|

Getting your Trinity Audio player ready...

|

Solana (SOL), like many cryptocurrencies, has experienced a slight correction in the past 24 hours. After an impressive 5% weekly price hike, SOL’s value has dipped, sparking concerns among investors. At the time of writing, Solana is trading at $193 with a market capitalization exceeding $92 billion. Renowned crypto analyst Ali Martinez has emphasized the importance of the $190-$180 price range, suggesting that slipping below this level could lead to significant losses for investors.

Sell #Solana $SOL if it breaks this level! pic.twitter.com/MrTfofMWkq

— Ali (@ali_charts) December 29, 2024

SOL’s On-Chain Metrics: A Mixed Bag

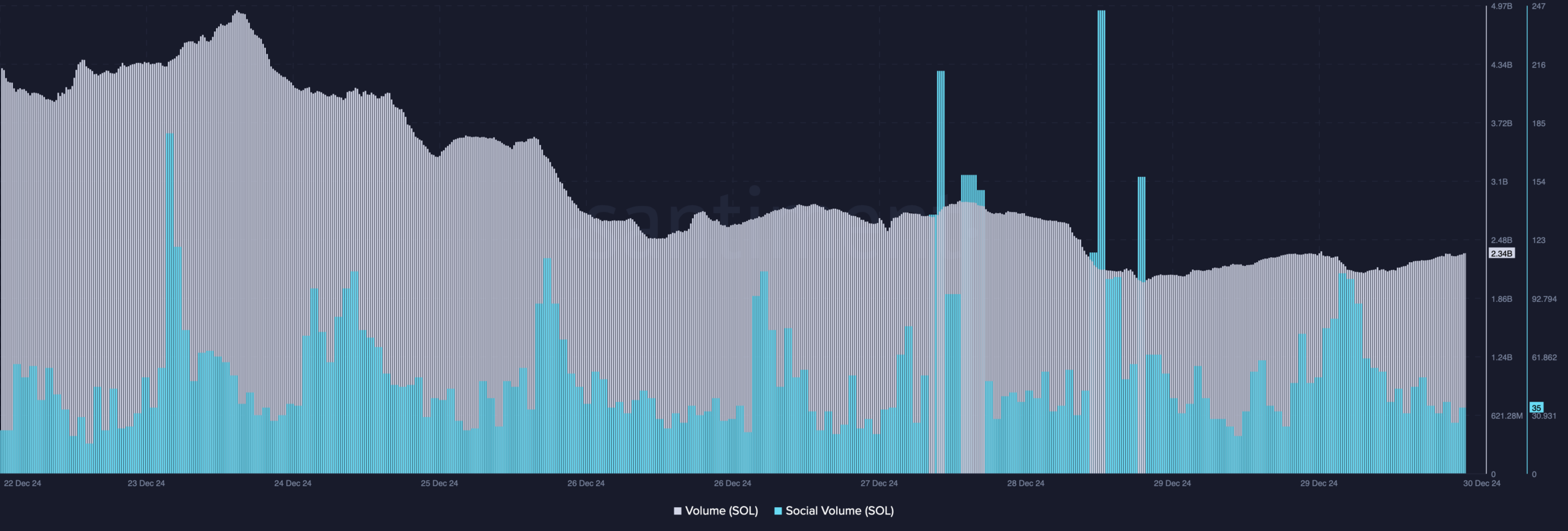

Recent analysis from AMBCrypto, utilizing Santiment’s data, highlights a potential bearish trend for Solana. Trading volume for the token has declined over the last week, which is often an early warning sign of waning market interest. However, Solana’s social volume remains high, demonstrating its continued prominence in the crypto space.

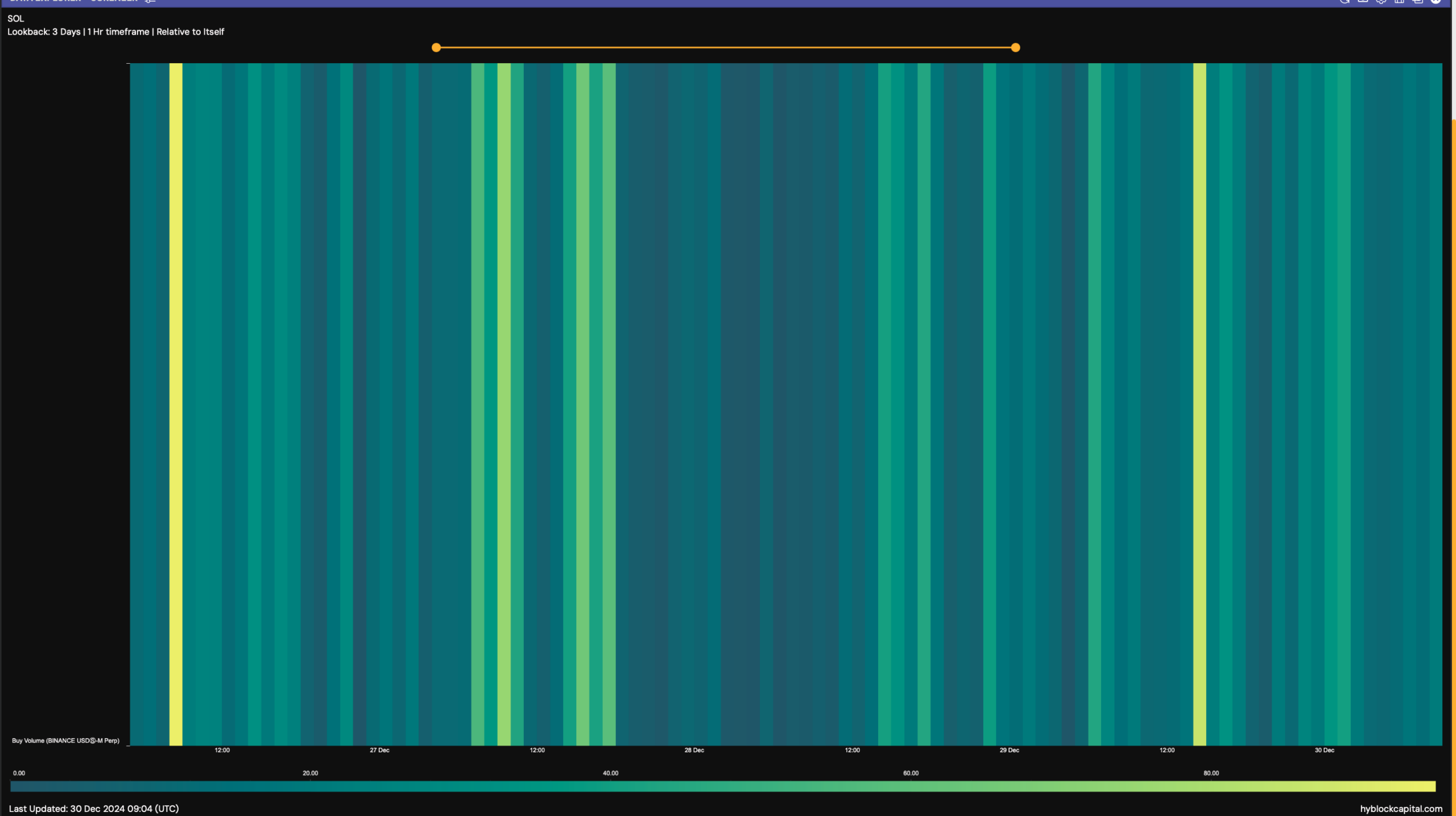

A notable positive development is the uptick in SOL’s Long/Short Ratio, indicating a larger number of long positions. This reflects a sense of optimism among investors, suggesting they anticipate price recovery or stabilization. Data from Hyblock Capital further supports this sentiment, with the token’s buy volume reaching 86 on December 29. A reading near 100 signals robust buying pressure, which often supports price stability or growth.

Technical Indicators Paint a Nuanced Picture

Solana’s Relative Strength Index (RSI) has shown a slight increase, pointing to a surge in buying activity. Yet, the Chaikin Money Flow (CMF) has dipped, signaling reduced capital inflow into the asset. This contrasting data leaves investors questioning whether Solana can maintain its crucial support level of $180-$190.

What Lies Ahead for Solana?

While bullish signals such as increased long positions and strong buy volume offer hope, declining trading volume and CMF suggest caution. If Solana falls below the critical $180 threshold, it could face increased selling pressure, potentially eroding its market capitalization as 2024 concludes.

Also Read: Solana’s Road to Redemption: Overcoming Congestion and Poised for a Stronger 2025

Investors should keep a close watch on Solana’s on-chain metrics and broader market trends to gauge its next move. As the crypto market remains volatile, Solana’s ability to sustain its position in the $190-$180 range will be pivotal in determining its trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.