|

Getting your Trinity Audio player ready...

|

Litecoin (LTC) miners have escalated their selling activity, leading to notable supply movements on-chain. At press time, LTC traded at $119.06, marking a 4.96% drop in the last 24 hours. With a trading volume of 156.29k, miners appear to be rebalancing their positions amid ongoing market turbulence.

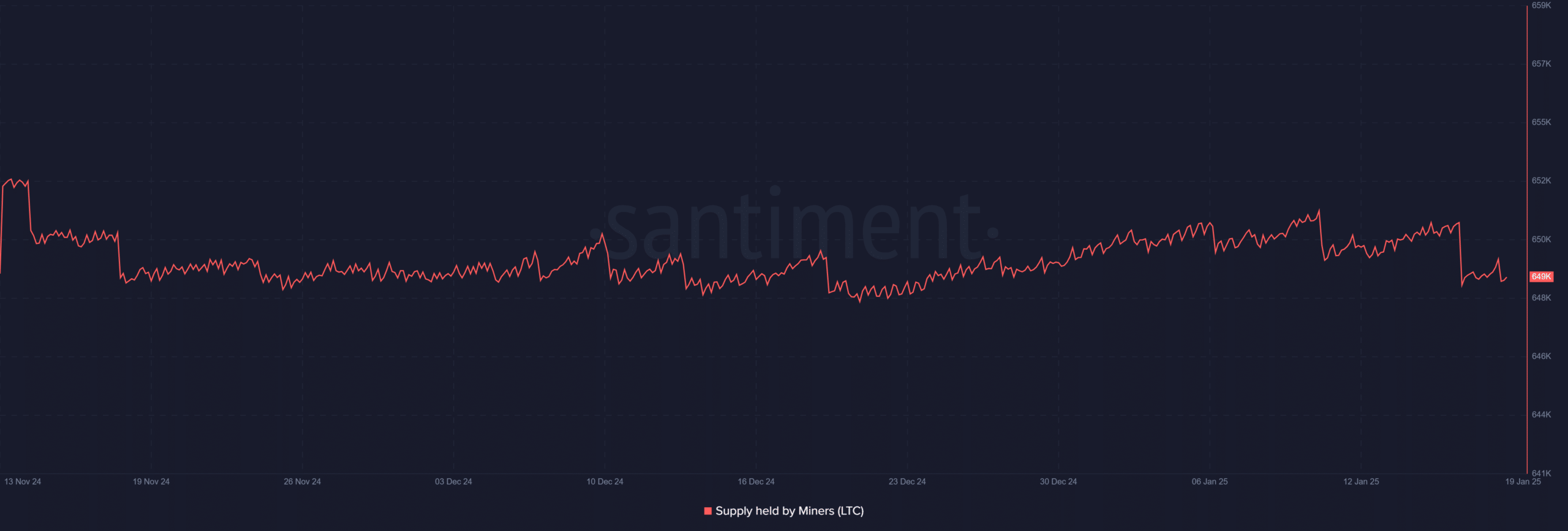

Miner Activity and Supply Trends

On-chain data indicates a gradual reduction in Litecoin miners’ holdings, with supply decreasing from 655k LTC to approximately 645k LTC over the past two months. This steady pattern of liquidations reflects a calculated strategy rather than panic-driven sell-offs. Mid-January supply volatility highlighted increased miner activity during significant price fluctuations.

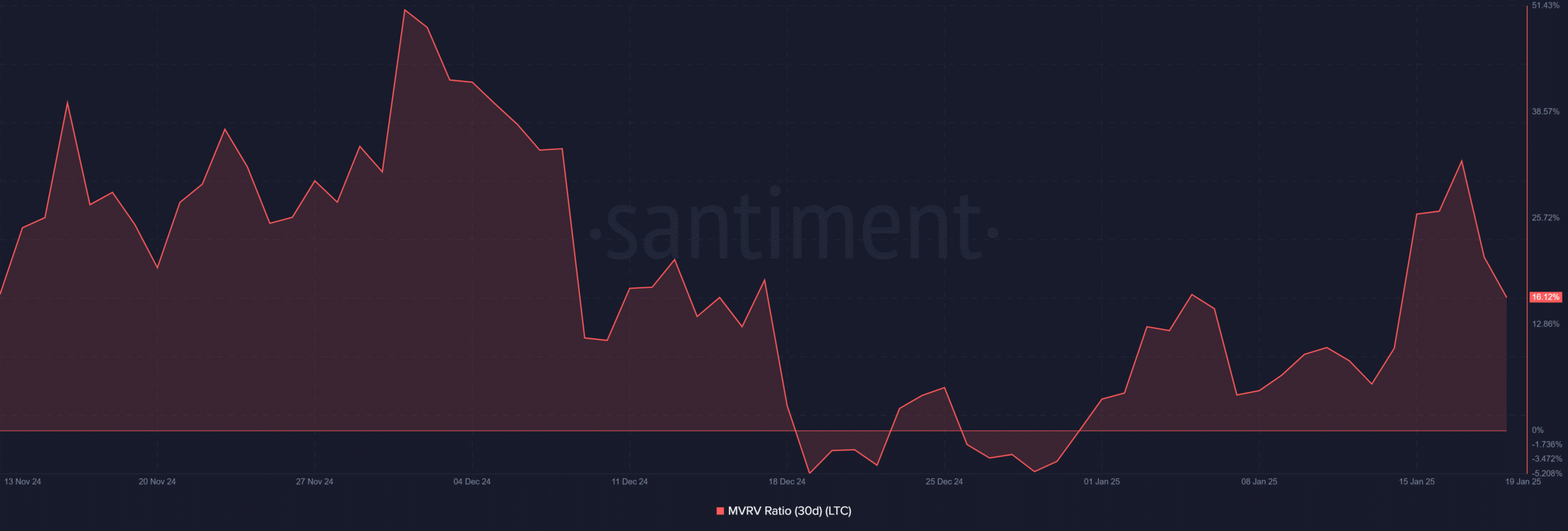

Market Sentiment Shifts in Focus

Litecoin’s 30-day Market Value to Realized Value (MVRV) ratio has dropped from December 2024 highs of 38.57% to 16.12%. This steep decline suggests reduced profitability for short-term holders and cooling speculative interest, potentially pointing to a shift toward more sustainable valuation levels.

Technical Analysis Highlights

Despite the miner sell-offs, Litecoin’s technical indicators reveal resilience. The 50-day moving average at $113.31 and the 200-day moving average at $80.84 maintain a bullish crossover, signaling medium-term price strength. Additionally, the Accumulation/Distribution line has risen to 67.37M, indicating sustained buying pressure, particularly from retail and institutional investors.

The Chaikin Money Flow (CMF) oscillates around 0.07, suggesting marginally stronger buying than selling pressure. Interestingly, this divergence indicates that broader market participants are absorbing the miners’ selling activity, bolstering Litecoin’s price action.

Litecoin’s market structure is at a critical juncture. The miners’ sustained sell-off contrasts with strong accumulation metrics, underlining robust buyer interest. The MVRV ratio’s positive territory hints at recovery potential if selling pressure eases.

Also Read: Litecoin (LTC) Surges 12% as Nasdaq Files for ETF Listing: Is This the Start of a Bullish Run?

Crucially, the $113 support level, aligned with the 50-day moving average, will be pivotal in maintaining Litecoin’s bullish outlook. The coming weeks will reveal whether miner activity represents healthy redistribution or signals a broader market shift.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.