|

Getting your Trinity Audio player ready...

|

Solana (SOL), a leading cryptocurrency by market cap, has been on a tear in 2024. Year-to-date, SOL boasts a staggering surge of over 500%, recently surpassing $150. This consistent upward trend has solidified Solana’s position as a top performer, attracting a growing legion of traders and investors seeking high-growth opportunities.

Adding fuel to the fire, a bullish pennant pattern has emerged on Solana’s one-day chart, as identified by CryptoBusy. This technical indicator is often seen as a precursor to price rallies, and it materialized following an 18% price increase for SOL in the last week. Such pennants typically form during price consolidation phases after significant gains, suggesting sustained investor interest and the potential for further upswings.

However, caution is warranted. Prominent crypto analyst Honey emphasizes that SOL has reached “short-term price targets” of around $160. Honey advises traders to be prudent with leveraged positions, especially in this “pivot area.” She outlines potential next steps: “reclaim = $192 next. reject = $140s next. go easy on the leverage.”

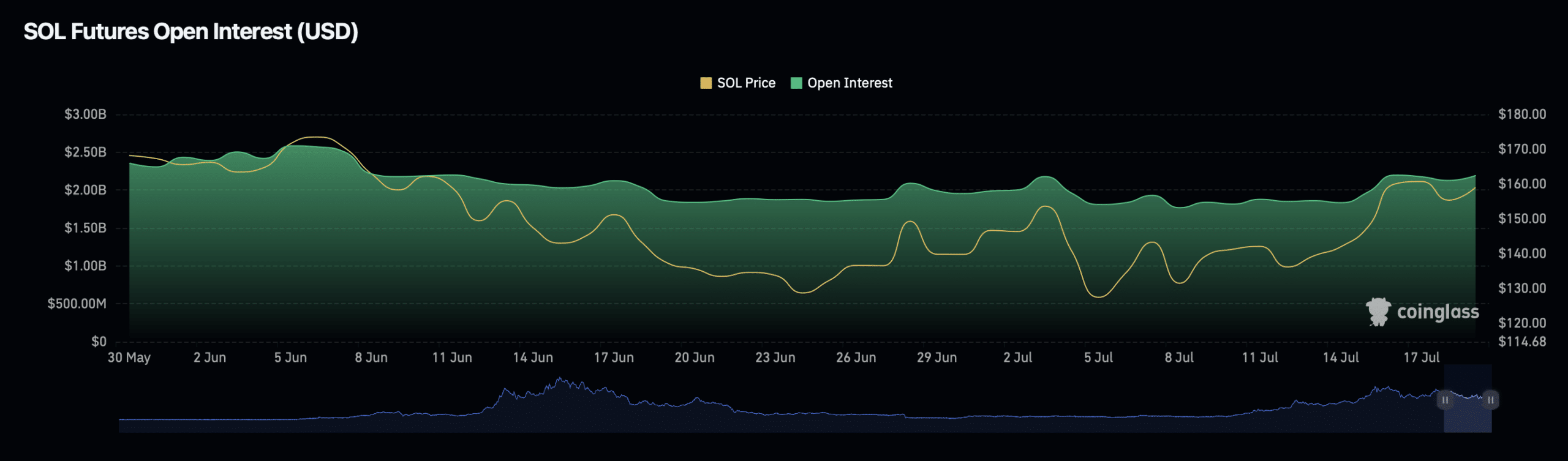

Beyond technicals, Solana’s fundamentals paint a promising picture. Coinglass data reveals a significant rise in Solana’s futures trading activity. Open Interest, which reflects outstanding contracts, jumped 5.39%, while trading volume surged 7.45% within the last 24 hours. This surge has pushed Solana’s Open Interest to $2.3 billion and its trading volume to a staggering $6.82 billion, indicative of heightened market engagement and investor confidence.

Solana’s network activity has also witnessed an upswing, with the number of active wallets climbing from under 900,000 to nearly 1.2 million in the past week. This surge in active participation aligns perfectly with the bullish sentiment evident in trading patterns.

It’s important to note that this bullishness surrounding SOL coincides with the recent spotlight cast on the asset due to the potential launch of a spot exchange-traded fund (ETF).

Solana’s impressive performance in 2024, coupled with bullish technical indicators and strong fundamentals, has positioned the cryptocurrency as a force to be reckoned with. However, cautious optimism is key, as analyst advice suggests potential turning points ahead. With heightened market activity and investor confidence, Solana’s future trajectory promises to be an exciting one to watch.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.