|

Getting your Trinity Audio player ready...

|

Polygon (POL) holders have been facing a challenging period, with on-chain data revealing that a staggering 81.60% of them are currently “out of the money.” This metric, which tracks the profitability of wallet addresses based on their purchase price relative to the current market price, suggests that the majority of POL holders are experiencing losses.

As POL struggles to regain bullish momentum amidst a broader market downturn, this data raises important questions: Is this a sign of capitulation, or is it laying the groundwork for a potential recovery?

A Bleak On-Chain Picture

Data from IntoTheBlock paints a stark picture of POL’s on-chain health. The dominance of red zones on the “In/Out of the Money” chart indicates that a significant portion of holders are underwater. This aligns with POL’s extended price decline throughout 2024, reflecting both broader market trends and specific challenges facing the Polygon ecosystem.

Such periods often witness increased selling pressure as frustrated holders exit their positions, further exacerbating the downtrend. However, they can also mark a market bottom if long-term investors seize the opportunity to accumulate at discounted prices. Historically, high percentages of loss-making holders have sometimes preceded recovery phases.

Technical Analysis – A Mixed Bag

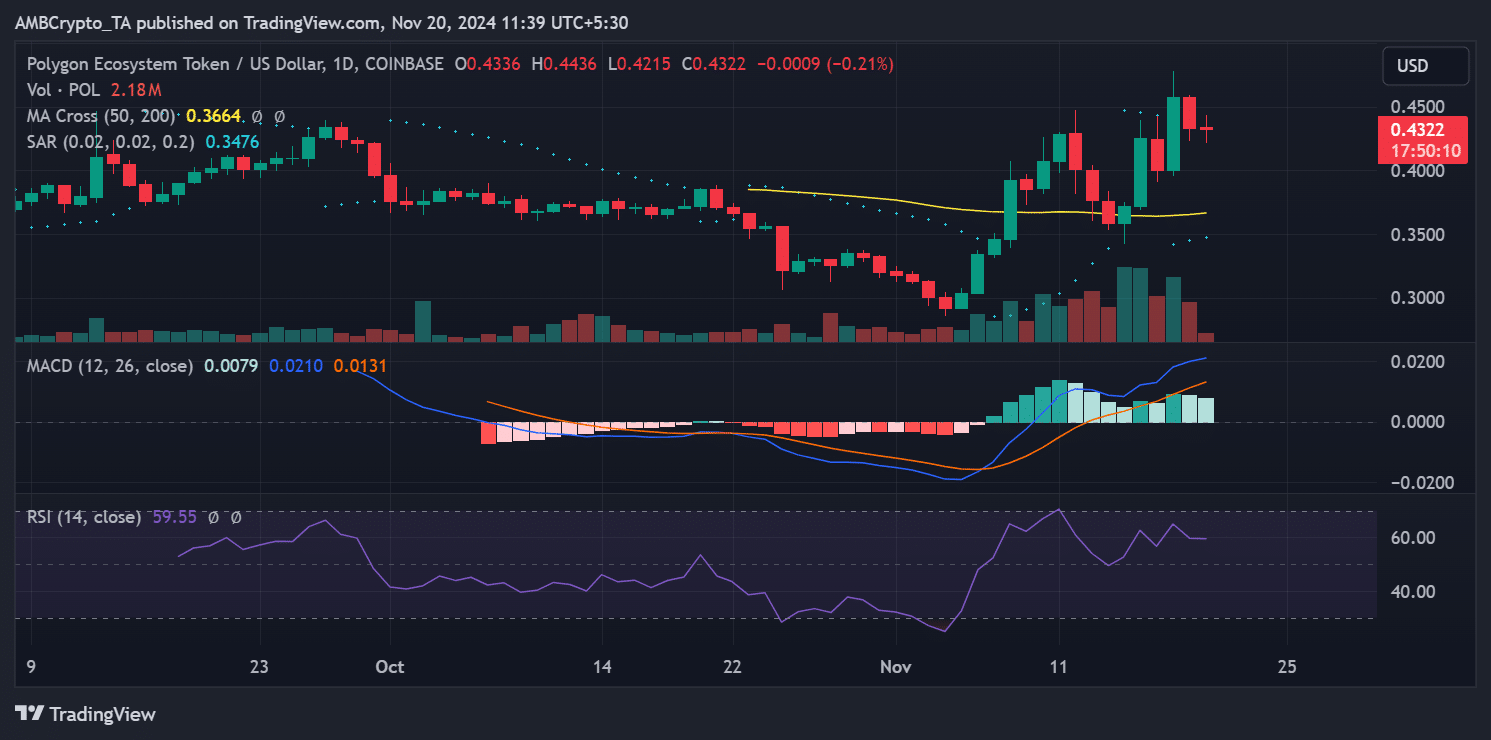

Technical indicators offer a mixed outlook for POL. The 50-day Moving Average (MA) crossing above the 200-day MA suggests potential near-term bullish momentum. However, POL remains below these critical levels, signaling that the overall trend is still bearish.

The Moving Average Convergence Divergence (MACD) indicator highlights weakening bullish momentum, with the histogram bars hinting at a possible reversal. The Relative Strength Index (RSI) hovers around 59, indicating a neutral zone and suggesting consolidation rather than strong directional movement.

To regain positive traction, POL needs to break above resistance levels at $0.50 and $0.55 while maintaining consistent trading volume.

Network Activity – A Sign of Life or Stagnation?

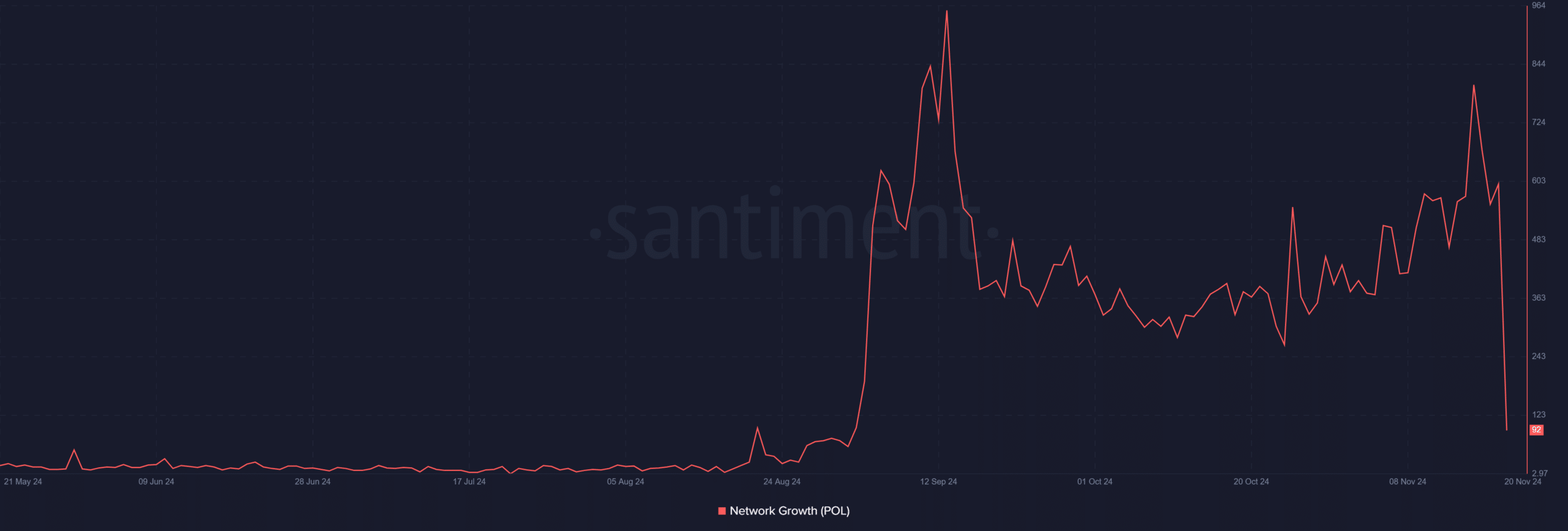

On-chain activity, as measured by Santiment’s network growth chart, reveals fluctuations in Polygon’s ecosystem engagement. Recent spikes in network activity indicate intermittent interest in the platform, but the declining trend since early November reflects waning user and developer participation.

Strong network activity and ecosystem developments are crucial for POL to regain its footing.

Polygon’s current state is undoubtedly challenging for its holders and ecosystem. With 81.60% of holders underwater, market sentiment appears bearish. However, such conditions have historically served as turning points, offering opportunities for long-term investors.

POL’s trajectory depends on its ability to reclaim key technical levels and reinvigorate network growth. While the data indicates caution, it also presents a potential setup for recovery if broader market conditions improve.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.