|

Getting your Trinity Audio player ready...

|

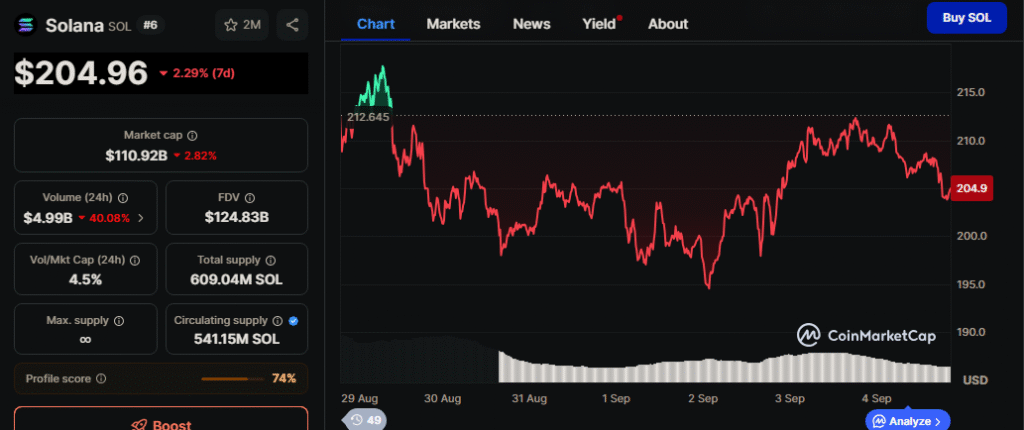

- Solana trades at $206.8, facing strong resistance at $215–$220.

- Alpenglow upgrade improves scalability and block finality, boosting adoption.

- Spot Solana ETF approval nears, with 99% odds, potentially driving institutional inflows.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Solana (SOL) has shown impressive strength recently, gaining 23% over the past month. However, the altcoin’s recent rally has hit a pause, struggling to break past the $210 level. Despite this, bullish sentiment remains strong, supported by daily trading volumes around $6.0 billion. Investors and analysts are closely watching key technical levels and upcoming upgrades that could define the next leg of SOL’s price action.

Solana Price Action: Key Levels to Watch

Currently, Solana trades at $206.8, moving within an intraday range of $206.2 to $212.4. The altcoin continues to follow an ascending pattern of higher lows, with the $197–$200 zone acting as crucial support. On the upside, resistance between $215–$220 represents the next major hurdle. Analysts suggest that a successful breakout above this range could open the path to $236–$252, with some projections even targeting $260 if strong trading volumes persist.

However, failure to hold support at $206–$200 could lead to declines toward $190–$186, with further downside potentially reaching $180. Market watchers emphasize that Solana’s trajectory depends heavily on both technical and fundamental catalysts.

Alpenglow Upgrade Boosts Bullish Sentiment

Solana’s bullish narrative is reinforced by the recent Alpenglow upgrade, designed to deliver near-instant block finality and enhanced scalability. By integrating technologies like Rotor and Votor, the upgrade reduces finality times to around 150 milliseconds, improving network efficiency. This enhancement is particularly significant for decentralized finance (DeFi) applications and real-world assets (RWAs), potentially driving broader adoption across the Solana ecosystem.

ETF Optimism and Institutional Adoption

Adding to bullish momentum is optimism surrounding a spot Solana ETF. The SEC has requested updated S-1 filings, signaling that the approval process is nearing completion, with a high probability of approval by October. Polymarket now estimates a 99% likelihood for the ETF’s approval, which could trigger significant institutional inflows and push SOL prices higher.

Meanwhile, Galaxy Digital has tokenized its SEC-registered Class A shares on the Solana blockchain, marking a major step toward integrating traditional equities with blockchain technology. This move underscores Solana’s growing relevance in bridging traditional finance with crypto innovation.

Solana’s price action remains poised between critical support and resistance levels. With the Alpenglow upgrade enhancing scalability and ETF approval on the horizon, the altcoin could experience substantial upside. Investors should watch the $215–$220 breakout zone closely, as surpassing it may unlock new highs for SOL.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

Also Read: Solana Reaches $500M RWAs as Galaxy Digital Tokenizes Nasdaq Shares On-Chain

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!