|

Getting your Trinity Audio player ready...

|

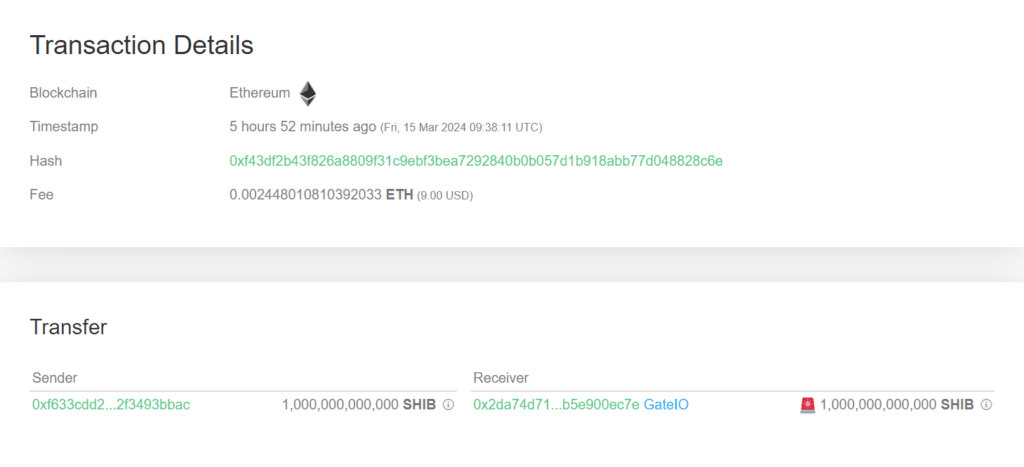

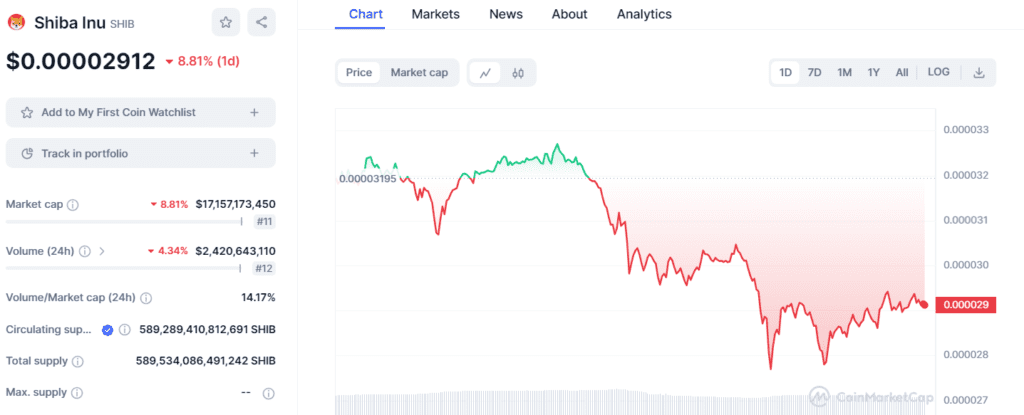

Shiba Inu (SHIB), the popular Ethereum-based memecoin, is facing a wave of selling pressure after a mysterious whale dumped a staggering 1 trillion SHIB tokens onto the market. This massive transaction, coinciding with a broader crypto market selloff, has sent SHIB prices tumbling and raised questions about the token’s future.

SHIB Price Takes a Dive

Following a nearly 200% surge in the past month, SHIB has experienced a sharp reversal of fortune. As of writing, the price has dropped almost 10% in the last 24 hours, slipping below the $0.00003 mark. This decline comes despite the continued efforts of the SHIB community to burn tokens, a mechanism aimed at reducing supply and theoretically increasing value.

According to blockchain tracker Whale Alert, an unknown wallet transferred 1 trillion SHIB to GateIO, a major cryptocurrency exchange. This large-scale selloff has fueled bearish sentiment among investors, as it suggests a potential loss of confidence in SHIB from a major holder.

Exchange Inflow Dampens Burning Efforts

The influx of SHIB onto exchanges like GateIO could potentially dilute the impact of token burning initiatives. When a large amount of SHIB floods the market, it becomes more difficult for burning to significantly impact the price.

Market Uncertainty Brews

The current market dynamic surrounding SHIB is complex. While trading volume has surged, Coinglass data reveals a 13.83% decrease in open interest. This suggests heightened short-term trading activity, with investors hesitant to commit to long-term positions due to market uncertainty.

Despite the recent price slump, the Relative Strength Index (RSI) for SHIB currently sits around 59. This indicator suggests weakening downward momentum, potentially hinting at a consolidation phase ahead. While this doesn’t guarantee a price increase, it suggests there may be some buying interest in the market that could prevent a further freefall.

The Road Ahead for SHIB

The coming days will be crucial for Shiba Inu. Whether the current downturn is a temporary setback or the start of a longer-term correction remains to be seen. Crypto enthusiasts are advised to exercise caution and closely monitor market movements before making any investment decisions.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!