|

Getting your Trinity Audio player ready...

|

Sui (SUI) has recently garnered significant attention from Binance users after experiencing a sharp decline. The cryptocurrency’s latest price action has set up an optimal risk-to-reward ratio, making it an attractive opportunity for intraday traders.

Bullish Sentiment Dominates SUI Trading

According to data from Coinglass, SUI’s long/short ratio on Binance stands at 2.51, indicating strong bullish sentiment. This means that for every short position, there are 2.51 long positions. Furthermore, 75% of top traders on Binance are currently holding long positions, while only 25% are shorting the asset.

This trend is not limited to Binance alone. Across global exchanges, 58% of traders have taken long positions on SUI, compared to 42% holding shorts. This reinforces the growing optimism among market participants.

$43.50 Million SUI Outflow Signals Accumulation

Beyond trading activity, investor behavior suggests increased accumulation. Coinglass data reveals that $43.50 million worth of SUI has been withdrawn from exchanges in recent days. This significant outflow is often interpreted as a sign of accumulation by whales and long-term holders, reducing sell pressure and potentially fueling further price appreciation.

Key Technical Levels and Price Predictions

At press time, SUI was trading near $3.45, reflecting a 9.50% increase over the past 24 hours. However, its trading volume dropped by 28%, indicating lower market participation compared to the previous day.

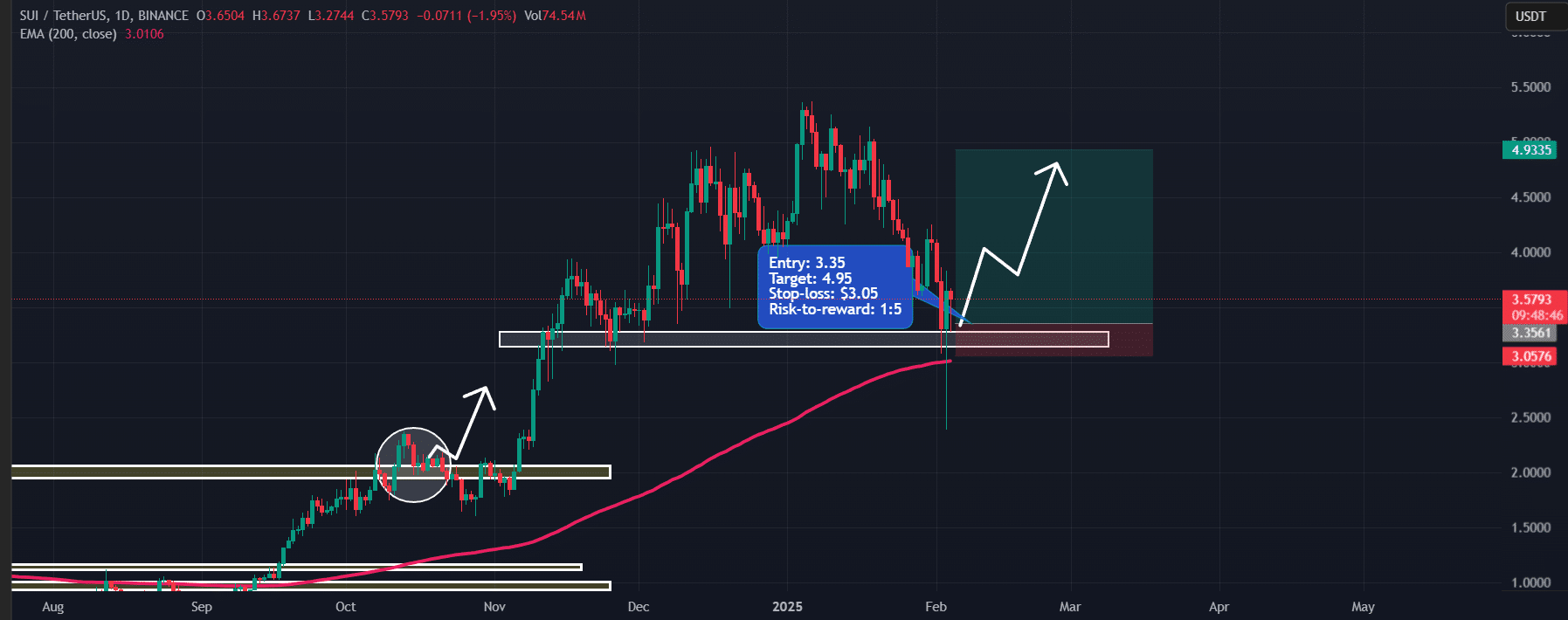

Technical analysis from AMBCrypto highlights that SUI is currently testing a crucial support level at $3.30, a price point known for historical reversals. The current price setup has formed a favorable 1:5 risk-to-reward ratio. If SUI maintains its position above the $3 mark, it could surge by 47% to hit $5 in the coming days.

With strong bullish sentiment, significant accumulation, and favorable technical indicators, SUI appears well-positioned for a potential breakout. Traders and investors will be closely monitoring its ability to hold key support levels and sustain upward momentum.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Hyperliquid (HYPE) and SUI Surge: Price Analysis, Bullish Outlook, and What’s Next for Both Tokens

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.