|

Getting your Trinity Audio player ready...

|

Polkadot (DOT) has recently broken out of its falling wedge pattern on the weekly timeframe, a critical technical signal that often precedes significant bullish rallies. Currently trading at $6.83, down 1.98% at press time, Polkadot’s breakout and subsequent retest phase present a promising opportunity for traders to capitalize on potential gains. The question now is whether DOT can sustain its momentum and rally toward its midterm target of $24.

DOT’s Breakout and Price Prediction

The falling wedge breakout on Polkadot’s chart signals the possibility of a bullish reversal, making the current price action highly significant. DOT is now encountering its first major resistance at $10.88, with a midterm price target of $24. This technical development is further confirmed by a recent retest of the breakout level, suggesting that buyers are entering the market at crucial levels. If the buying pressure continues, Polkadot’s trajectory looks poised for a substantial upside, positioning the cryptocurrency for notable gains in the near future.

Analyzing Technical Indicators

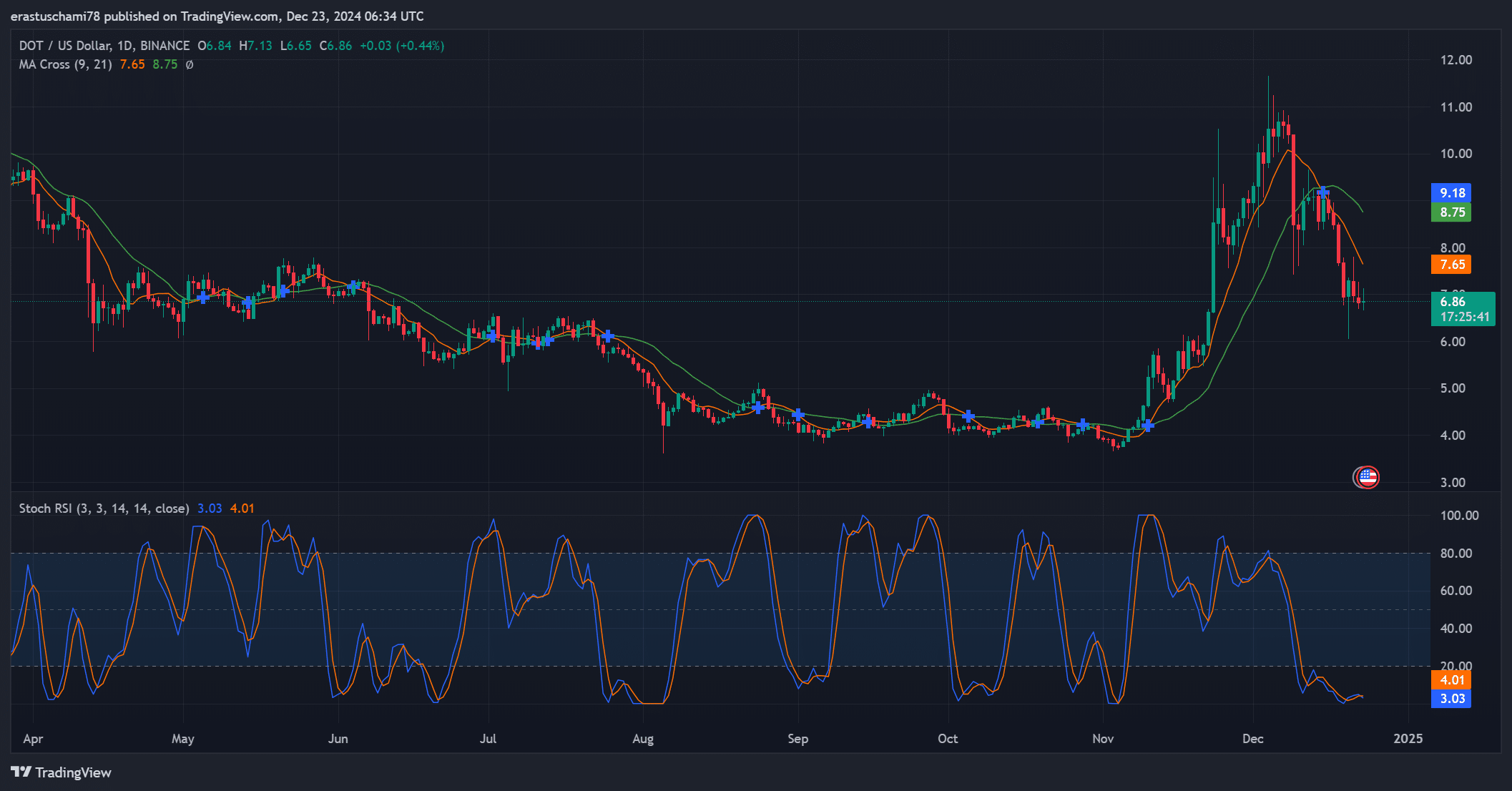

Polkadot’s technical indicators are also providing strong support for a bullish outlook. The stochastic RSI shows oversold conditions, with values around 3.03 and 4.01, suggesting a potential price rebound in the short term. Meanwhile, the moving average (MA) crossover on the daily chart hints at short-term consolidation but indicates that DOT may soon reverse its downward trend, strengthening the case for a bullish move.

Social Volume and Derivatives Market Support

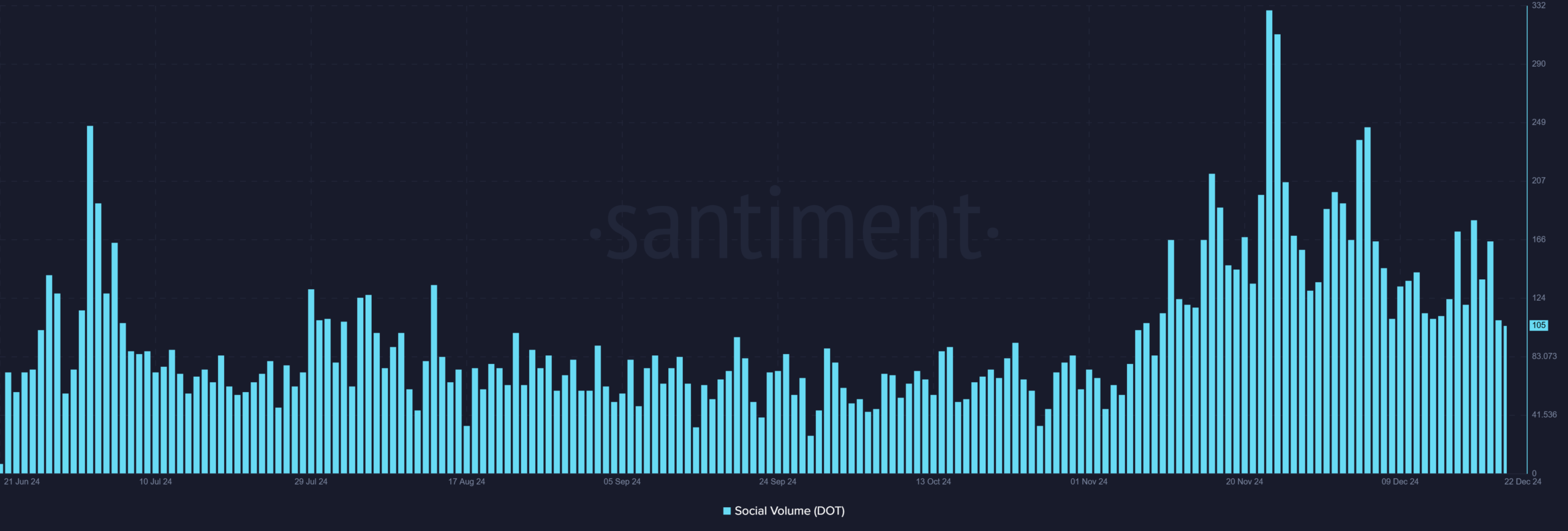

Polkadot’s growing social volume, currently at 105, reflects rising interest in the cryptocurrency. Increased community engagement often correlates with renewed investor sentiment, which can drive further price action. Additionally, Polkadot’s derivatives market data strengthens the bullish outlook. With $207.51K in long liquidations compared to $177.75K in shorts, long traders are showing increasing confidence. The positive OI-weighted funding rate of 0.01% further supports this bullish sentiment.

With its breakout from the falling wedge pattern, favorable technical indicators, and growing momentum in both social and derivatives markets, Polkadot is well-positioned for a potential rally. While overcoming the resistance at $10.88 is essential, the midterm target of $24 remains within reach. Polkadot appears to be on track for a significant bullish breakout in the coming weeks.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Polkadot (DOT) Faces 35% Dip After December Surge: Will Bulls Regain Momentum?

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.