|

Getting your Trinity Audio player ready...

|

As we usher in 2025, the cryptocurrency market is grappling with heightened volatility, with Solana (SOL) emerging as a focal point. Hovering around the critical $180 level, Solana faces increased scrutiny from traders eyeing potential price swings. This price point has become a key battleground, setting the stage for either a bullish breakout or a bearish retreat.

Social Volume: A Double-Edged Sword

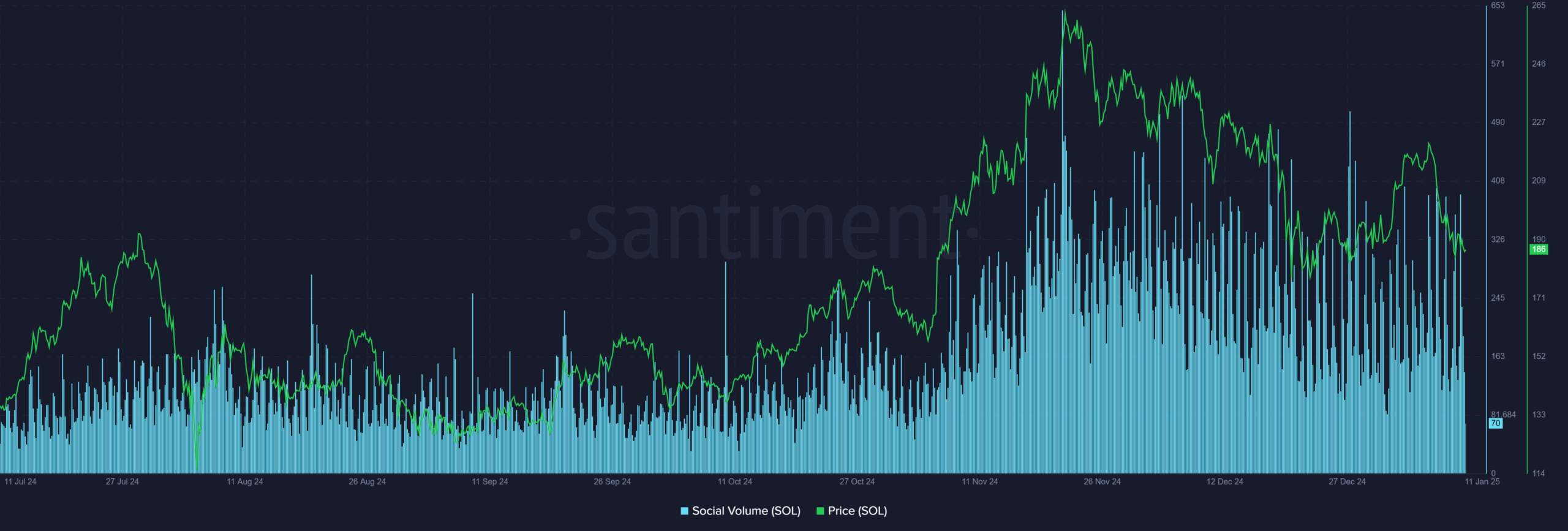

Solana’s social volume has displayed a strong correlation with its price movements. Spikes in social activity often signal impending volatility, with recent chatter hinting at a potential sentiment-driven rally. However, elevated social volume can also act as a warning sign, indicating overenthusiasm that might precede a reversal.

Traders should tread carefully as social engagement remains high. If Solana fails to maintain support above $180, the heightened sentiment may mask underlying weaknesses, paving the way for further declines.

Decreasing Active Addresses Raise Concerns

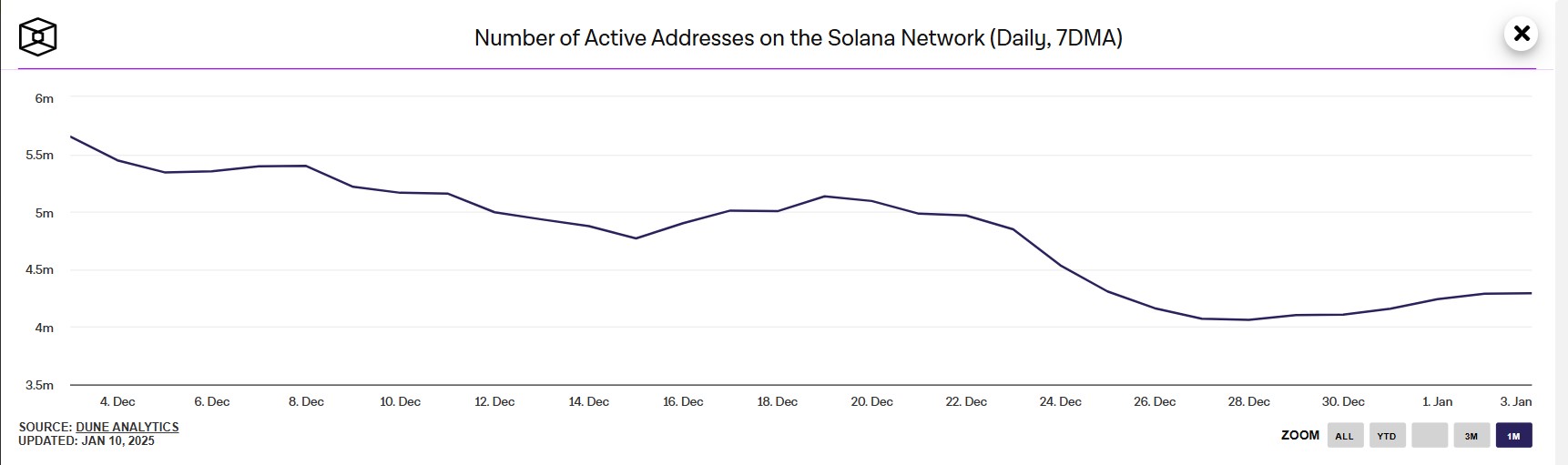

A sharp decline in active addresses has raised red flags for Solana’s network activity. Between early and late December, active addresses plummeted from nearly 6 million to just over 3.5 million—a staggering 40% drop. Although early January showed a modest recovery, the metric remains significantly below its highs, reflecting reduced engagement and utility.

This decline in participation could exert additional downward pressure on Solana’s price, as waning demand often signals diminishing investor confidence.

What’s Next for Solana?

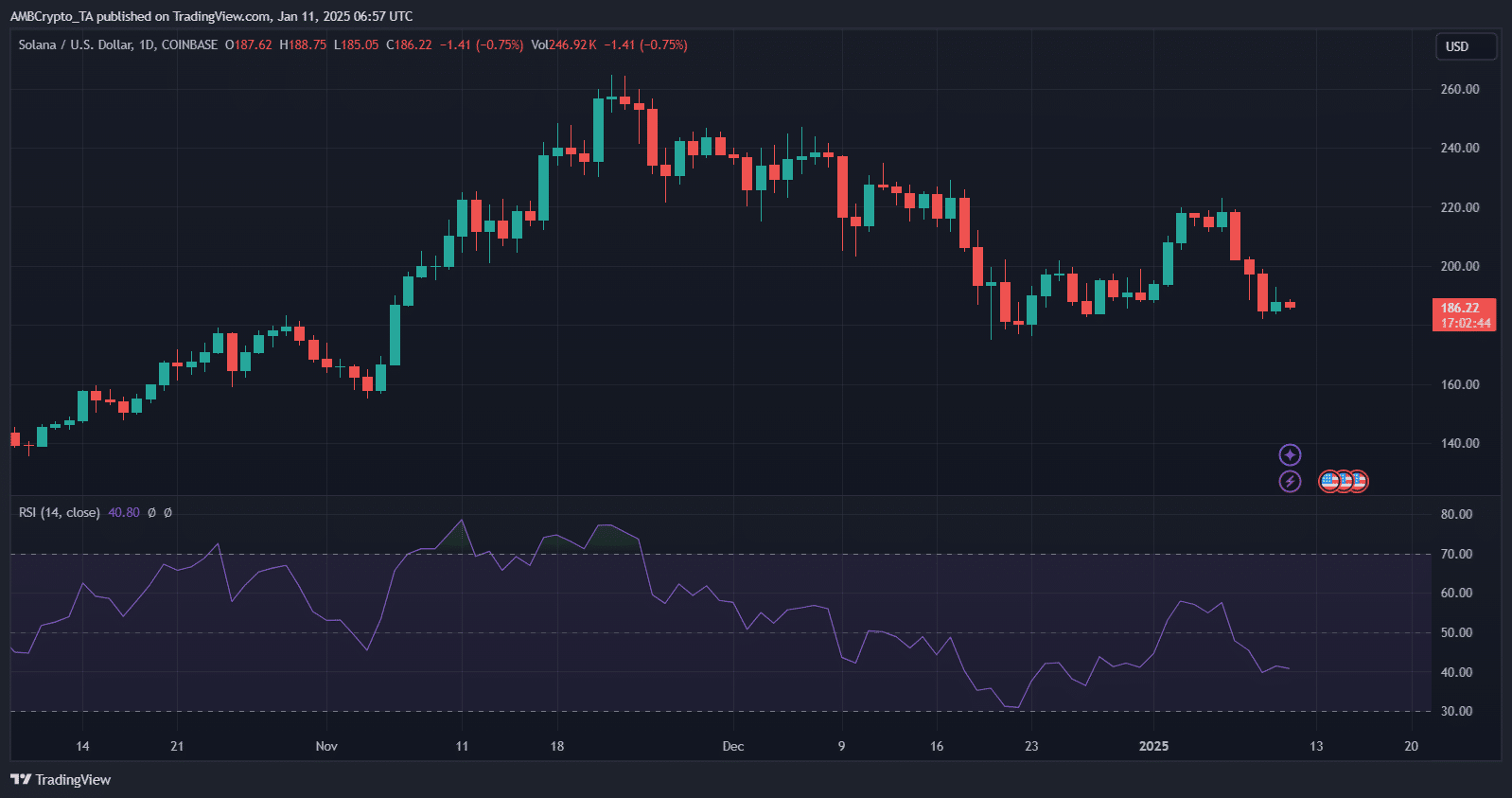

Currently, Solana is navigating a precarious setup. The Relative Strength Index (RSI) suggests bearish momentum, approaching oversold territory. A breach of $180 could trigger further declines, with immediate targets around $165 and stronger support in the $130-$150 range.

Conversely, reclaiming $190 could spark a relief rally toward $200, but weak trading volumes and falling on-chain activity may limit gains. For Solana, the $180 level serves as a crucial pivot, underscoring the need for renewed buying interest and network activity to avoid deeper retracement.

Also Read: Solana Faces Pressure After $45.7 Million Whale Dump – What’s Next for SOL?

As the market evolves, Solana’s next moves could set the tone for its performance in 2025.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.