|

Getting your Trinity Audio player ready...

|

Onyxcoin [XCN] stole the spotlight this week as the best-performing altcoin gem, soaring by an impressive 135% over the past three days. The explosive rally placed XCN at the top of CoinMarketCap’s daily gainers list, with a staggering 260% surge in trading volume in just 24 hours, making it the hottest trending asset across major crypto platforms.

The parabolic price action triggered strong technical reactions. Notably, the daily Relative Strength Index (RSI) surged into the overbought zone — a classic signal that the asset may be due for a short-term cooldown. Meanwhile, the On Balance Volume (OBV), which tracks cumulative buying and selling pressure, rebounded sharply from April lows but encountered resistance at the 91 billion mark.

These indicators paint a picture of intense buying momentum that may now be slowing. Adding to this cautious outlook is Santiment’s 30-day Market Value to Realized Value (MVRV), which shows that holders who bought XCN a month ago are sitting on an average 45% unrealized profit — a potential incentive for profit-taking.

Despite this, data showed limited sell pressure. Santiment’s “Supply on Exchanges” metric revealed a decline in tokens available for trading, suggesting that most XCN holders are withdrawing their coins from exchanges rather than preparing to sell.

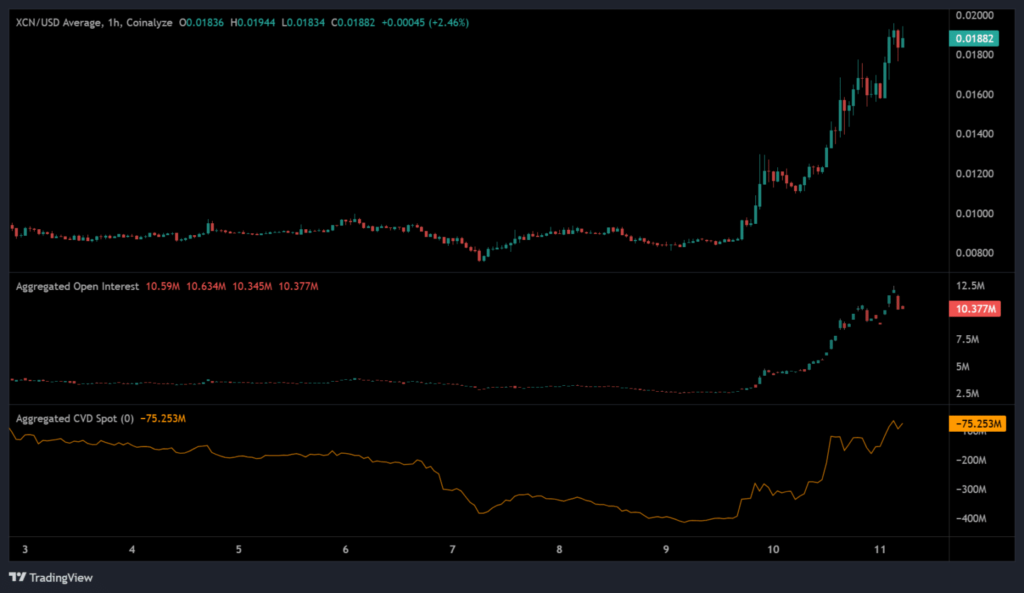

A key strength of XCN’s rally lies in its foundation — a rise in both spot market demand and derivatives activity. The increase in CVD Spot and Open Interest (OI) points to healthy organic interest rather than overleveraged speculation, reducing the risk of sharp liquidations.

Looking ahead, XCN could push toward the $0.023 mark, potentially gaining another 25% if bullish momentum holds. However, with key indicators hinting at a possible price pullback, traders should brace for a near-term consolidation before any further upside.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Onyxcoin (XCN) Price Soars 800% in Just 2 Weeks: Here’s What’s Driving the Surge

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!

![Onyxcoin [XCN]](https://chainaffairs.com/wp-content/uploads/2025/01/onyxcoin-xcn-coin-stacks-cryptocurrency-3d-render-illustration-free-png.webp)