|

Getting your Trinity Audio player ready...

|

MicroStrategy, the business intelligence giant led by Executive Chairman Michael Saylor, has become known for its aggressive Bitcoin acquisition strategy. However, as the company prepares for potential restrictions in January 2025, some analysts speculate that its Bitcoin buying spree could slow down, potentially disappointing investors who have closely tracked its bold cryptocurrency moves.

A popular venture capitalist recently claimed that MicroStrategy could face a blackout period beginning in January 2025, preventing it from issuing new convertible debt to fund additional Bitcoin purchases. While blackout periods are common among publicly traded companies to avoid the appearance of insider trading, the specifics surrounding MicroStrategy’s potential restrictions remain unclear.

The blackout period typically spans two weeks to a month, ending shortly after a company announces its quarterly earnings. While the U.S. Securities and Exchange Commission (SEC) does not prohibit insiders from trading after a fiscal quarter ends, many firms impose these periods to maintain ethical standards. Given MicroStrategy’s major Bitcoin holdings, which have seen significant gains, any delays in acquisitions could have substantial market implications.

There are various theories about the cause of the potential restrictions. Some speculate that the blackout could apply solely to “at the market” (ATM) share sales, while others suggest it may be related to the company’s inclusion in the NASDAQ 100 on December 23, 2024. The timing of the blackout could coincide with the company’s next earnings report, scheduled between February 3-5, 2025, with some analysts predicting it could last for the entire month of January.

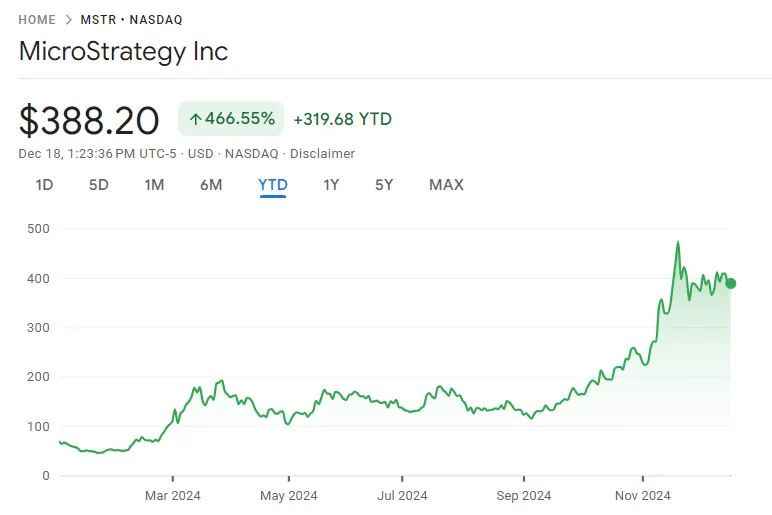

MicroStrategy currently holds $46.02 billion worth of Bitcoin, sitting on an unrealized profit of over $18.9 billion. Its recent Bitcoin purchases, including more than $3 billion worth in December alone, reflect the company’s unwavering belief in the cryptocurrency’s long-term potential. This bullish stance has paid off, as MicroStrategy’s stock price has surged by over 460% year-to-date.

This market momentum helped propel the company into the prestigious NASDAQ-100, with analysts predicting it could be a contender for inclusion in the S&P 500 next year. However, as restrictions loom, the next few months could prove crucial in shaping both MicroStrategy’s future Bitcoin strategy and its stock performance.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: VanEck Proposes Bitcoin as U.S. Reserve Asset to Slash National Debt by 36%

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.