|

Getting your Trinity Audio player ready...

|

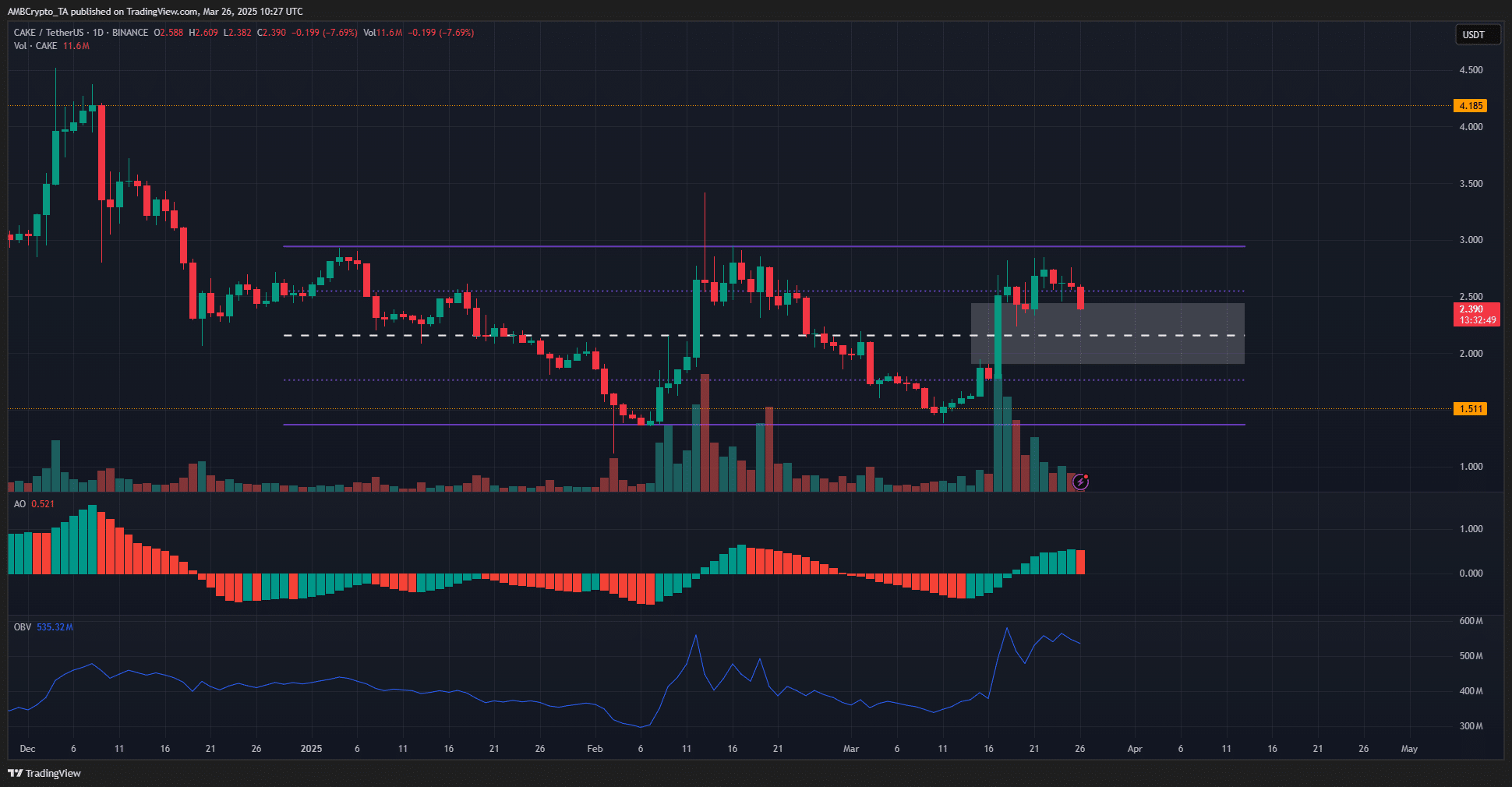

PancakeSwap [CAKE] bulls failed to defend the critical $2.55 support, yet the token has demonstrated resilience over the past two weeks. Strong gains recorded on March 17 left a fair value gap (FVG) on the 1-day chart, providing key insights into potential support levels for a bullish reversal.

CAKE’s Price Action Hints at a Rebound

Since early 2025, PancakeSwap has been trading within a range formation, extending from $1.37 to $2.94, with a mid-range level at $2.16. The token’s rally on March 17, accompanied by the highest daily trading volume in four months, suggested strong bullish momentum. However, resistance at $2.85 over the weekend led to a rejection, pushing CAKE lower.

Despite the recent dip, the On-Balance Volume (OBV) remains in a strong uptrend, surpassing February highs. The Awesome Oscillator (AO) also reflects robust upward momentum, indicating that the current retracement may not dip below the $2.16 mid-range support.

Key Levels to Watch for a Bullish Reversal

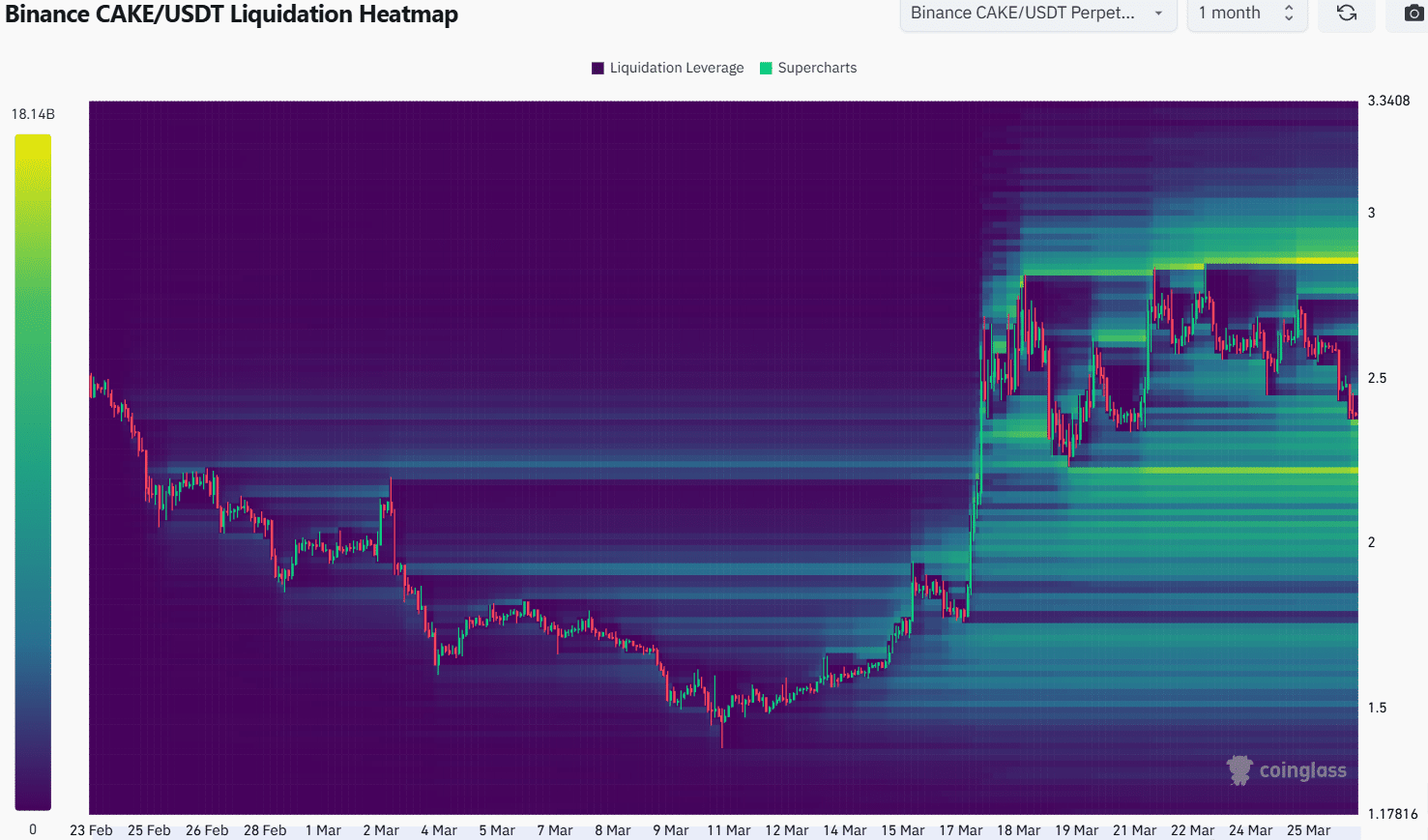

A look at the 1-month liquidation heatmap from Coinglass highlights two critical liquidity clusters: one at $2.36 and another at $2.22. The latter represents last week’s lows and aligns closely with the mid-range support at $2.16. If CAKE tests these levels and rebounds, it could indicate a bullish reversal.

For traders eyeing a long position, it is crucial to monitor price action at the $2.22 and $2.15 levels. A surge in buying volume and bullish momentum on lower timeframes following a retest of these zones would confirm a potential uptrend.

Also Read: PancakeSwap (CAKE) Surge 21% as Inflows Hit $3.37M—Is More Upside Coming?

A Critical Moment for CAKE

PancakeSwap is at a pivotal point, with short-term retracement levels aligning with strong support zones. If bulls successfully defend these levels, CAKE could retest the $2.94 range high and even aim for the psychological resistance at $3. However, failure to hold above $2.16 may result in extended bearish pressure. As market conditions evolve, traders should stay vigilant and watch for confirmation signals before making their next move.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.