|

Getting your Trinity Audio player ready...

|

Polygon (POL) has experienced a difficult few months, with its price sinking to an all-time low of $0.28 on November 4. This steep decline has pushed approximately 94% of POL holders into unrealized losses. While the network has seen an uptick in user engagement, the future of POL remains uncertain, as on-chain and technical analysis point to the possibility of further price corrections.

Despite its price struggles, Polygon’s user base has grown. According to Santiment, the network has seen an increase in active addresses, a metric that tracks the number of users sending or receiving tokens. Rising active addresses typically signal growing interest and network activity. However, a sharp drop in active addresses on January 30, followed by a slight recovery, highlights a volatile user sentiment.

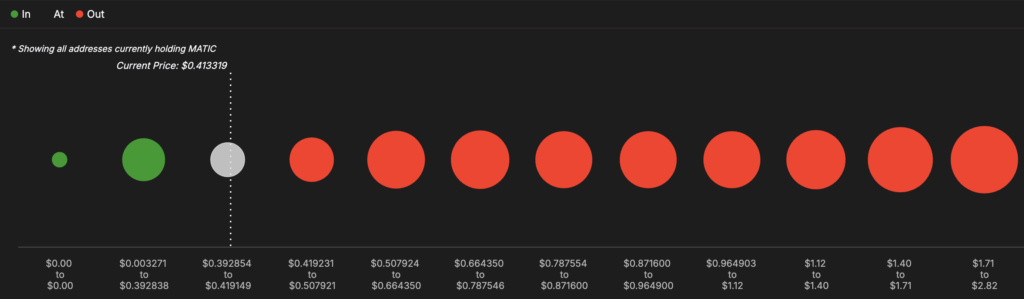

While the surge in active addresses is a positive sign for Polygon, the market’s overall sentiment is tempered by data from the Global In/Out of Money (GIOM) indicator. This metric reveals that a significant portion of POL holders is currently in unrealized losses, particularly between $0.41 and its all-time high of $2.82. This situation creates a potential resistance zone where many holders may choose to sell off their tokens to break even, putting further pressure on the price.

From a technical perspective, Polygon’s price faces additional challenges. The Awesome Oscillator (AO), which measures momentum, remains positive, suggesting some bullish sentiment. However, the Relative Strength Index (RSI) is below neutral, indicating a bearish trend. Moreover, the token is trading within a descending triangle pattern, a classic bearish formation that could result in further price declines.

If these bearish indicators hold, POL could see another pullback, potentially retesting the $0.28 low. However, a surge in demand could drive prices toward $0.67, with the possibility of a rally to $1 if market conditions improve.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Polygon (POL) Faces Bearish Pressure as Whale Dumps $2.28M – Can Bulls Regain Control?

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.