|

Getting your Trinity Audio player ready...

|

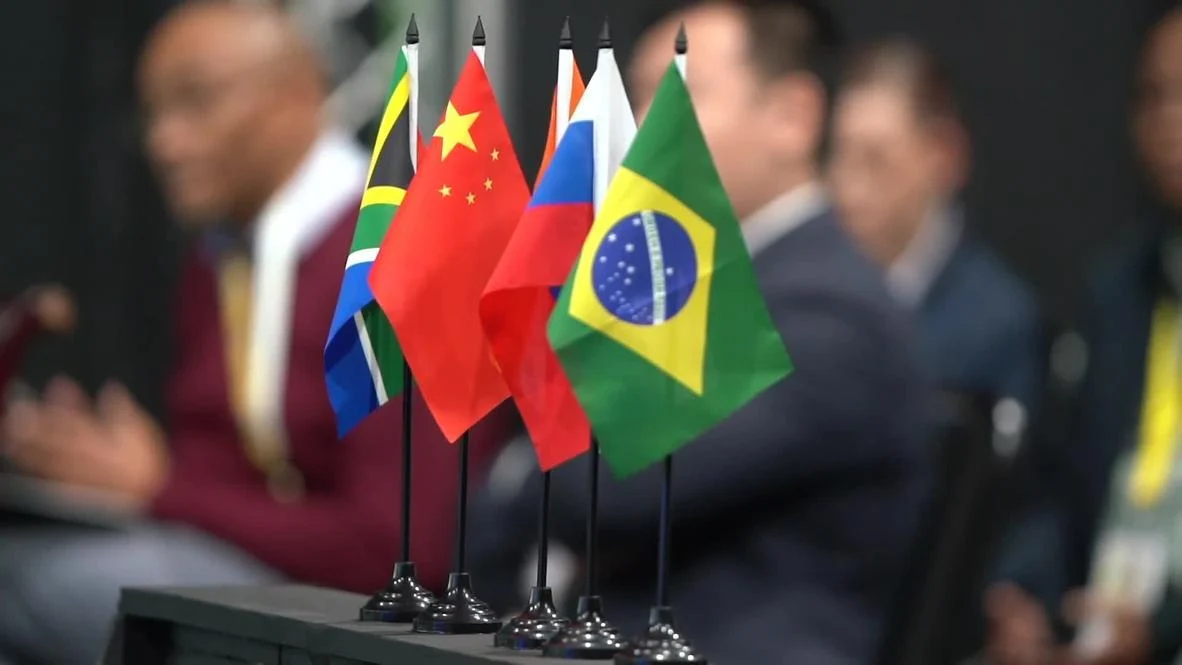

During the recent Russian Energy Week Forum in Moscow, President Vladimir Putin announced a groundbreaking initiative aimed at reshaping international trade dynamics. In his address, Putin revealed that Russia is collaborating with BRICS nations—Brazil, Russia, India, China, South Africa, and others—to develop an independent payment and settlement system for foreign trade. This strategic move seeks to bolster economic sovereignty and create a more efficient framework for handling international transactions.

Putin emphasized the significance of this new system, stating, “This initiative will enhance the overall service of foreign trade dealings.” His remarks underscore Russia’s determination to streamline transactions and reduce dependence on existing global financial networks, which have increasingly been viewed as restrictive.

Strengthening BRICS Economic Cooperation

The 7th Russian Energy Week, supported by the Russian Government, the Ministry of Energy, and the Moscow Government, provided the perfect backdrop for this announcement. As the global economic landscape shifts, this initiative marks a pivotal moment for Russia and its BRICS partners. The collaboration includes not just the original BRICS members but also new additions like Iran, Egypt, Ethiopia, and the United Arab Emirates, all of whom are keen on fostering deeper economic ties and enhancing their collective bargaining power.

Russian Foreign Minister Sergey Lavrov revealed that a comprehensive report on alternative payment systems for BRICS nations will be presented at an upcoming summit in Kazan. This initiative, championed by Brazilian President Lula da Silva, aims to diminish reliance on traditional financial platforms such as SWIFT, paving the way for a more autonomous economic framework among member states.

A Response to Global Economic Changes

The creation of an independent payment system is particularly crucial in the context of recent geopolitical tensions and economic sanctions that have isolated Russia from Western financial systems. By establishing its own interbank networks and payment systems, Russia seeks to enhance BRICS’ financial influence and expand cross-border settlements using national currencies. This shift is designed to mitigate the impact of Western sanctions and reduce dependency on the US dollar and euro.

The interest from BRICS nations in exploring alternative payment solutions highlights a broader trend among emerging economies. As countries seek to diversify their financial options, they are increasingly looking for ways to engage in trade without the constraints imposed by Western financial institutions.

The Future of BRICS Payments

As Russia assumes the presidency of BRICS, the momentum behind this independent payment system is expected to grow. Analysts suggest that the establishment of such a framework could transform global trade practices, especially for nations seeking alternatives to the dollar-centric model. With discussions at the Kazan summit on the horizon, the commitment to fostering economic independence among BRICS nations is clearer than ever.

In conclusion, Putin’s announcement during the Russian Energy Week signifies a transformative moment not only for Russia but for the entire BRICS bloc. As these nations collaborate to create an independent payment and settlement system, they are laying the groundwork for a new era of economic cooperation that prioritizes sovereignty and mutual support. The implications of this initiative could reverberate across global markets, signaling a shift in the balance of economic power.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.