|

Getting your Trinity Audio player ready...

|

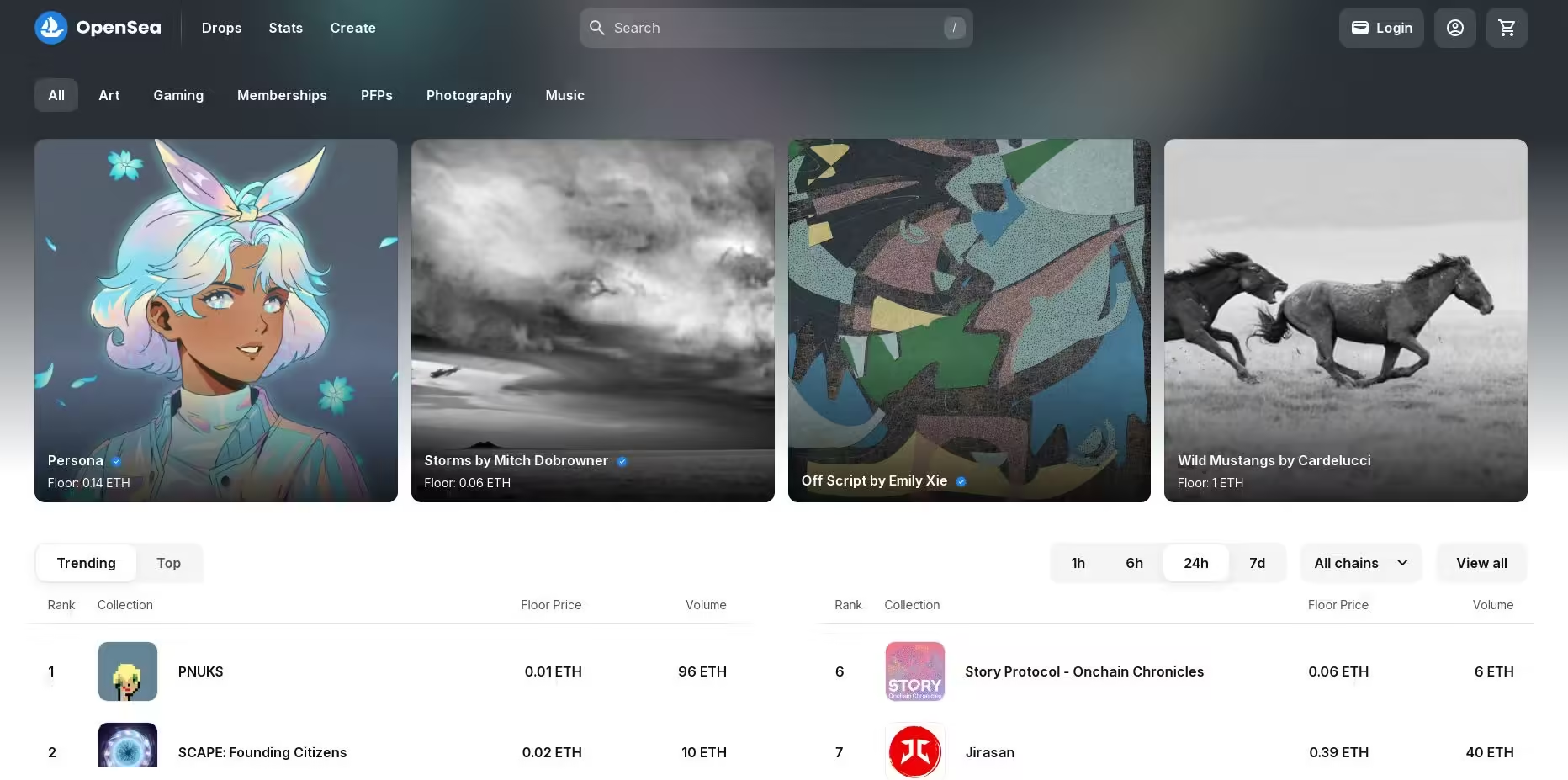

Non-fungible token (NFT) marketplace OpenSea has received a Wells notice from the U.S. Securities and Exchange Commission (SEC), indicating potential legal action. The SEC alleges that NFTs sold on OpenSea are securities, a claim that has sent shockwaves through the crypto community.

OpenSea CEO Devin Finzer expressed surprise and disappointment at the SEC’s move, stating that it is a sweeping attack on creators and artists. He vowed to fight the notice and pledged $5 million to support NFT creators and developers who may also face similar legal challenges.

This is not the first time a crypto company has faced SEC scrutiny over securities allegations. Decentralized exchanges like Uniswap, Coinbase, Kraken, and trading platform Robinhood have also received Wells notices. However, OpenSea’s case is unique as it specifically targets NFTs as securities.

The SEC’s actions against NFT projects like Impact Theory and Stoner Cats have created a chilling effect in the NFT space, with many creators and companies hesitant to proceed with new projects. Online betting company DraftKings recently shut down its NFT business due to these legal developments.

OpenSea’s CEO argued that NFTs are not securities, citing a recent lawsuit filed by two NFT artists in Louisiana. He emphasized the potential negative consequences for creators if the SEC’s stance prevails, as it could deter digital art creation.

Also Read: Ripple vs. SEC – 3 Judges Back XRP’s Legal Victory—Why The SEC Might Not Appeal

As the legal battle between OpenSea and the SEC unfolds, the outcome will have significant implications for the NFT industry and the broader crypto ecosystem. The resolution of this case could provide much-needed clarity regarding the regulatory status of NFTs and their classification as securities.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.