|

Getting your Trinity Audio player ready...

|

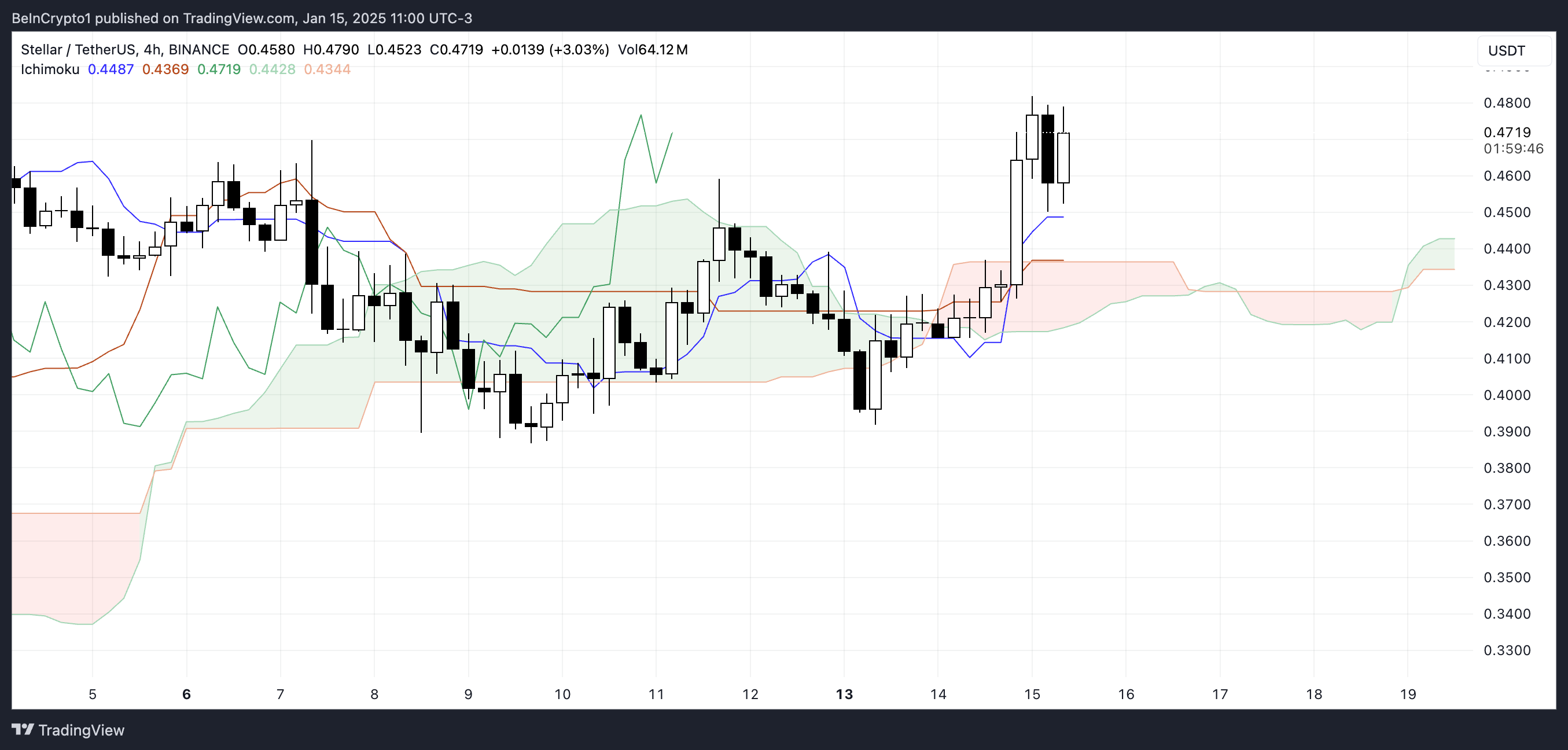

Stellar (XLM) is poised for a breakout as it nears critical resistance at $0.485. A successful breach could propel the cryptocurrency above $0.50 for the first time since December 7, marking a significant milestone. However, bearish pressures could test support at $0.43, with a potential drop to $0.38 if that level fails to hold.

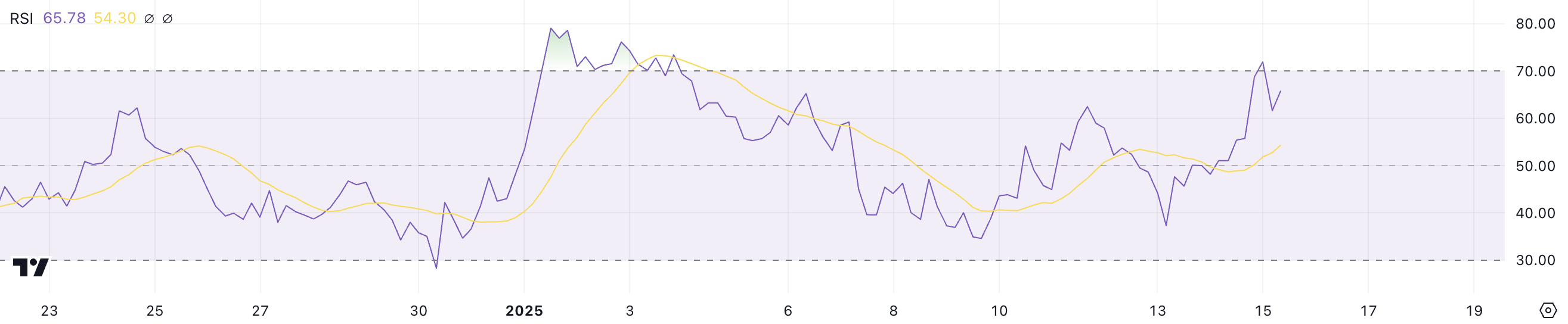

RSI Indicates Strong Buying Pressure

XLM’s Relative Strength Index (RSI) currently stands at 65.7, reflecting robust buying momentum. This is a sharp rise from 37.3 just two days ago, though it has retreated slightly from an earlier peak of 71.9. The RSI’s position in bullish territory signals continued upward momentum but also warns of overbought conditions if it exceeds 70. Traders should remain cautious, as a move into overbought levels could trigger a correction.

Ichimoku Cloud Signals a Bullish Setup

Stellar’s Ichimoku Cloud analysis shows a strong bullish trend. XLM is trading above the green Kumo (cloud), with the Senkou Span A positioned above Senkou Span B, confirming a positive setup. The Tenkan-Sen (conversion line) aligns closely with the price, while the lagging span remains above the cloud, reinforcing bullish sentiment. The cloud’s thickness offers moderate support, providing stability for XLM’s uptrend.

EMA Lines Point to Upward Momentum

Exponential Moving Averages (EMAs) also reflect a bullish configuration. Short-term EMAs are positioned above long-term ones, with widening gaps indicating growing confidence in the uptrend. This alignment supports the case for a potential rally if XLM surpasses the $0.485 resistance.

Also Read: Stellar (XLM) Soars 11.94%: Breakout Signals Major Gains Ahead as Altcoin Market Momentum Builds

If Stellar breaks past $0.485, it could target $0.50, a level not seen in over a year. However, failure to sustain momentum may lead to a correction. Key support lies at $0.43, with a potential drop to $0.38 in a bearish scenario. Traders should monitor these levels closely as XLM navigates this critical juncture.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.