|

Getting your Trinity Audio player ready...

|

The ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) remains a major challenge for XRP, with legal experts keeping a close eye on the latest developments. The Appeal Court notice related to the case has become a point of significant interest for both Ripple and the broader crypto community. A favorable ruling could be a game-changer for XRP, offering the much-needed regulatory clarity that could attract institutional investors and bolster the token’s long-term stability.

Ripple’s Legal Struggles and XRP’s Growth

XRP’s price and growth potential have been directly impacted by the lawsuit, which centers on the SEC’s classification of the cryptocurrency as a security. If Ripple wins or reaches a favorable settlement, the outcome could eliminate one of the biggest hurdles facing XRP. A favorable ruling could result in XRP being classified as a non-security, leading to a more favorable regulatory environment and a stronger market presence.

However, the timing of such a resolution remains uncertain, which means XRP’s future trajectory is still in flux. Legal experts have stressed that while a positive ruling could provide significant benefits for Ripple and its stakeholders, the timing and certainty of the case’s outcome are critical factors to consider for investors and stakeholders in the space.

The Election Impact: Could Trump’s Victory Shift the Regulatory Landscape?

Adding complexity to XRP’s future are the upcoming U.S. presidential elections. Legal experts speculate that a potential Trump victory could lead to significant changes in the regulatory approach towards cryptocurrencies, including Ripple’s ongoing case. One key aspect of this scenario revolves around SEC Chair Gary Gensler’s position. If Trump wins, there is speculation that Gensler could be removed, potentially signaling a shift toward a more crypto-friendly regulatory stance.

Gensler’s strict approach to digital assets, particularly his stance on securities classification, has created significant obstacles for Ripple since the case was filed in 2020. His tough approach has raised concerns among crypto enthusiasts and investors alike. A change in leadership at the SEC could open up new opportunities for Ripple and other cryptocurrencies, potentially fostering a regulatory climate more conducive to innovation.

Optimism Within the XRP Community

Despite the uncertainties surrounding both the legal case and the upcoming election results, optimism within the XRP community remains high. Many believe that a change in the U.S. political leadership could boost the country’s position as a global leader in cryptocurrency, benefiting XRP by offering greater regulatory clarity and a path to wider adoption.

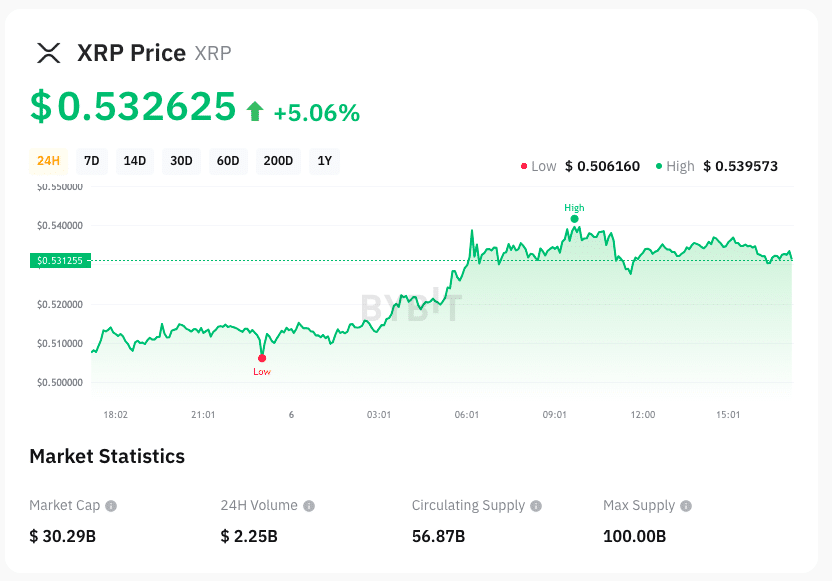

However, experts caution that investors should remain cautious as both the lawsuit and the political landscape remain fluid. XRP’s price could experience significant volatility in the short term, as legal developments and political shifts continue to unfold. Currently, XRP is trading at $0.5326, having seen a 5% increase in the last 24 hours and a 2.02% rise over the past week.

In her recent tweet, Amelie, a prominent crypto voice, highlighted Ripple’s Q3 market report, which emphasized the importance of the SEC lawsuit in determining XRP’s price. She noted that if Trump wins the election, there could be a major change in the SEC’s leadership that could provide a substantial boost to XRP’s price.

For XRP investors, the combination of the ongoing lawsuit, regulatory shifts, and the potential political changes offers a mix of risks and opportunities, making it an exciting yet unpredictable time for the token.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!