|

Getting your Trinity Audio player ready...

|

Key Takeaways:

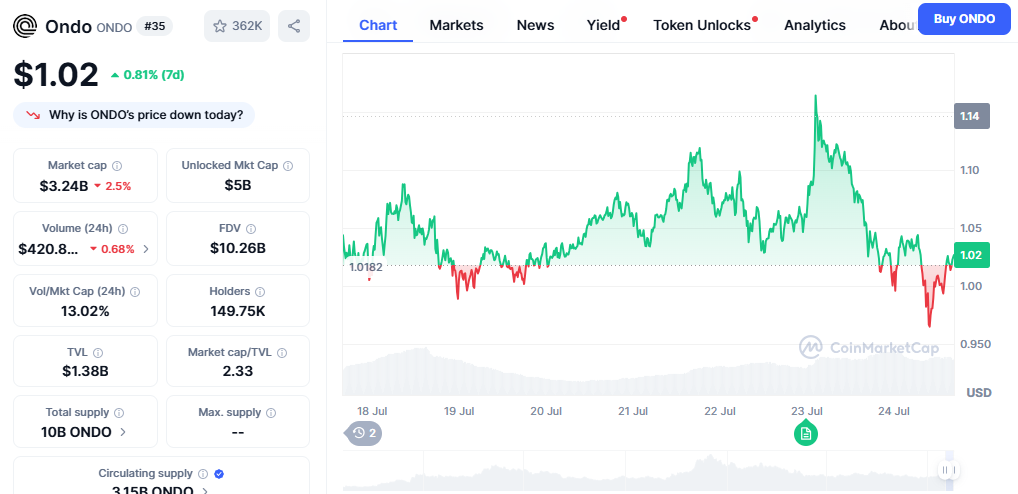

- ONDO fell 5% in 24 hours but remains in a bullish uptrend.

- Renewed trader interest points to possible upward momentum.

- Breakout above resistance could propel ONDO toward new highs.

Ondo (ONDO), a DeFi platform that bridges traditional finance (TradFi) with blockchain via real-world assets (RWAs), has seen a 5% dip in its token price over the past 24 hours. Despite this correction, technical indicators and open interest data signal potential for a bullish breakout, attracting attention from market analysts and investors.

ONDO Experiences Short-Term Pullback in Asian Trading

During the July 24 Asian trading session, ONDO opened at $1.0105 and remained relatively stable despite a notable intraday drop to $0.93. CoinMarketCap data showed the price rebounding slightly to $1.02, reflecting a 5.17% 24-hour decrease. The token’s market capitalization currently sits at $3.22 billion, with a 24-hour trading volume of $438.52 million—up 5.87%.

Notably, the platform’s Fully Diluted Valuation (FDV) reached $10.2 billion, while its unlocked market cap stands at $4.93 billion. The total value locked (TVL) is $1.38 billion, giving ONDO a market cap to TVL ratio of 2.3—signaling relatively healthy DeFi adoption.

Open Interest Data Signals Strong Market Confidence

Despite recent price volatility, open interest in ONDO futures remains strong. According to Coinglass, ONDO’s open interest steadily rose from November 2023 through mid-January 2024, peaking at $600 million. After a brief dip in March, interest resurged from late April and has been trending upward since early July.

By July 23, open interest had once again approached the $600 million mark, showing a close correlation with ONDO’s price movement. The data indicates ongoing trader engagement and long-term confidence in the project’s fundamentals.

Also Read: 21Shares Files for First Spot ONDO ETF, Advancing Tokenized RWA Adoption

Bullish Chart Structure Points to $3.80 and Beyond

Technical analysis of ONDO suggests a bullish continuation pattern. The token has maintained a higher low structure since bottoming in 2023. Analysts identify a conservative price target near $3.80, which aligns with the 1.618 Fibonacci extension level.

Should the asset break above its current diagonal resistance, further upside could be seen toward the $6.50 level. A potential take-profit zone has been projected between $6.50 and $13.00. However, any failure to hold current support levels may risk pullbacks below $1.00, with prior buy zones between $0.50 and $0.77 providing strong historical demand.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!