|

Getting your Trinity Audio player ready...

|

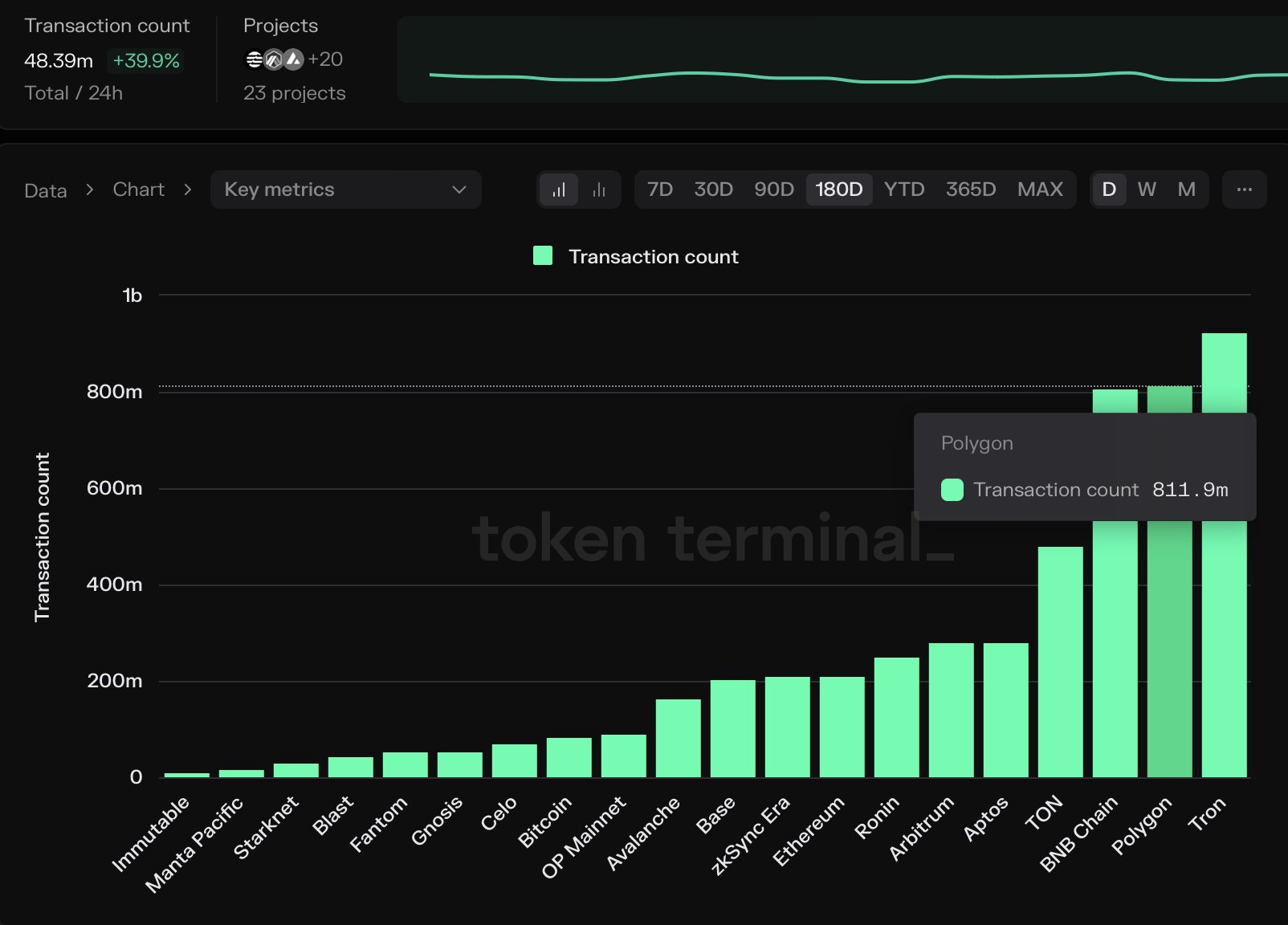

Polygon (MATIC) continues to be a powerhouse in the Web3 arena, boasting the second-highest transaction volume globally over the past six months. According to Polygon Stats, the network processed a staggering 811.9 million transactions, trailing only TRON and edging out BNB Chain. This impressive figure solidifies Polygon’s position as “one of the most active chains in Web3.”

While transaction volume is a key indicator of a blockchain’s health, it’s crucial to consider the associated costs. Here’s where Polygon shines. Token Terminal data reveals Polygon’s average transaction fee sits at a mere $0.005, making it an attractive option for developers and users alike.

Polygon (MATIC) Fees Tell the Real Story

A closer look at the top transaction leaders reveals a stark contrast. While TRON boasts the highest transaction volume, its average fee skyrockets to $0.633, over 120 times more expensive than Polygon. Even BNB Chain, despite lower fees than TRON, still charges a significant $0.131 per transaction. Ethereum, the undisputed leader in smart contracts, remains burdened by high fees, averaging $3.17 per transaction. This highlights the vital role of Layer 2 solutions like Polygon in alleviating the pressure on Ethereum’s congested network.

Despite recent gains, Polygon’s native token, MATIC, currently trades at $0.7468. While this represents a 4.15% daily increase and an 8% weekly jump, MATIC remains down 23% year-to-date. Interestingly, IntoTheBlock data suggests a potential buying opportunity. With four out of five MATIC holders currently underwater (in the red), selling pressure might be limited, creating a potential springboard for future price appreciation.

Beyond Transaction Volume: Bullish Indicators Abound

While transaction volume is a strong indicator, other metrics paint a bullish picture for Polygon. Analysts cite factors like low token concentration, healthy network growth, a favorable bid-ask volume imbalance, and a consistent presence of large transactions as evidence of continued investor confidence.

Polygon’s ability to process a high volume of transactions at a fraction of the cost positions it as a leader in the Web3 space. As Ethereum grapples with scalability issues, Polygon’s efficient infrastructure positions it to capture a significant share of the market. With key metrics hinting at a potential price surge, MATIC could be an attractive investment for those looking to capitalize on the burgeoning Web3 ecosystem.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!