|

Getting your Trinity Audio player ready...

|

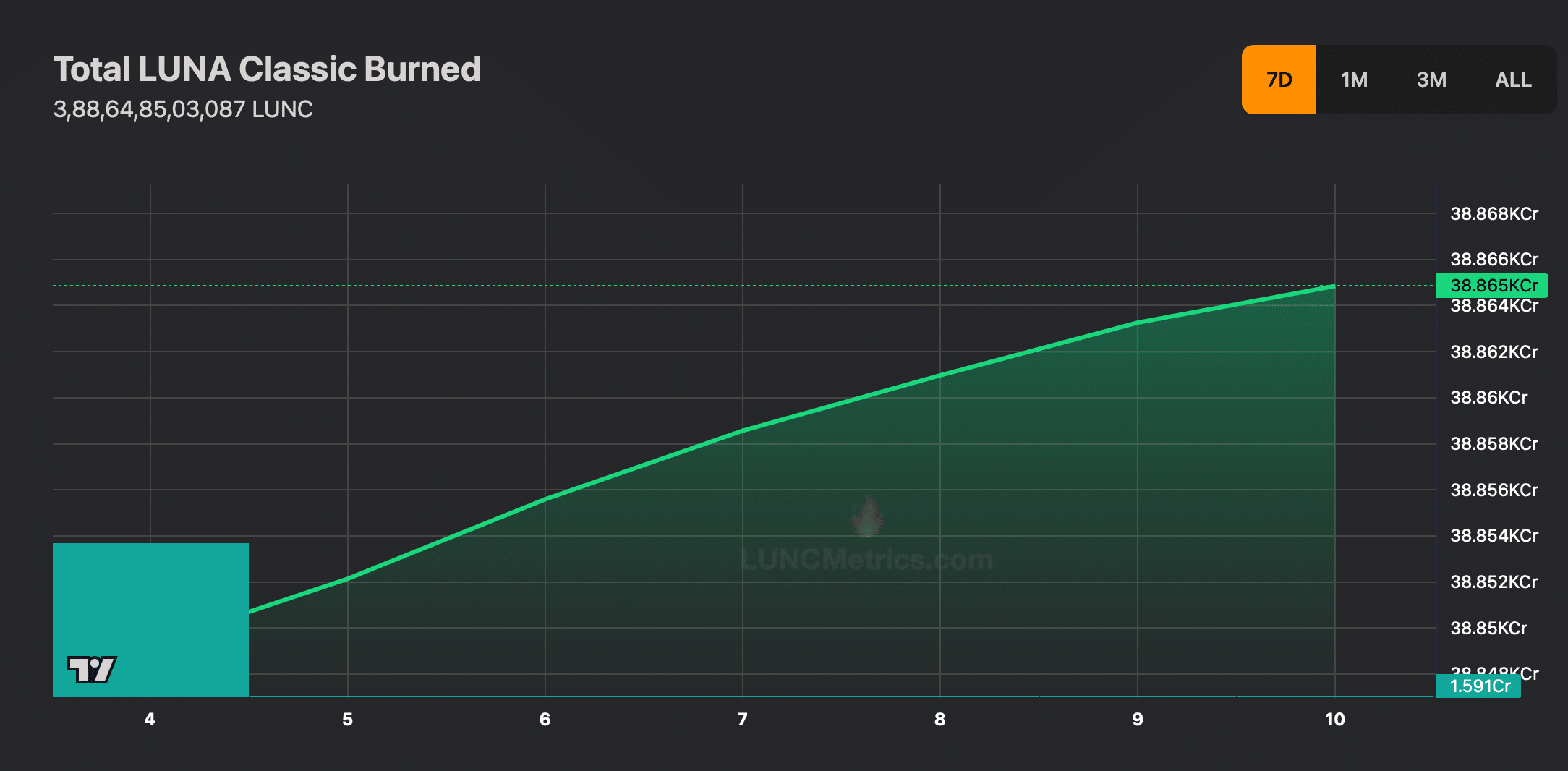

Terra Classic (LUNC) has recently experienced a significant price surge, captivating the attention of crypto enthusiasts. The token’s price has skyrocketed by over 18% in the past week, fueled by increased investor interest and a surge in its burn rate.

A Bullish Surge

The recent price rally has pushed LUNC’s market capitalization above $544 million, solidifying its position as the 130th largest cryptocurrency. This bullish momentum has been accompanied by a rise in social volume, indicating increased public interest and discussion surrounding the token.

However, a closer look at the on-chain data reveals a mixed bag of signals. While the increased burn rate is generally a positive sign, as it reduces the total supply of LUNC and can potentially drive up the price, other indicators suggest caution.

A Potential Correction

The sharp decline in LUNC’s Weighted Sentiment suggests that bearish sentiment is on the rise. This could potentially lead to a price correction as investors may start to take profits. Additionally, the recent drop in Open Interest indicates a decrease in market activity, which could also signal a potential downturn.

Despite these bearish signals, LUNC’s Relative Strength Index (RSI) has moved into overbought territory, suggesting that the token may be overvalued. While this could lead to a short-term correction, it’s important to note that the RSI can remain overbought for extended periods, especially during strong bull runs.

The future of LUNC remains uncertain. While the recent price surge is undoubtedly exciting, it’s crucial to consider the potential risks and rewards. Investors should carefully analyze the on-chain data and market sentiment before making any investment decisions.

As always, it’s important to conduct thorough research and consider consulting with a financial advisor before investing in cryptocurrencies. The cryptocurrency market is highly volatile, and past performance is not indicative of future results.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.