|

Getting your Trinity Audio player ready...

|

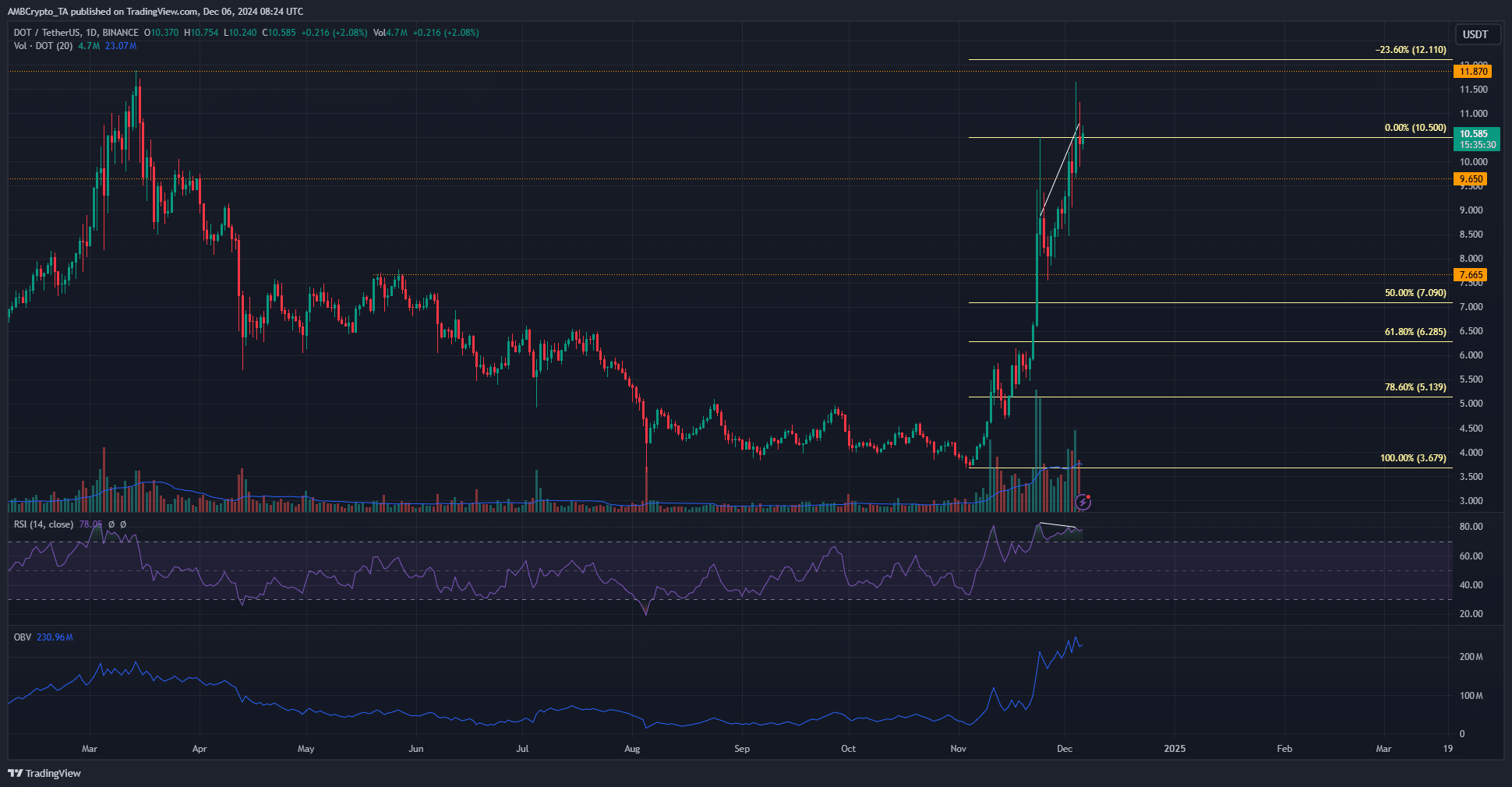

Polkadot [DOT] has captured the spotlight in the cryptocurrency market, surging on a bullish rally over the past month. Reaching a local high of $11.65 on December 4, DOT has showcased robust demand and momentum. However, the $10.5 zone remains a critical resistance level, and the bulls have yet to flip it into support, signaling a potential pause in the upward trajectory.

Short-Term Consolidation Ahead for DOT

Despite a strong bullish trend on the daily timeframe, signs of exhaustion are evident. On-Balance Volume (OBV) has hit a new high, surpassing levels last seen in March when DOT traded at $11.8. This uptick highlights sustained demand among buyers. However, a bearish divergence on the Relative Strength Index (RSI) casts doubt on the immediate bullish momentum.

Over the past two weeks, RSI has recorded lower highs even as DOT’s price pushed higher. This divergence indicates weakening bullish strength and suggests a consolidation phase may be on the horizon. Market conditions will need time to reset, with the possibility of DOT forming a short-term range.

Critical Levels to Watch

For traders eyeing DOT, key levels provide insight into the market’s trajectory:

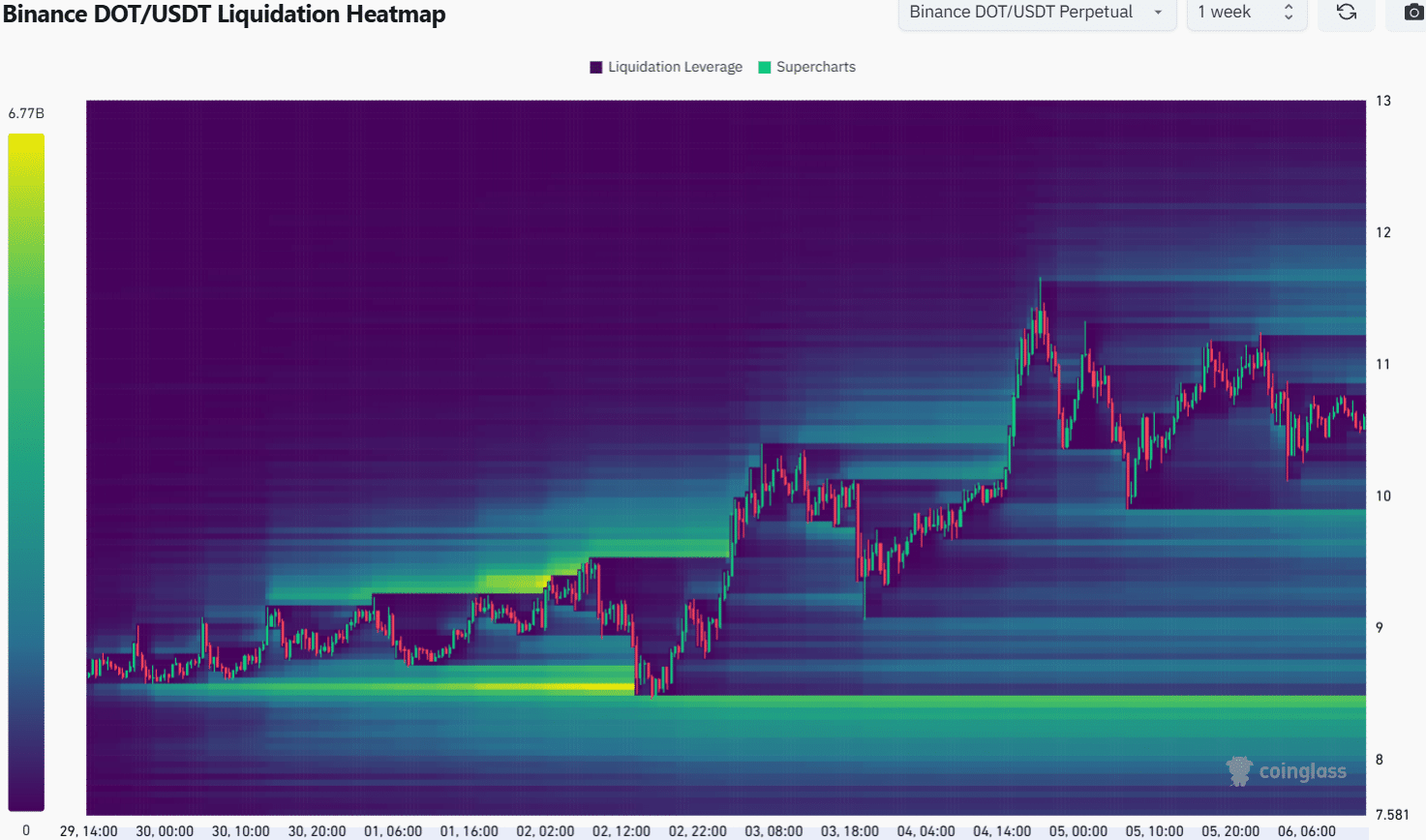

- Support Zones: The $8.4 and $7.4 levels are pivotal. These regions have shown a build-up of liquidation points, reinforcing their importance on the daily chart. A breach below these levels could shift the higher timeframe trend to bearish, though such a scenario seems unlikely given the current data.

- Resistance Zones: Flipping the $10.5 resistance into support is crucial for sustained bullish momentum. If achieved, DOT could target $16.35 and even $23.85 in the coming weeks.

Potential Buying Opportunities

Recent activity highlights $9.9 and $11.3 as magnetic price zones, where DOT could consolidate in the near term. Traders should monitor these levels for potential range formation. However, caution is advised, as a deeper retracement to $8.4 or lower remains a possibility before the next significant rally.

Long-Term Outlook Remains Bullish

Despite short-term bearish signals, Polkadot’s higher timeframe trend remains upward. Unless DOT falls below $7.55, the long-term bias stays bullish. This suggests that any consolidation or retracement could present strategic buying opportunities for long-term investors.

Polkadot’s recent rally underscores its potential as a market leader, but short-term consolidation may temper immediate gains. With strong support zones and a resilient uptrend, DOT remains a promising contender for bullish traders. Keep an eye on key resistance levels and broader market sentiment to navigate the next phase of Polkadot’s price action.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Evrloot Launches Free-to-Play RPG Campaign on Polkadot’s Moonbeam Chain

Crypto and blockchain enthusiast.