|

Getting your Trinity Audio player ready...

|

As the long-running XRP lawsuit inches toward a conclusion, Ripple Labs is intensifying its efforts to secure key legal wins that could shape its future. Digital assets attorney James Farrell revealed that Ripple is not only pursuing a settlement with the U.S. Securities and Exchange Commission (SEC) but is also seeking an indicative ruling to smoothen the path for a potential IPO.

In a recent post on X, Farrell explained that Ripple aims to convince Judge Analisa Torres to modify her previous ruling. The goal? To permit private sales of XRP — a crucial step if Ripple hopes to go public in the near future. “Without it, the possibility of an IPO in the next 3+ years is basically zero,” Farrell warned.

1/20 What’s next in the Ripple/SEC saga (TLDR; you are probably measuring this in months and not days).

— James Farrell (@Farrell1969) April 16, 2025

The development comes after both Ripple and the SEC agreed to temporarily pause their appeals, allowing room for settlement discussions. While a settlement offer from Ripple seems imminent, the pursuit of an indicative ruling may prove more complex.

Farrell notes that Ripple’s legal team could submit the settlement proposal and the request for a modified judgment either jointly or separately. A green light from the SEC would still require a formal motion before Judge Torres, a process expected to take about six months.

If Torres approves the motion, both parties would proceed to voluntarily dismiss the ongoing appeal at the appellate court — a move that could wrap up in just a month. However, should the judge deny the request, the case could drag on, with a new round of appeals potentially pushing the saga into early 2027.

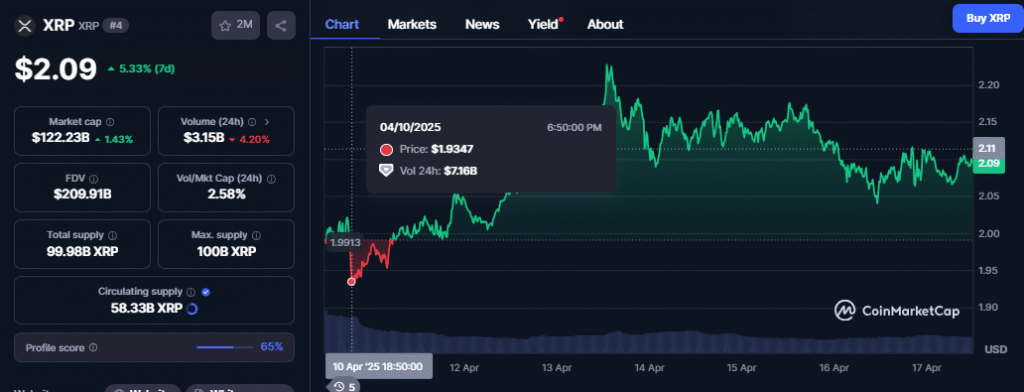

Meanwhile, market analysts are optimistic about XRP’s prospects. Following the legal pause, some have tipped $2 as a potential price floor for a parabolic XRP rally, signaling that investor sentiment is closely tied to Ripple’s legal victories.

As Ripple eyes both regulatory clarity and public markets, the coming months could be pivotal — not just for the company, but for the broader crypto industry.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: XRP ETF Momentum Builds Amid ProShares Update

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!