|

Getting your Trinity Audio player ready...

|

Key Takeaways

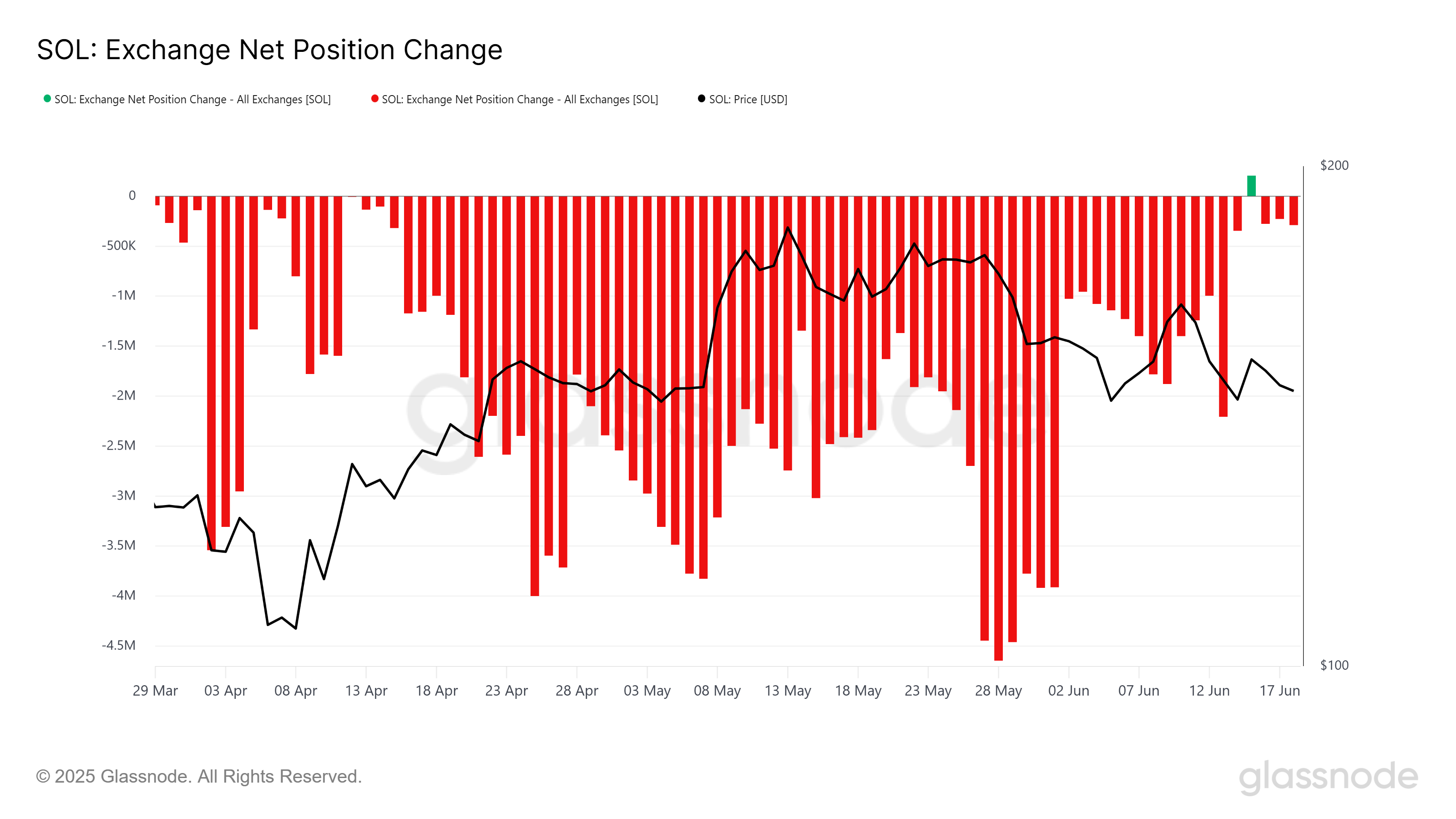

- Solana investors continue accumulating, with exchange data showing minimal selling over the past three months.

- Declining NVT ratio and strong support at $144 suggest potential for a bullish SOL price rebound.

Solana (SOL) has faced a challenging June, with repeated efforts to spark upward momentum being stifled by the broader market downturn. Despite the weak market conditions, Solana holders have largely resisted the urge to sell, pointing to growing investor confidence and long-term conviction in the project’s fundamentals.

Solana Investors Stick to Accumulation

Data from on-chain analytics platform Glassnode highlights a sustained accumulation trend among Solana investors. Over the past three months, there has been only one notable instance where net exchange outflows turned into net inflows—signaling a rare shift from accumulation to selling. This consistent withdrawal of SOL from exchanges indicates a strong preference among investors to hold rather than liquidate.

This behavior signals a broader shift in investor psychology. Rather than reacting to short-term volatility, Solana holders appear to be taking a long-term approach, banking on the project’s technological strengths and potential for future growth. The ongoing accumulation is also seen as a bullish indicator, especially as it contrasts with broader market weakness.

NVT Ratio Signals Potential for Growth

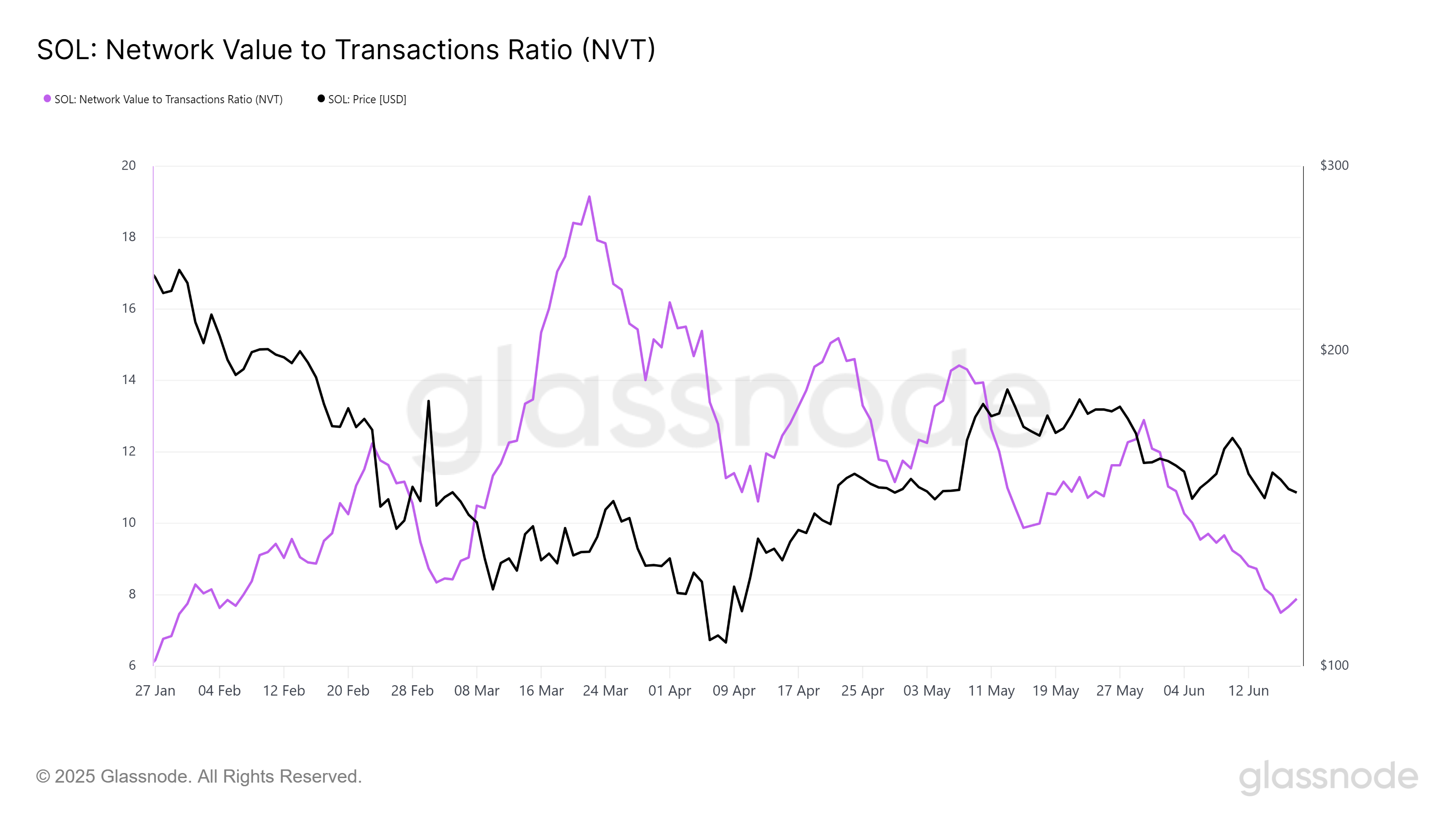

One of the key metrics supporting the bullish sentiment is Solana’s Network Value to Transactions (NVT) ratio, which has been on a downward trend. The NVT ratio, often viewed as a measure of an asset’s valuation relative to its transaction volume, helps determine whether a cryptocurrency is over- or undervalued.

A declining NVT ratio indicates that the value of the network is increasingly supported by transaction activity. In Solana’s case, this suggests that the asset is becoming more fairly priced based on actual usage, rather than speculation. Such a trend often precedes upward price movements, as it reflects a healthier and more sustainable market foundation.

SOL Price Holds Key Support at $144

As of now, Solana is trading at $146, holding above the critical support level of $144. This level has served as a key psychological and technical barrier throughout June, preventing further downside despite market headwinds. Maintaining this support is crucial, as it gives SOL a chance to rally toward the next resistance levels at $152 and potentially $161.

If bullish momentum holds and buyers step in at current levels, Solana could stage a rebound, strengthening the case for a broader recovery. However, a drop below the $144 support zone could invalidate the current bullish outlook, exposing the token to a possible pullback toward $136.

Also Read: Solana Surges 8% on ETF Hype, But Bearish Signals Suggest Caution Ahead

While June has presented challenges for Solana, the token’s resilience is clear. Long-term holders are showing confidence by accumulating rather than selling, and key metrics like the NVT ratio reinforce the narrative of a fundamentally sound network. If technical support continues to hold, SOL could be primed for a bounce back in the coming weeks.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.