|

Getting your Trinity Audio player ready...

|

The Solana (SOL) network has experienced a significant decline in usage throughout August, raising concerns about its long-term prospects. As the month draws to a close, Solana has reached its lowest point in terms of both transaction and active address count for the entire year.

This dramatic drop in network activity has had a cascading effect, leading to plummeting network fees and revenue. According to data from The Block, the number of unique addresses interacting with the Solana network this month has fallen by a staggering 67% compared to July. This translates to a user base of only 18.09 million in August compared to 54.33 million in the previous month. Additionally, the number of new users on the network this month has shrunk by 66% compared to the year-to-date peak recorded in July.

The decline in user activity extends to transaction volume as well. Non-vote transactions on Solana, which encompass all activities except voting for block producers, have hit their lowest point for the year. Since the beginning of August, these transactions have totaled approximately 486.61 million, representing a significant drop from previous months.

Also Read: Solana (SOL) Dips 20% In A Month – Is The $140 Support Level The Key To A Comeback?

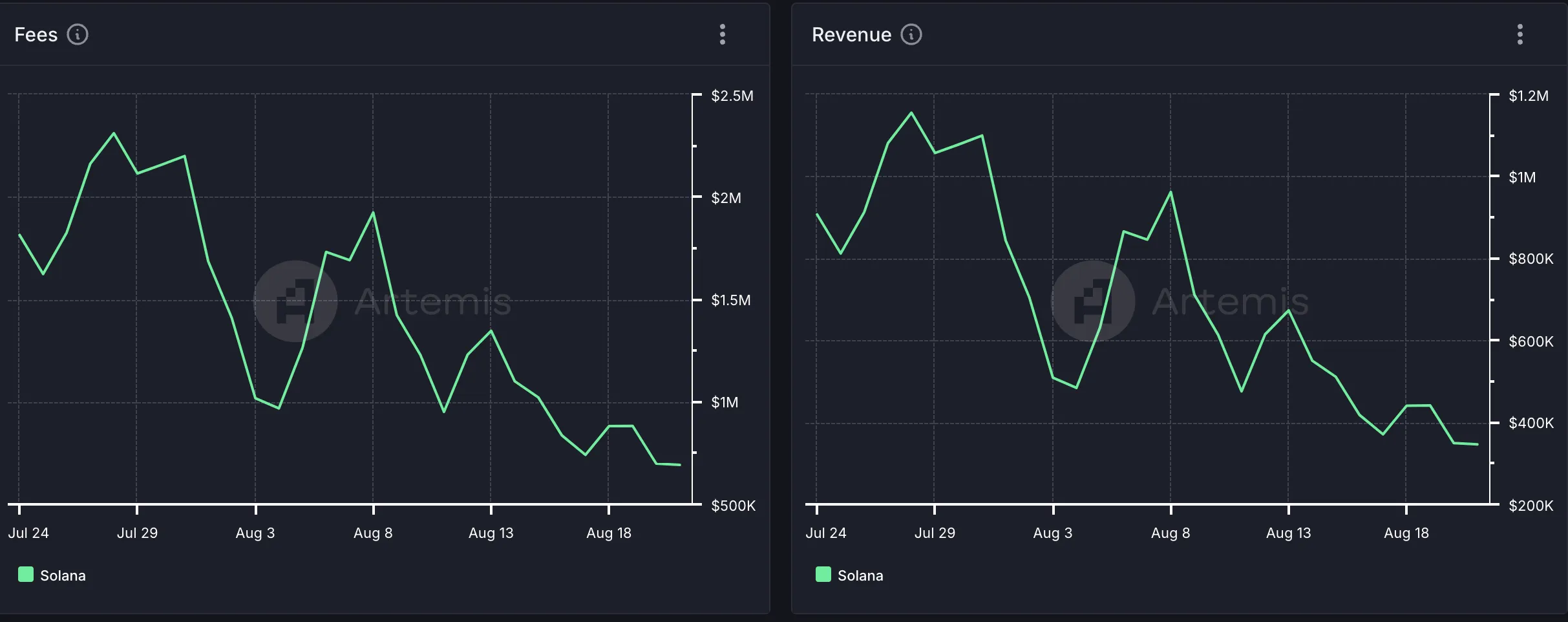

This decline in network activity has directly impacted Solana’s financial performance. Data from Artemis reveals a staggering 62% drop in network fees and revenue over the past month. This drop in revenue presents a challenge for the network’s future development and sustainability.

Solana Price Stalls in Consolidation

At the time of writing (August 23rd), SOL is trading at $145.58. The past few weeks have seen a period of relative price stagnation, with resistance at $152.12 and support at $137.65. This lack of volatility is reflected in SOL’s flat Relative Strength Index (RSI), an indicator that measures overbought and oversold market conditions. A flat RSI signifies a period of consolidation.

While a breakout above the resistance line could potentially lead to a 10% increase in SOL’s price, a surge in selling pressure could cause it to fall below support. Analysts will be closely monitoring the price action in the coming days to see if Solana can regain momentum or if the current slump will continue.

The recent slump in network activity raises questions about the future of Solana. While the hype surrounding Pump.fun, the Solana-based meme coin platform, provided a temporary boost, it wasn’t enough to offset the broader decline in user engagement. The coming weeks will be crucial for Solana as it strives to regain user trust and rebuild its network activity.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.