|

Getting your Trinity Audio player ready...

|

Polygon (POL) has been a focal point for whales recently, as evidenced by the purchase of 59 million POL tokens over the past 48 hours. This move comes amid a growing altcoin season and a pullback in prices, which has opened up a potential buying window for large investors.

#Polygon whales bought over 59 million $POL in the last 48 hours! pic.twitter.com/g9CvQCrooF

— Ali (@ali_charts) November 27, 2024

Although the whales’ purchase appears significant, it’s important to note that 59 million POL represents only a small fraction of the total supply of over 10 billion tokens. This raises the question: is POL undervalued, and does it have massive upside potential?

The Market Value to Realized Value (MVRV) ratio offers some insights. Both the 30-day and 180-day MVRV ratios show positive readings of 35% and 44%, respectively. This indicates that investors who have held POL over the past month or six months are sitting on unrealized profits of more than 30%, even amid the recent 20% pullback. This suggests that short-term holders could potentially offload their tokens to lock in profits. However, this pullback has not significantly dented their overall gains, and there is still room for further upside, especially if demand continues to rise.

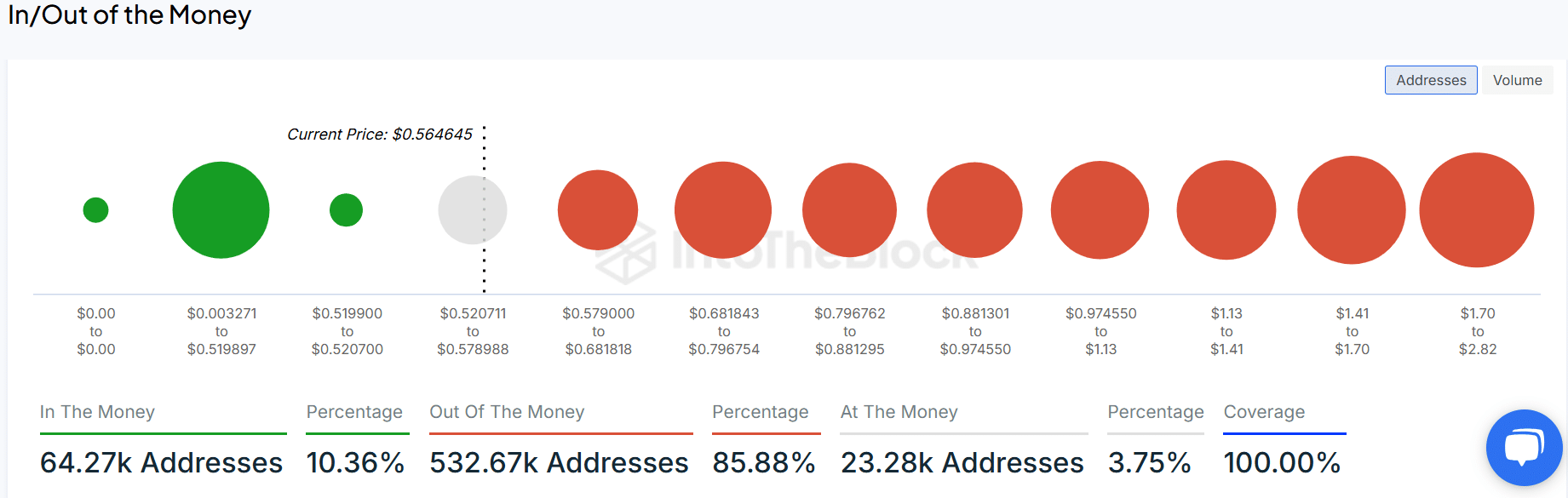

Looking deeper into the data from IntoTheBlock, we find that despite the short-term gains, only 10% of total POL holders are currently in profit. A larger portion—over 85% of holders—are still underwater.

This suggests that most holders have not yet realized gains and may be waiting for the price to recover to at least break even before selling. This could provide support for POL’s continued upside, as many investors are still holding onto their tokens with the hope of recouping their initial investment.

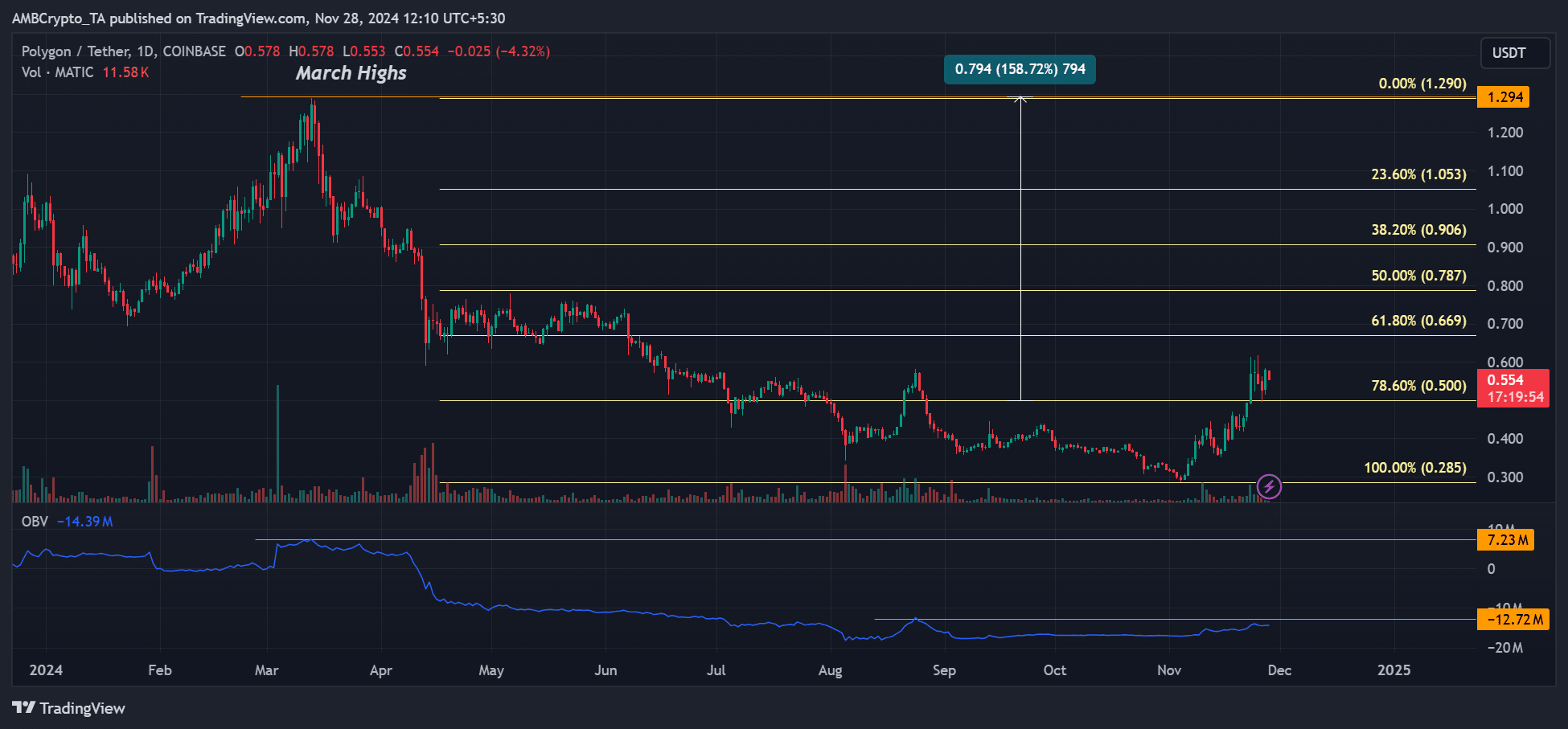

On the technical side, POL’s price action appears to have room for growth. The On-Balance Volume (OBV) remains low, indicating that there is still ample headroom for upward movement. If POL surpasses the $0.6 level, this could trigger further momentum, and a decisive surge above $0.8—aligning with Fibonacci levels and a three-month price range—could solidify the continuation of the uptrend.

Looking ahead, if POL targets its March 2024 highs of $1.2, this could present nearly 160% in potential gains from the current price level, further supporting the belief in the asset’s upside potential.

Overall, despite some short-term profit-taking, the underlying data and price chart suggest that POL still has significant room to grow, with the potential for larger upside as whales continue to position themselves.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.