|

Getting your Trinity Audio player ready...

|

The Solana (SOL) community’s excitement over the prospect of exchange-traded funds (ETFs) has hit a potential snag, with recent reports indicating that the U.S. Securities and Exchange Commission (SEC) may reject pending applications for Solana ETFs. This development could delay the inclusion of Solana in the ETF hype that has bolstered Bitcoin and Ethereum’s market presence.

SEC Set to Reject Solana ETF Applications

According to a recent report, the SEC has informed at least two applicants that their Solana ETF filings are likely to be rejected. Companies such as VanEck, Bitwise, Grayscale Investments, 21Shares, and Canary Capital had filed for Solana ETFs, banking on the momentum gained from Bitcoin and Ethereum ETFs. However, the regulatory body cited concerns over Solana’s asset classification, particularly the lingering question of whether SOL qualifies as a security.

This regulatory ambiguity has cast a shadow over the potential for institutional adoption of Solana through ETFs. Such products are often viewed as a gateway for large-scale investors to enter the crypto market, promising an influx of liquidity.

Implications for SOL Price Action

The anticipation of Bitcoin and Ethereum ETFs fueled significant pre-launch price rallies for those assets. Yet, these launches were met with sell-offs, highlighting the “buy the rumor, sell the news” phenomenon. In the case of Solana, the rejection of ETF applications might not lead to immediate price fluctuations but could curtail the long-term inflow of institutional capital, which is crucial for sustained price growth.

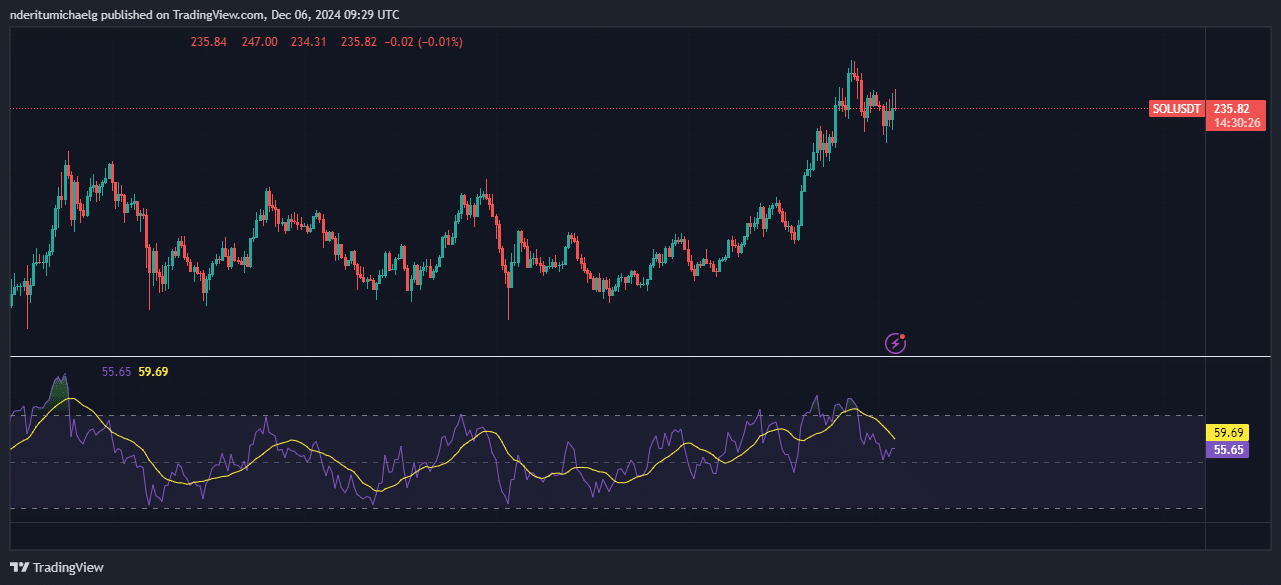

Currently trading at $235.88, SOL has demonstrated robust performance this year, climbing comfortably above the $200 mark. Analysts believe that if bullish sentiment persists in December, SOL could revisit and potentially exceed its recent highs. Conversely, bearish market conditions might push the price down to $157 before finding support.

Solana’s On-Chain Metrics Show Strength

Despite the potential regulatory setbacks, Solana’s on-chain performance continues to impress. The network’s total value locked (TVL) reached an all-time high of $11.69 billion, while daily transaction volumes surged past 50 million in Q4, up from 40 million earlier. In the past 24 hours alone, Solana recorded on-chain activity worth $5.88 billion, signaling robust network health and growing adoption.

The SEC’s decision on Solana ETFs will undoubtedly shape the near-term narrative for SOL. While rejection may slow institutional interest, Solana’s expanding network activity and developer ecosystem suggest resilience. Investors will watch closely for shifts in regulatory sentiment and broader market trends that could influence SOL’s trajectory.

Also Read: Solana ETF Rejections – Bloomberg Analyst Eyes Approval Shift Under New SEC Chair

With or without an ETF launch, Solana continues to cement its position as a formidable player in the blockchain ecosystem.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.