|

Getting your Trinity Audio player ready...

|

Terra LUNA 2.0, the reborn cryptocurrency from the ashes of the 2022 Terra collapse, is once again capturing investor attention. With the LUNA token trading at $0.1507, analysts are exploring whether the network can regain its former prominence or remains a cautionary tale in crypto history. Market sentiment is cautiously optimistic, fueled by recent network upgrades, token burn events, and the anticipation of regulatory clarity.

As the ecosystem continues rebuilding, traders and institutions are asking: Is Terra LUNA dead, or does it have growth potential through 2030? This article explores realistic Terra LUNA price projections, market factors, and the challenges ahead.

LUNA 2.0: From Collapse to Rebuilding

Terra Classic (LUNC) and Terra 2.0 (LUNA) emerged after the collapse of the original Terra ecosystem, triggered by the UST stablecoin losing its $1 peg in 2022. LUNA’s price plummeted from an all-time high of $19.54 in May 2022 to near zero, shaking investor confidence.

The aftermath led to two separate blockchains: Terra Classic (LUNC), largely community-driven, and Terra 2.0 (LUNA), rebuilt with fresh governance and development teams. Despite these efforts, skepticism remains, as the project must rebuild trust in both its tokenomics and its wider DeFi ecosystem.

Recent developments have improved confidence. The Terra Chain v2.18 upgrade boosted network efficiency, while aggressive token burn programs — including 1.57 billion LUNC burned last week — have reinforced the supply-reduction narrative. These moves are designed to support long-term price appreciation, but market adoption and use cases remain critical.

Terra LUNA Price Predictions: 2025 and Beyond

Based on current technical analysis and market projections, LUNA’s short-term and long-term outlook shows potential upside if the network can regain investor trust and adoption.

2025 Forecast:

- Potential Low: $0.15

- Average: $0.20

- Potential High: $0.30

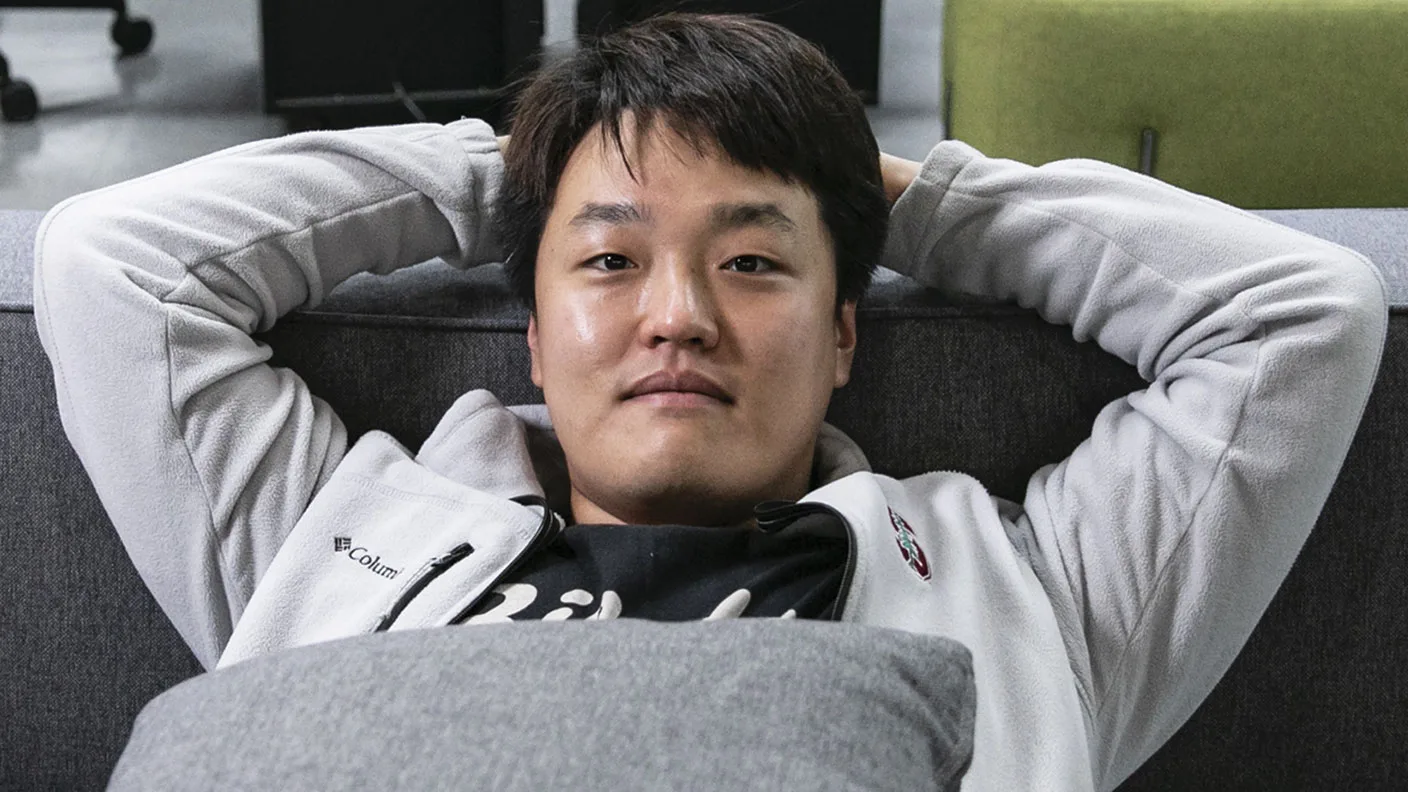

LUNA’s price rally in December has been driven by improving sentiment, ecosystem upgrades, and speculative interest ahead of high-profile legal proceedings involving Do Kwon, the founder of the original Terra network. Analysts highlight that regulatory clarity and community engagement will play a decisive role in whether these levels are sustainable.

2026–2030 Forecasts:

- 2026: $0.51 – $1.29 (average $0.90)

- 2027: $0.63 – $1.67 (average $1.17)

- 2028: $0.89 – $2.24 (average $1.56)

- 2029: $1.17 – $2.90 (average $2.03)

- 2030: $1.56 – $3.75 (average $2.65)

If Terra 2.0 successfully positions itself as a major DeFi platform, leveraging real-world applications and decentralized finance adoption, LUNA could reach the higher end of these projections. Conversely, if adoption stagnates or the project fails to overcome lingering trust issues, prices could remain near current lows.

Market Sentiment and Investor Behavior

Market interest in Terra 2.0 has been cyclical. Bullish catalysts include:

- Network upgrades and protocol improvements

- Ongoing token burn mechanisms reducing supply

- Renewed investor interest around key ecosystem events

On the bearish side, challenges include:

- Lingering skepticism after the 2022 collapse

- Regulatory scrutiny and legal developments involving the Terra team

- Competition from other DeFi networks with stronger adoption

Several forecasting platforms provide varying targets. Wallet Investor predicts $0.0578 in 2025 and $0.1031 in 2026. Priceprediction.net is more optimistic, with $1.13 in 2025 and $1.60 in 2026. DigitalCoinPrice estimates $1.05 in 2025 and $1.45 in 2026. This divergence highlights the uncertainty surrounding Terra’s revival.

Is Terra LUNA Dead or a Comeback Story?

Despite the collapse, Terra 2.0 is actively developing its ecosystem. Its position in DeFi — one of the fastest-growing sectors in crypto — gives it potential to regain relevance. Strong network updates, supply reductions, and cautious optimism from investors suggest LUNA may not be dead but is in a rebuilding phase.

Ultimately, LUNA’s long-term trajectory depends on whether the Terra community and developers can restore credibility, attract developers, and maintain token utility. Market adoption, coupled with broader crypto market cycles, will influence whether LUNA sees incremental growth toward its projected highs.

Terra LUNA 2.0 represents a high-risk, high-potential scenario in crypto investing. While historical collapses and market skepticism temper expectations, ongoing upgrades, tokenomics strategies, and active community support provide a foundation for potential recovery.

2025–2030 projections suggest LUNA could reach as high as $3.75 by 2030, provided adoption and investor confidence increase. For now, traders should monitor network activity, burn rates, and market sentiment closely to gauge realistic price potential.

Terra LUNA is not dead, but its revival will require time, development, and sustained community and institutional engagement.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.