|

Getting your Trinity Audio player ready...

|

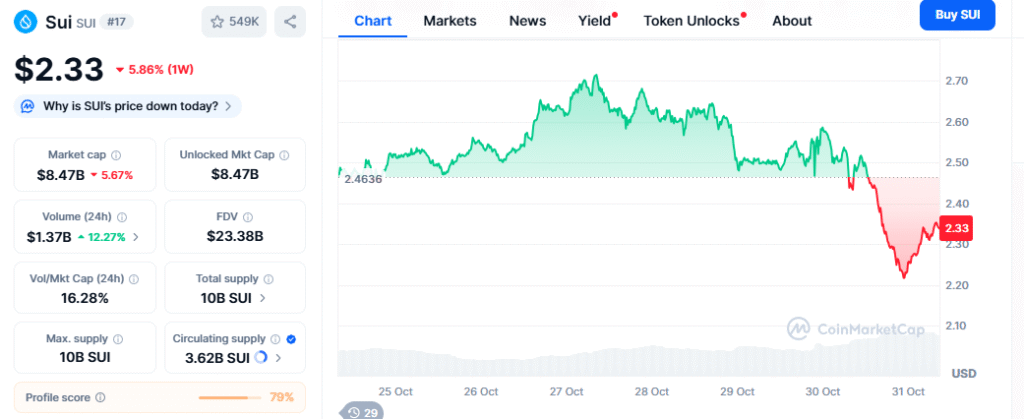

- SUI is testing a vital $2.40 support zone, key for near-term sentiment.

- Technical patterns hint at a potential recovery toward $4–$5 levels.

- Holding above $2.40 could fuel a multi-month bullish phase into 2026.

SUI (SUI/USDT) is hovering around a crucial support level near $2.40, a zone traders say could decide the token’s next major move. Currently trading at $2.51, down nearly 3.8% in the past 24 hours, the asset faces a key test as bulls attempt to defend this critical threshold. Analysts note that holding above this area could signal a potential recovery phase heading into November.

#SUI

— Emijaop.Turbo(💙,🧡) (@Emijaop) October 30, 2025

بنظرم از محدوده 2.4 میتونه برگرده بالا pic.twitter.com/iFTcK5udu2

Technical Setup Points to a Recovery Move

According to a chart shared by trader Emijap Turbo, SUI appears to be forming a double-bottom pattern on Binance’s 3-day chart — a structure often seen before price reversals. This setup mirrors previous rebounds where SUI surged after consolidating around similar price zones.

If SUI stabilizes above $2.40, technical models suggest an upside path toward $4.18–$5.28, marking key resistance zones from prior cycles. The confluence of moving averages near $2.50 supports the view that the market remains in consolidation rather than breakdown mode, hinting at a possible shift toward accumulation.

Bulls Target Mid-Range Breakout Levels

Analysts highlight $3.00 as the first threshold to watch. A decisive move above that level could trigger fresh buying interest, pushing SUI toward the $5 region in the months ahead. The broader technical picture, supported by Fibonacci retracement levels, suggests that once momentum returns, SUI could enter a new bullish phase extending into early 2026.

Also Read: SUI Altcoin Hits Key Resistance After $20B Crypto Crash: What’s Next for Traders?

Investor Sentiment Turns Cautiously Optimistic

Despite recent volatility, SUI has shown resilience by defending its macro support for the third time this year. Market observers note that the pattern of higher lows within its current range reflects growing investor confidence. If this structure holds, it may form the base for a sustained recovery and potential multi-month rally.

SUI’s current consolidation around $2.40 is more than just a technical moment — it’s a psychological test for market sentiment. A firm defense of this level could set the stage for a measured climb toward $5, aligning with historical recovery trends seen in previous market cycles.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!