|

Getting your Trinity Audio player ready...

|

Crypto analysts spotlighted Pepe (PEPE) as a high-potential breakout candidate, drawing attention to its current chart structure that mirrors its late October 2024 consolidation range. The memecoin, which surged an eye-popping 1,435% year-over-year in 2024, opened that year at $0.0000013 before rallying to exponential heights.

$Pepe #Pepe Went More Than 100%+ After Breakout In October Now Expecting Same Move After Successful Breakout. https://t.co/eVSs3xVFrT pic.twitter.com/itsBHJcFgP

— World Of Charts (@WorldOfCharts1) April 14, 2025

However, as of mid-April 2025, PEPE is trading nearly 61% below its Q1 2025 opening—a sign of broader market corrections. Despite this decline, technical analysts are tracking a familiar pattern on the 1-day chart: a compressed price structure eerily similar to the one that preceded PEPE’s 227% rally in November 2024, when it peaked at $0.00002597.

‘

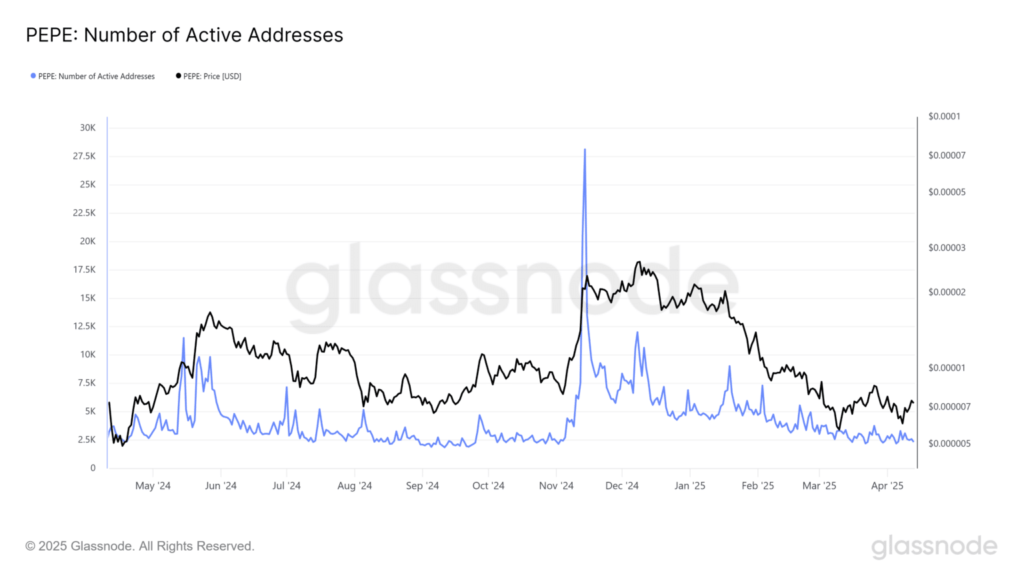

This deja vu in chart formation has fueled speculation about whether another parabolic move is on the horizon. A closer look at on-chain activity adds to the intrigue. Historically, spikes in PEPE’s active addresses—from an average of 2,500 to over 20,000 in mid-November—have acted as leading indicators of bullish momentum. Currently, active addresses hover at 2,587, consistent with previous consolidation phases before explosive breakouts.

Yet, while the technicals paint a hopeful picture, fundamentals tell a more complex story. According to Coinglass, PEPE’s Open Interest (OI) in futures markets has jumped by nearly 5%, now sitting at $301.48 million—surpassing levels seen before its November rally. This surge in leveraged positions has fueled a 20% weekly gain, but without strong spot market support, the memecoin remains vulnerable.

Also Read: Pepe Coin (PEPE) Whales Trigger Sell-Off: 1 Trillion Tokens Offloaded as Price Slides 14% Weekly

Analysts warn that absent organic dip-buying activity, PEPE’s rally could trigger liquidation cascades—handing the advantage to short-sellers. The ongoing rise appears driven more by leveraged liquidity than sustained investor accumulation.

In short, while PEPE’s historical breakout patterns suggest a possible 100% upside, market participants should tread carefully. Without supporting fundamentals, this speculative momentum may not hold, reinforcing the need for measured optimism and tight risk controls in an increasingly volatile memecoin arena.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.