|

Getting your Trinity Audio player ready...

|

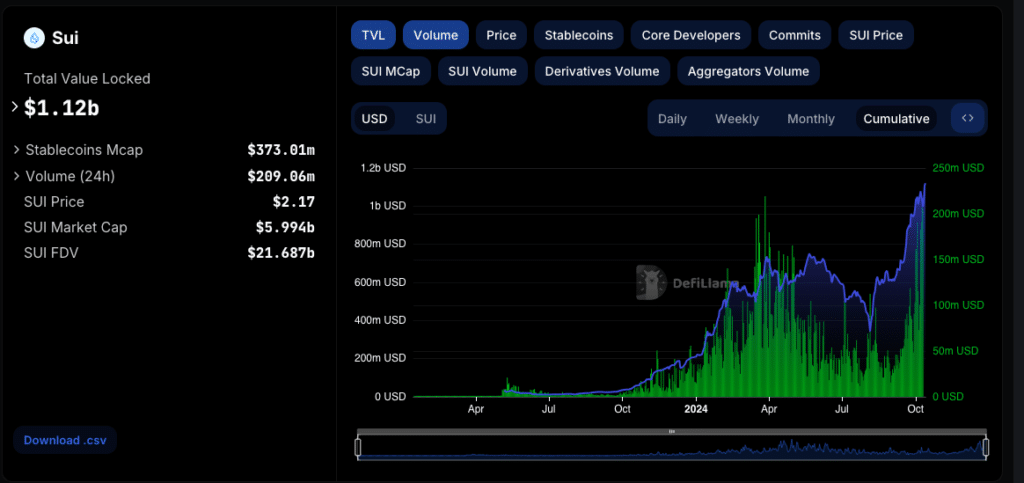

- The total value locked (TVL) on the Sui network has increased by 50% in the past month.

- The number of unique addresses interacting with the Sui blockchain has reached a new all-time high.

- The global DeFi market is projected to reach $1 trillion by 2025.

The cryptocurrency market is buzzing with excitement as traders anticipate a potential breakout for Sui (SUI). With its strong fundamentals and positive market sentiment, SUI is poised to climb higher.

Long Traders Dominate the Market

Coinglass data reveals a clear bullish bias among SUI traders. The long/short ratio currently stands at 1.3, indicating that more traders are holding long positions compared to short positions. This is further supported by a significant increase in trading volume and open interest for SUI derivatives.

Moreover, the recent liquidation of short positions suggests that traders are becoming increasingly confident in SUI’s upward trajectory. As more short traders are forced to close their positions, it could fuel a further price rally.

Strong Fundamentals Support Bullish Outlook

Sui’s fundamentals also paint a positive picture for the coin. The surging decentralized finance (DeFi) activity on the Sui network, as evidenced by the increase in DEX volume and TVL, indicates a growing ecosystem and potential for future growth.

Price Prediction: A Breakout to $2.50

Crypto expert Michael Van De Poppe has predicted that SUI could reach a new all-time high of $2.50. This prediction is based on the coin’s strong bounce at the $1.79 price level and its positive technical outlook.

Sui is currently in a strong position, with both technical and fundamental factors supporting a bullish outlook. The dominance of long traders, increasing trading volume, and positive market sentiment suggest that a breakout could be imminent.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!