|

Getting your Trinity Audio player ready...

|

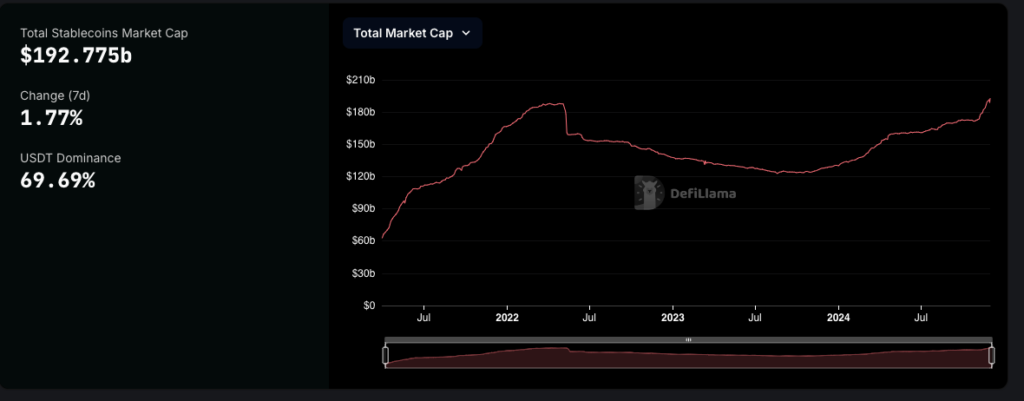

The cryptocurrency market has witnessed a significant surge in stablecoin supply, with the global market capitalization nearing a staggering $200 billion. According to data from DefiLlama, this year alone, the stablecoin market has expanded by a substantial 46%, reaching $192.56 billion at the time of writing.

Tether Dominates the Stablecoin Market

Tether (USDT) continues to reign supreme as the largest stablecoin, commanding a dominant 69.70% market share. With a market capitalization of $134.21 billion, USDT has become a cornerstone of the cryptocurrency ecosystem. Circle’s USDC follows closely behind, holding a $39.7 billion market cap. The remaining $18 billion is distributed among various algorithmic and fiat-backed stablecoins such as DAI, Ethena USD (USDe), First Digital USD (FDUSD), and others.

Bullish Market Fuels Stablecoin Demand

The recent bullish trend in the cryptocurrency market has fueled the demand for stablecoins. To meet this increased demand, issuers have minted a significant amount of stablecoins, particularly USDT. Tether alone has minted over $50 billion of USDT in the past year.

Global Factors Influencing Stablecoin Adoption

Several global factors have contributed to the rising popularity of stablecoins:

- Favorable Regulatory Environment: Recent policy developments, such as the UK’s decision to introduce a crypto market framework in 2025, have created a more favorable regulatory environment for digital assets, including stablecoins.

- Increasing Institutional Adoption: As institutional investors increasingly enter the crypto market, they seek stablecoins as a reliable way to store value and manage risk.

- Growing DeFi Ecosystem: The decentralized finance (DeFi) ecosystem relies heavily on stablecoins for various financial activities, such as lending, borrowing, and trading.

The surge in stablecoin supply underscores the growing importance of these digital assets in the cryptocurrency market. As the market continues to evolve and mature, stablecoins are poised to play a pivotal role in shaping the future of finance.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.