Solana (SOL) bulls are feeling the heat as the altcoin’s price continues its descent. In the last month alone, SOL has shed a staggering 19%, currently sitting at $135.56. This slump has triggered a wave of liquidations for futures traders who bet on a price rally.

Long Liquidations Squeeze SOL Bulls

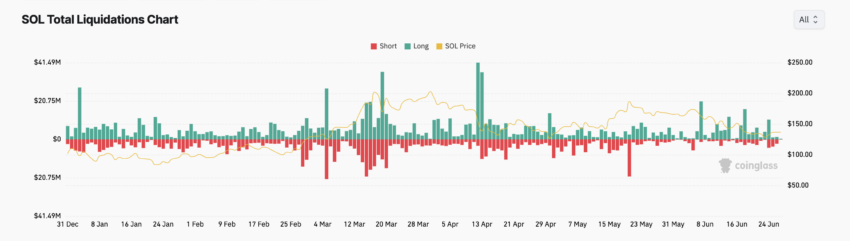

The derivatives market tells a harsh story. In the past six days, long liquidations, where traders are forced to exit positions due to falling prices, have amounted to a hefty $27.36 million. Despite this pain, the demand for long positions remains surprisingly resilient. This is evident in SOL’s funding rate, which remains positive at 0.0063%.

Funding rates play a crucial role in perpetual futures contracts, ensuring the contract price stays aligned with the spot price. A positive funding rate suggests more traders are bullish on SOL, expecting its price to rise. This stands in contrast to those taking short positions, betting on a price decline.

However, there are signs that SOL’s long squeeze might not be over. The Chaikin Money Flow (CMF), an indicator measuring money flow into and out of an asset, paints a concerning picture. SOL’s CMF is steadily dropping, signifying a liquidity outflow from the spot market. This suggests selling pressure is currently outweighing accumulation by buyers.

Also Read: Solana Shines Beyond Memes: Becomes DePIN Leader with 12x GPU Growth & Apple WWDC Tie-In

Technical Analysis: A Glimpse into the Future?

When an asset’s price and CMF decline in tandem, it often signals further weakness ahead. This could lead SOL to trade below the psychologically important $130 mark, potentially reaching $122.80.

But not all hope is lost. If market sentiment flips from bearish to bullish, and buying pressure surges, SOL could defy the current trend. In this scenario, the price could potentially climb towards $148.15.

The Takeaway: Cautious Optimism for SOL

The current situation for SOL is a precarious one. While long liquidations highlight the vulnerability of bullish bets, the positive funding rate suggests some lingering optimism. Ultimately, the direction of SOL’s price hinges on a shift in market sentiment. Whether the bulls can regain control or the bears continue their dominance remains to be seen.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.