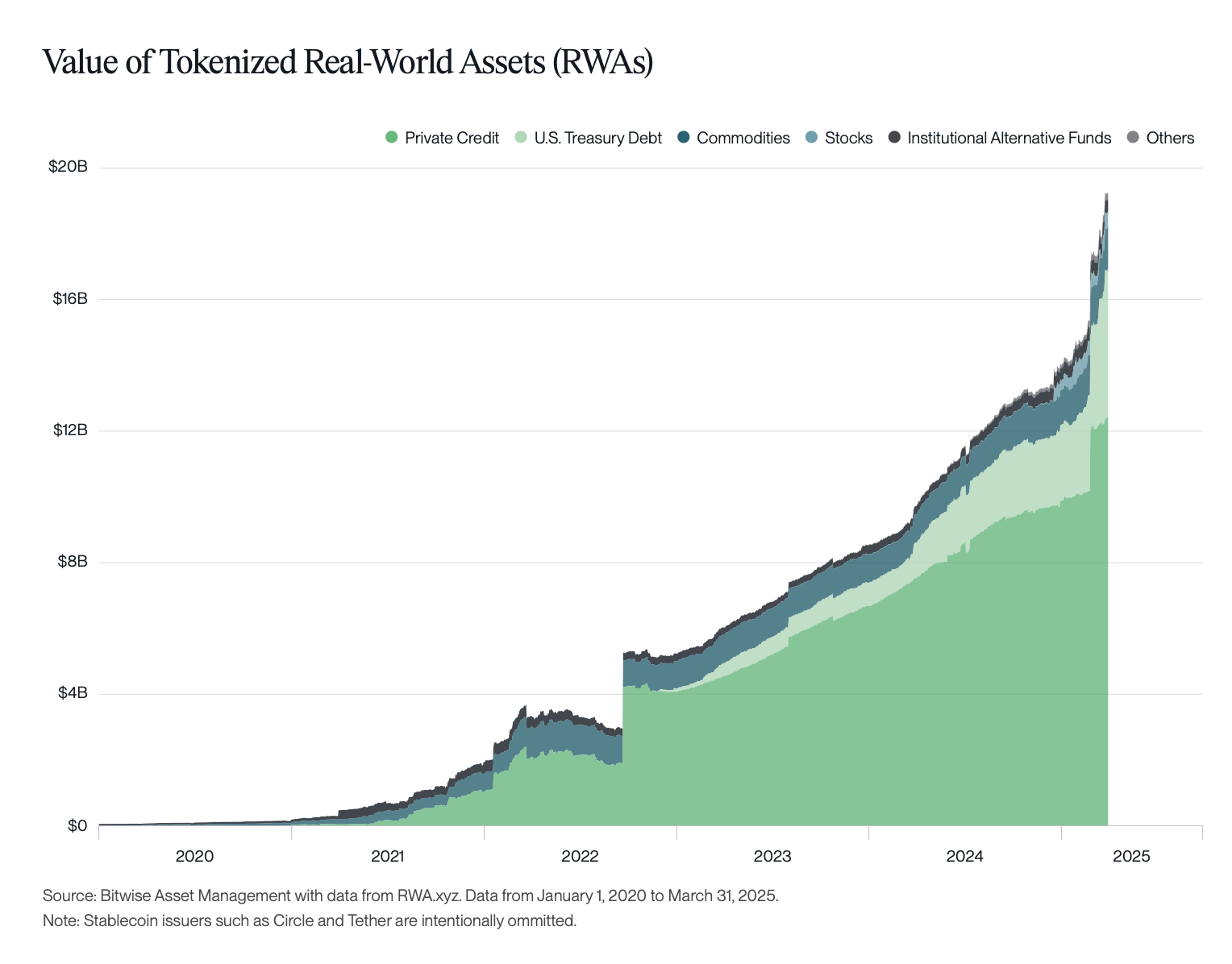

At this week’s TokenizeThis conference in New York, industry leaders from Dinari, STOKR, Galaxy Digital, and 21Shares gathered to discuss the expanding universe of tokenized real-world assets (RWAs). While stablecoins currently dominate with a nearly $230 billion market cap, tokenized RWAs are emerging fast — reaching $18.5 billion, according to RWA.xyz.

Despite market turbulence, Q1 saw RWAs grow 37% quarter-over-quarter, marking a milestone Bitwise described as “the best worst quarter in crypto’s history.” One highlight: BlackRock’s tokenized money market fund BUIDL surpassed $2 billion in AUM, cementing the potential of tokenized Treasury products.

Executives agreed that regulation remains the linchpin for broader adoption. “Stablecoins and tokenized Treasury products will be the foundation,” said Mike Bucella of Neoclassic Capital. “If we can’t mirror offchain functionality onchain, the space won’t scale.”

Following the success of stablecoins and yield-bearing Treasury instruments, Dinari Chief Business Officer Anna Wroblewska sees tokenized public stocks as the next logical frontier. However, Galaxy Digital’s Thomas Cowan suggests the greatest opportunity lies in private credit — markets plagued by opacity and slow settlement times.

Also Read: US Government’s Bitcoin Reserve Plan: How Buying 1 Million BTC Could Lead to $1 Million Bitcoin

Anton Kozlov of 21Shares echoed this, envisioning tokenized private equity in high-demand companies like SpaceX and OpenAI. Blockworks Research analyst Carlos Gonzalez Campo believes tokenized shares of such private firms could materialize within four years.

A recent report by crypto custody firm Taurus estimates fund tokenization could reach a $1 trillion market by 2030. Taurus argues that illiquid assets — currently traded through weeks-long, paper-based processes — are ripe for disruption via blockchain.

While stablecoins and money market funds continue to pave the way, the next battleground for tokenization appears to be in less transparent, harder-to-access markets. One thing is clear: investors are looking for a unified platform — “a Robinhood experience,” as Kozlov put it — where they can access crypto, public equities, and tokenized private markets in a single interface. That vision, for many, is becoming increasingly attainable.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.