|

Getting your Trinity Audio player ready...

|

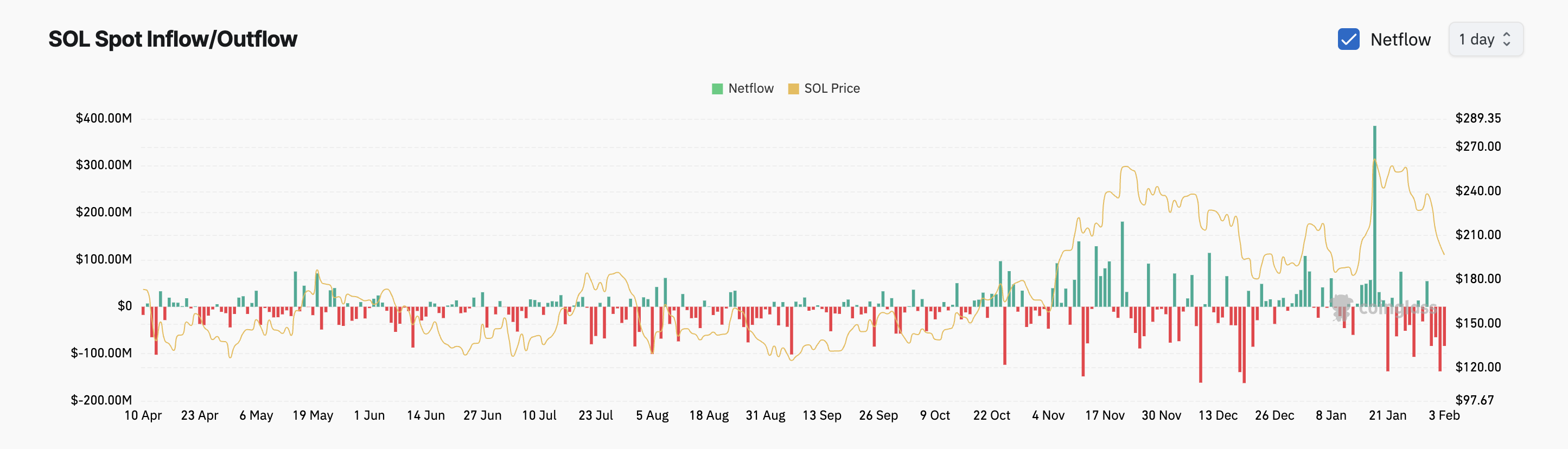

Solana (SOL) is grappling with a sustained decline in demand, as evidenced by significant outflows from its spot markets. Over the past three days, traders have pulled out over $365 million from SOL, signaling a shift in market sentiment towards bearish conditions.

SOL Spot Market Records Heavy Outflows

SOL, which shares a strong positive correlation with Bitcoin, has been under selling pressure following Bitcoin’s decline below the $100,000 threshold on February 1. As BTC struggles, SOL traders have responded by reducing their exposure to the altcoin.

According to data from Coinglass, SOL has witnessed $367 million in cumulative outflows over three days. Such persistent outflows indicate that more traders are selling or withdrawing their holdings rather than accumulating, leading to a decrease in demand. This pattern suggests a bearish outlook for SOL, as market participants continue to offload their assets.

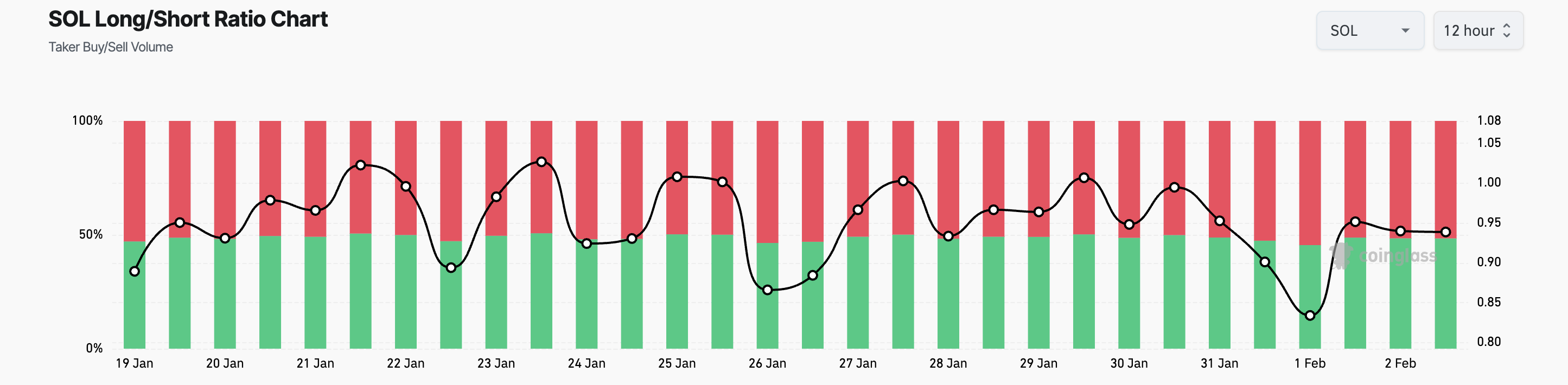

Bearish Sentiment Confirmed by Long/Short Ratio

Reinforcing this bearish sentiment, SOL’s long/short ratio has dropped below 1, currently standing at 0.93. This metric compares the number of long positions—bets that SOL’s price will rise—to short positions, which anticipate a price decline. A ratio below 1 indicates a dominance of short positions, reflecting pessimism among traders regarding SOL’s near-term prospects.

SOL Price Outlook: Potential for Further Decline

Technical indicators also suggest a challenging road ahead for SOL. The Chaikin Money Flow (CMF) indicator, which measures money inflows and outflows, currently hovers at the zero line. This implies strong selloffs and reduced buying interest, further confirming bearish momentum.

Should this trend persist, SOL’s price may decline toward $187.71. However, if demand resurges and buying pressure increases, SOL could rally to reclaim the $229.03 mark.

With sustained spot outflows and a weakening long/short ratio, Solana faces a critical test in the coming days. While technical indicators lean bearish, a shift in market sentiment could still drive a recovery. Traders should monitor BTC’s performance, as SOL’s price movement remains closely tied to the leading cryptocurrency’s trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Solana Stablecoins Double in Market Cap to $11.4 Billion in January, Driven by Memecoin Surge

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.