|

Getting your Trinity Audio player ready...

|

The Pi Network price has continued its downward trajectory, slipping below the crucial $0.8 mark. With growing concerns in the broader crypto community, market sentiment remains bleak. Analysts foresee a further dip to around $0.6, although long-term prospects still appear promising.

Pi Price Drops 3%: What’s Behind the Decline?

At the time of writing, Pi Network’s price has fallen approximately 3%, trading around $0.79. Despite the price dip, its 24-hour trading volume surged by 33% to $327 million, signaling heightened market activity. The token reached a daily low of $0.77, reflecting a gloomy outlook among investors.

The recent downturn has been attributed to multiple factors, including a looming influx of unlocked tokens, regulatory uncertainty, and the absence of major exchange listings. Analysts suggest these elements are weighing heavily on investor sentiment, contributing to the persistent bearish trend.

Will Pi Coin Slip to $0.6?

Market analysts anticipate further losses for Pi Coin, citing an impending massive token unlock. According to PiScan data, approximately 105.96 million Pi tokens—valued at around $85 million at current prices—will be unlocked over the next 30 days. This amounts to an average daily unlock of 3.5 million coins, which could significantly impact the price.

The unlocking process isn’t expected to slow anytime soon. Over the next 12 months, 1.6 billion Pi tokens will enter circulation at an average monthly rate of 129 million. This trend is set to continue until May 2028, fueling fears of an oversupply-driven price dip. To counteract this, Pi enthusiasts are urging the Pi Core Team to implement burn mechanisms or smart contract features to reduce circulation.

What’s Next for Pi Network?

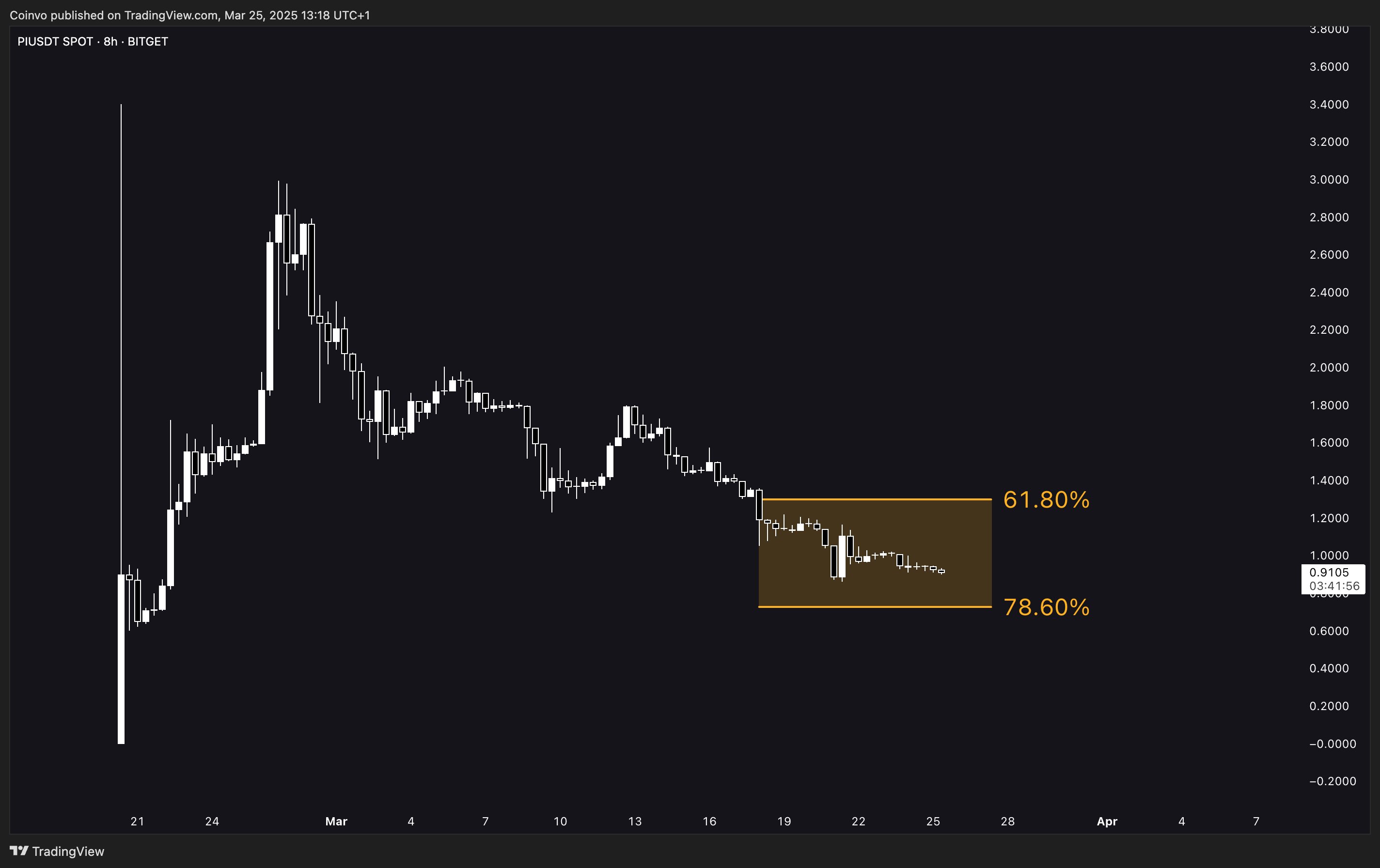

Technical analysts remain divided on Pi’s future. TradingView analyst bullstraders7 predicts a drop to $0.61 or even $0.6 in the coming days, further dampening sentiment. However, Coinvo sees the dip as a buying opportunity, citing Pi’s RSI divergence and Fibonacci support levels as indicators of a potential rebound.

While short-term volatility remains high, long-term prospects depend on key developments, including potential exchange listings and strategic tokenomics adjustments. Investors are advised to exercise caution and conduct thorough research before making any trading decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Pi Network Faces Supply Shock: Can Token Burns Offset March 21 Unlock?

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!