|

Getting your Trinity Audio player ready...

|

The Ripple vs. SEC legal saga reaches a critical juncture this week, with the potential to reverberate through the entire cryptocurrency industry. Today, April 22nd, 2024, marks a significant date as Ripple submits its official response to the SEC’s hefty $2 billion fine and penalty demand.

Ripple’s Defense Takes Center Stage

The highly anticipated opposition brief, due today, will address the SEC’s claims laid out in their opening brief. This brief demanded nearly $2 billion in penalties for alleged security violations involving XRP sales. However, we won’t see the full picture immediately. The opposition brief will remain sealed until April 24th when a redacted version becomes publicly available.

This redaction process allows both parties to discuss and agree upon necessary edits before public release. As per the court order, the SEC has until May 6th to file its reply.

Ripple Denounces Excessive Fines

The SEC’s aggressive demand for fines, especially in a case lacking fraud accusations, has sparked criticism from Ripple’s leadership. In March 2024, Ripple’s Chief Legal Officer, Stuart Alderoty, accused the SEC of “wanting to punish and intimidate Ripple – and the industry at large,” highlighting their disregard for fair legal application.

Ripple’s CEO, Brad Garlinghouse, echoed these sentiments, labelling the $2 billion request as “unprecedented” and proof of the SEC acting “outside the law.” Garlinghouse further emphasized this as a “gross abuse of power” and vowed to continue their legal challenge.

XRP Price Hinges on Case Outcome

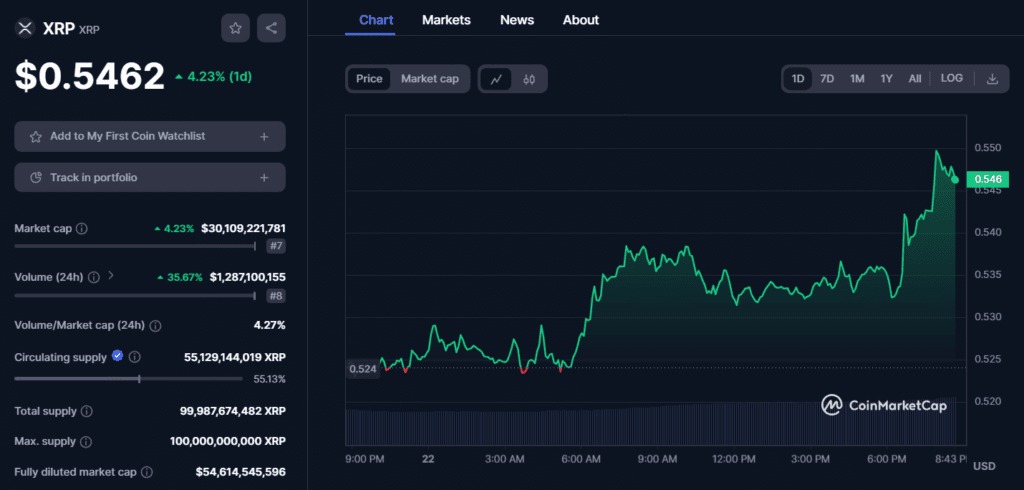

The Ripple vs. SEC case holds immense weight for the entire cryptocurrency industry, but particularly for XRP, Ripple’s native token. XRP’s price has displayed volatility recently, experiencing a surge past $0.50, likely fueled by anticipation surrounding Ripple’s response to the SEC’s hefty fine demand.

A successful defense from Ripple, potentially leading to reduced fines, could translate into a significant price boost for XRP. Similarly, Ripple’s partial victories in 2023 resulted in notable XRP price hikes, suggesting a favorable outcome could have a similar positive impact.

Also Read: XRP Price Prediction: Can the New Lending Protocol Drive a $20 XRP in the Next Bull Run?

However, if the SEC’s demands are upheld, it could lead to stricter crypto regulations, eroding investor confidence and potentially hindering the growth of the entire cryptocurrency market.

With Ripple’s response being submitted today, all eyes are on the court’s decision and its potential consequences for XRP’s future and the broader cryptocurrency landscape. The coming weeks will undoubtedly be crucial in determining the final verdict of this landmark case.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.