|

Getting your Trinity Audio player ready...

|

The cryptocurrency market suffered significant setbacks in Q1 2025, according to CoinGecko’s latest quarterly Report. The total market capitalization dropped by a staggering 18.6%, shedding approximately $633.5 billion, as macroeconomic pressures, investor caution, and high-profile scandals dampened momentum.

Despite a euphoric start to the year in January—spurred by hopes of crypto-friendly policies following Donald Trump’s inauguration—the gains were short-lived. The report highlights that while the TRUMP meme coin briefly energized Solana’s meme coin ecosystem, the excitement quickly faded. Meanwhile, the LIBRA scandal added to market unease, further dragging down sentiment.

Centralized exchanges also felt the squeeze. Spot trading volume fell 16.3% quarter-on-quarter, a decline partially attributed to the Bybit hack. Overall, daily crypto trading volume declined 27.3% from the previous quarter, signaling weakened investor engagement.

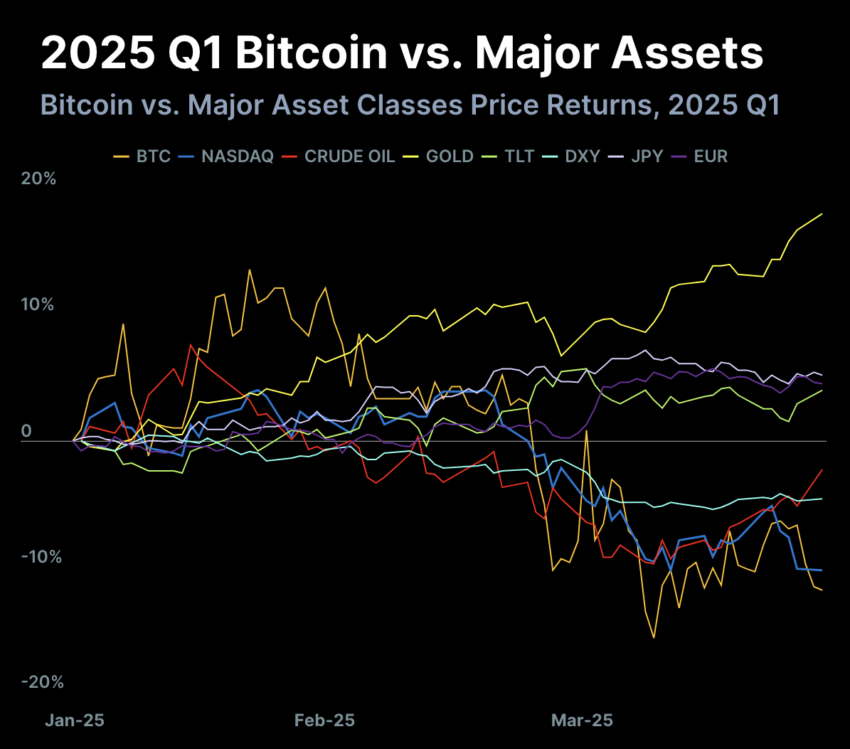

Bitcoin (BTC) maintained its reputation as a relative safe haven, increasing its dominance to 59.1% of the total crypto market cap—its highest level since 2021. However, BTC wasn’t immune to the downturn, falling 11.8% in Q1. Alarmingly, it underperformed both gold and U.S. Treasury bonds, despite the ongoing volatility in yields triggered by Trump’s new tariffs.

Altcoins bore the brunt of the crash. Ethereum (ETH) erased all gains made in 2024, and multichain DeFi total value locked (TVL) dropped by 27.5%. Even Solana, which led decentralized exchange (DEX) trading volume, saw its TVL decline by over 20%.

Also Read: 44% of Investors Bullish on Crypto AI Tokens: CoinGecko Survey Report

Bitcoin ETFs were a rare bright spot, attracting $1 billion in new inflows. However, falling prices slashed their total assets under management by nearly $9 billion.

In sum, CoinGecko’s Q1 2025 report paints a stark picture: recession fears are gripping the crypto sector, and even the few positives come with heavy caveats. As investors weigh risk amid global uncertainty, the broader market faces an uphill climb toward recovery.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!