|

Getting your Trinity Audio player ready...

|

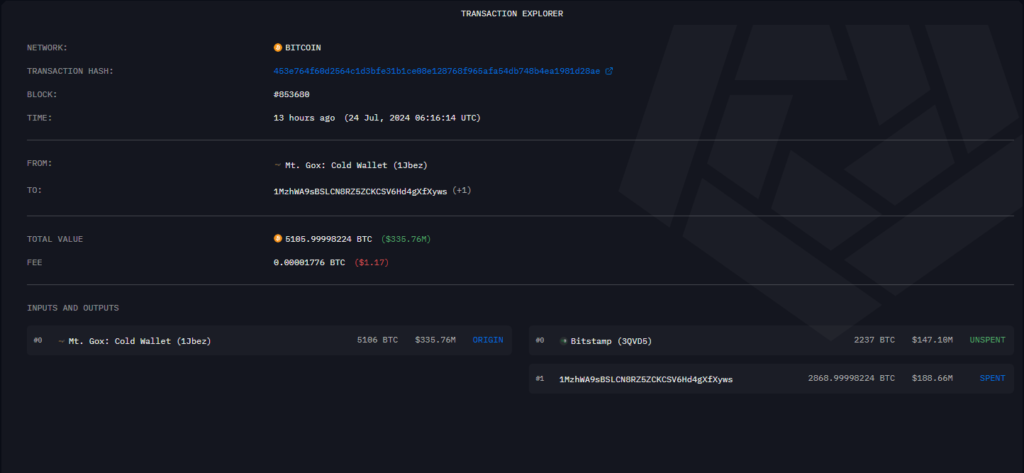

Mt. Gox, the defunct cryptocurrency exchange synonymous with a massive Bitcoin hack, continues its long-awaited creditor repayments. On July 24th, the exchange offloaded 5,106 Bitcoin (BTC), valued at roughly $335 million, in two separate transactions.

According to data from Arkham Intelligence, the transfers occurred at 6:16 am UTC. One transaction sent 2,237 BTC ($147 million) directly to the cryptocurrency exchange Bitstamp. The other, slightly larger transfer of 2,869 BTC, went to an unknown address beginning with “1MzhW.” However, this address didn’t hold onto the funds for long. It quickly moved them to another wallet (“12azL“) before ultimately sending them to addresses linked to Bitstamp.

Bitstamp’s Role

The $335 million in BTC appears to have been split into a direct and indirect route to reach Bitstamp wallets. This could be a tactic for smoother allocation of repayments to individual creditors. Cointelegraph reached out to Bitstamp for clarification on the process, but received no response as of publication.

Rehabilitation Plan Progress

Bitstamp is one of five exchanges chosen by Mt. Gox to facilitate the court-approved Rehabilitation Plan. This plan outlines the distribution of recovered funds to creditors affected by the 2014 hack. Data from CryptoQuant suggests over 66% of the total owed BTC has already been distributed.

Also Read: Mt. Gox Repayment Begins! Kraken Users Receive Long-Awaited Bitcoin

Mt. Gox’s Holdings Dwindle

While Mt. Gox’s remaining Bitcoin holdings haven’t been officially updated in the past 48 hours (according to Arkham Intelligence, which lists them at 90,344 BTC), Cointelegraph reported on July 23rd that the actual figure is closer to 42,744 BTC ($2.85 billion) after previous outflows. The July 24th transactions further reduce this amount. Subtracting the recent outflows from the July 23rd estimate leaves Mt. Gox with a holding of only 161 BTC, valued at approximately $10 million.

The recent Bitcoin transfers suggest Mt. Gox is actively fulfilling its repayment obligations. With the majority of owed BTC potentially distributed, the outflows could soon come to an end. This marks a significant development for creditors who have waited nearly a decade to receive their lost funds.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.