|

Getting your Trinity Audio player ready...

|

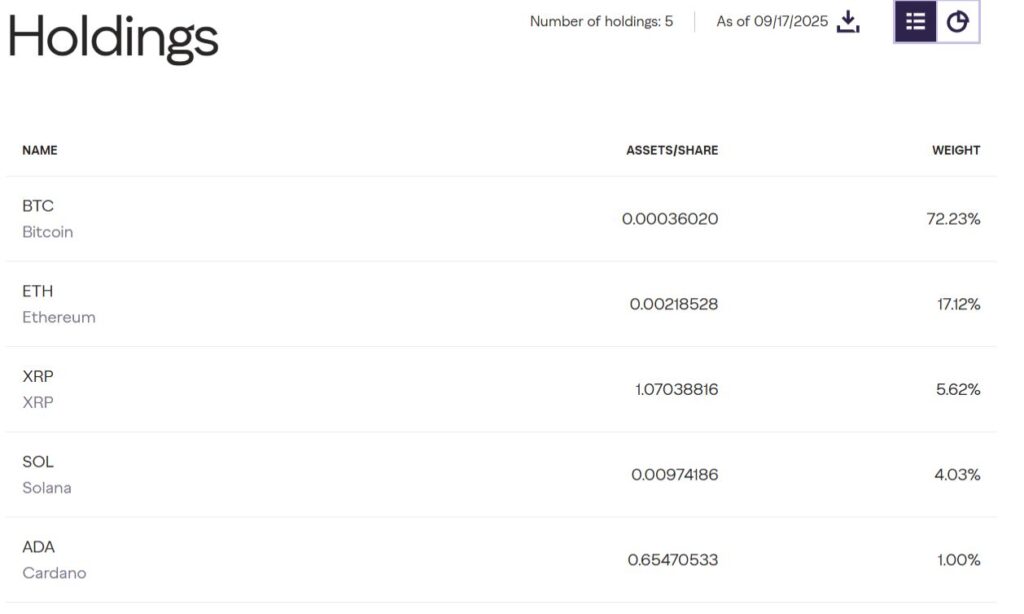

- GDLC fund holds top five cryptos, led by BTC and ETH.

- NYSE listing could boost institutional crypto adoption.

- Grayscale pursuing more ETFs for LINK, AVAX, ADA.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Grayscale has scored a major win in the U.S. crypto market with the SEC’s approval of its Digital Large Cap Fund (GDLC). The fund, which holds the top five cryptocurrencies by market cap—Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA)—will debut on the New York Stock Exchange soon.

With Bitcoin representing over 72% of the portfolio and Ethereum more than 17%, the fund balances its exposure across major altcoins, including XRP at 5.62%, Solana at 4.03%, and Cardano at 1%. Grayscale recently adjusted BTC holdings to increase exposure to these other digital assets.

Institutional Interest Could Surge

The listing on NYSE Arca signals growing institutional acceptance of cryptocurrency products. Grayscale CEO Peter Mintberg described GDLC as the first multi-crypto exchange-traded product (ETP) featuring a mix of major digital assets. Analysts suggest this approval could pave the way for more complex crypto ETFs, potentially unlocking new investment avenues for traditional investors seeking diversified crypto exposure.

ETF expert Nate Geraci highlighted that Grayscale’s legal battles with the SEC were instrumental in creating a smoother path for future crypto ETPs. The SEC’s adoption of Generic Listing Standards further simplifies the process, making it easier for other asset managers to launch similar products.

Looking Ahead: More Crypto ETFs on the Horizon

Beyond GDLC, Grayscale is actively pursuing ETFs for emerging cryptocurrencies such as Chainlink (LINK), Avalanche (AVAX), and Cardano (ADA). The firm recently filed a Form S-1 to convert its Chainlink Trust into an exchange-traded fund, which could trade under the ticker GLNK on NYSE Arca.

Also Read: Bitwise Joins VanEck and Grayscale in Race to Launch Spot Avalanche (AVAX) ETF

This series of moves underscores Grayscale’s commitment to expanding regulated crypto investment options in the U.S., bridging the gap between digital assets and traditional financial markets.

Grayscale’s GDLC fund launch marks a milestone for multi-crypto investment products. With regulatory approval in hand and more ETFs in the pipeline, Wall Street is witnessing a new chapter in mainstream cryptocurrency adoption.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.