|

Getting your Trinity Audio player ready...

|

While the broader cryptocurrency market continues to grapple with selling pressure, Solana (SOL) has emerged as a notable exception. The fifth-largest cryptocurrency by market capitalization has defied the downtrend, registering a significant price increase in the past 24 hours.

SOL’s performance has outshone major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB). At the time of writing, SOL is trading near $173, having surged by over 3.4% in the past day. Despite this price appreciation, trading volume has declined by 20%, suggesting that traders and investors may be exercising caution due to the prevailing market conditions.

Also Read: Solana Surges 5.62%, Overtakes Ethereum With $4.1M Daily Fees Amid AI Meme Coin Boom

Technical Analysis Points to Bullish Outlook

According to expert technical analysis, Solana’s recent breakout from a two-day consolidation pattern between $162 and $170 levels indicates a bullish trend. The cryptocurrency is poised to soar by 10% to reach the $190 level in the coming days.

SOL’s position above the 200-day Exponential Moving Average (EMA) on a daily time frame further reinforces the uptrend. This bullish momentum has led to the liquidation of nearly $3.5 million worth of short positions, while bulls have registered a liquidation of $350,000. These figures suggest that short sellers are becoming exhausted, paving the way for a potential price surge.

On-Chain Metrics Support Bullish Sentiment

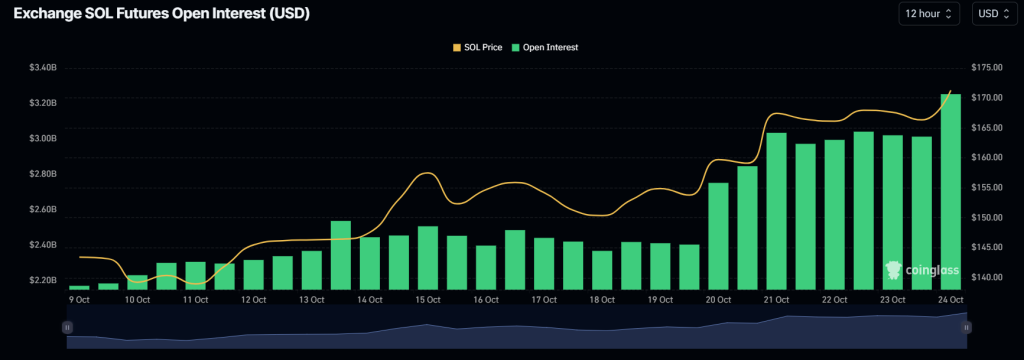

Solana’s bullish outlook is further supported by on-chain metrics. According to CoinGlass, a leading on-chain analytics firm, SOL’s Long/Short ratio currently stands at 1.02. This indicates a strong bullish market sentiment among traders. Additionally, the open interest has jumped by 11%, suggesting that new positions are being built up, likely due to the recent breakout from the consolidation pattern.

Traders and investors often consider a rising open interest and a Long/Short ratio above 1 as positive indicators for building long positions. When combined with the technical analysis, these on-chain metrics suggest that bulls are currently dominating the market and may be able to drive SOL’s price towards the target level.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.