Despite achieving a new all-time high in May, the meme coin Pepe (PEPE) is facing increasing selling pressure that could lead to a price decline. While the coin has surged by 956% over the past year, its current market value of $0.0000073 suggests a potential downturn.

Technical Indicators Suggest Caution

On the 4-hour chart, PEPE is trading near the 20 and 50-day Exponential Moving Averages (EMA). Historically, trading above these EMAs has signaled bullish momentum. However, the current convergence of the EMAs indicates a crucial juncture for PEPE’s short-term price movement.

On-Chain Data Points to Bearish Pressure

IntoTheBlock’s on-chain analysis reveals that bears may be gaining control over PEPE. The Bulls and Bears indicator shows a higher number of bears compared to bulls, suggesting a potential price decline.

Price Prediction: Resistance and Potential Downturn

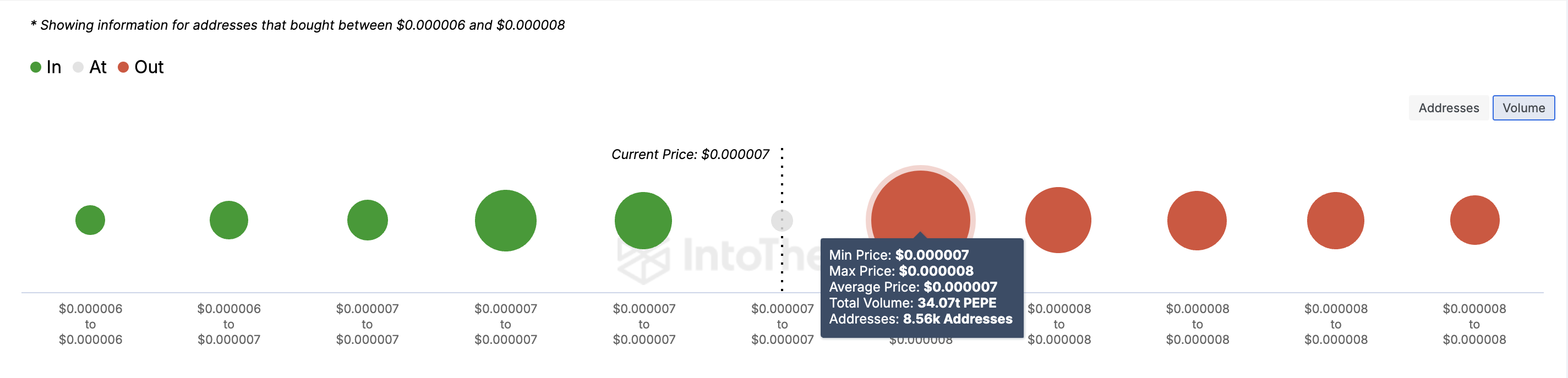

The In/Out of Money Around Price (IOMAP) metric indicates significant resistance at the $0.0000080 level. With more tokens held at a loss than at a profit, PEPE may struggle to break through this resistance.

If PEPE fails to overcome this resistance, its price could potentially fall to $0.0000070 or even lower. However, a surge in buying volume by bulls could reverse this trend and push the price towards $0.000010.

While Pepe has experienced remarkable growth, the current market conditions suggest a potential downturn. The convergence of EMAs, bearish on-chain indicators, and resistance levels all point to a challenging period for the meme coin. Investors should exercise caution and closely monitor market developments.

Also Read: Pepe (PEPE) Memecoin Price Analysis – Is A 35% Surge Possible By 2025?

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.