|

Getting your Trinity Audio player ready...

|

Solana (SOL) recently dropped below the $100 mark for the first time in over a year, sparking concerns about its short-term outlook. The prevailing macroeconomic uncertainty, including inflation fears and regulatory pressure, has created downward pressure on many cryptocurrencies, including SOL.

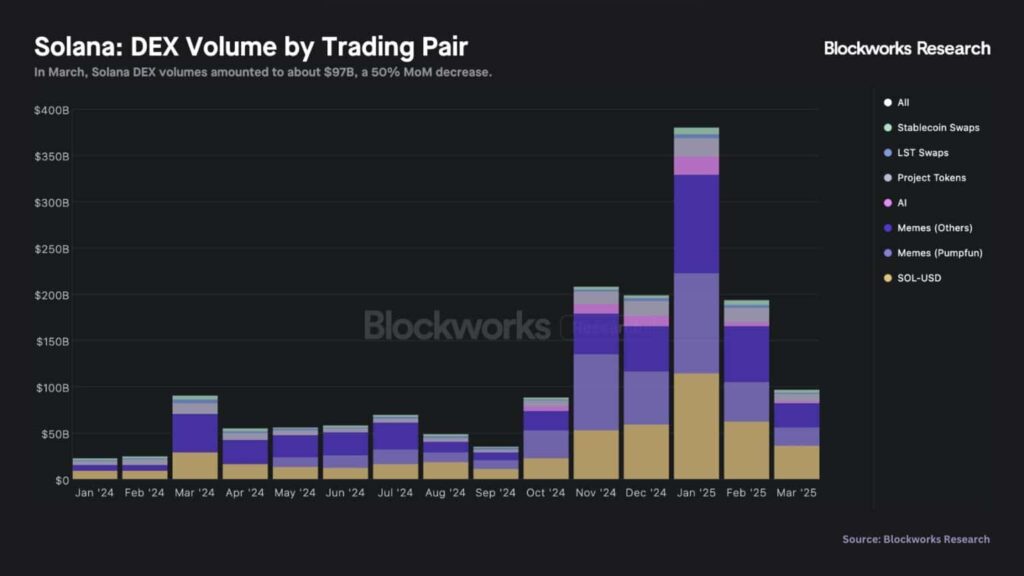

A key factor in Solana’s price decline is the significant drop in decentralized exchange (DEX) volumes. According to Blockworks, Solana’s DEX volumes plunged 50% in March, falling from $193 billion in February to $97 billion. This slump was particularly pronounced in Solana’s memecoin market segment, which fell from $60 billion to $26 billion over the same period. As memecoin activity cooled, demand for SOL tokens, which are essential for transactions on the network, also took a hit.

The drop in DEX volumes and the lack of memecoin-driven demand resulted in a 53% decline in SOL’s price, from $240 to $100, in just two months. However, there may still be hope for the altcoin in the form of institutional investment. SOL has caught the attention of institutional players, with companies like Janover, a real estate platform, making moves to acquire Solana validators. This has led to a significant surge in Janover’s JNVR stock, which spiked over 800% following the news.

Additionally, Solana-focused strategies, such as SOL Strategies, have continued to stake large amounts of SOL, potentially adding upward pressure on the token’s value in the long term. As of March, SOL Strategies had staked over 3 million SOL, worth nearly $400 million, signaling strong institutional belief in Solana’s future.

Also Read: Solana (SOL) to $60? XRP and ETH Also at Risk, Warns Analyst Jason Pizzino

Despite these positive signs, Solana faces challenges in the short term. The options market reflects pessimism, with just 10% of traders expecting SOL to break $150 by the end of April. Technical indicators also suggest that the altcoin may be at risk of further declines. While SOL could rebound from its current levels, a drop to $80 remains a possibility if broader market sentiment remains negative.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.